Reveal Etrade's Revenue Streams: How It Makes Money

Etrade's Revenue Streams: How It Makes Money

Financial institutions like Etrade operate within a complex ecosystem where profitability is derived from a combination of strategies, technologies, and market dynamics. As a leading brokerage platform, Etrade has carved out a niche by offering a diverse array of services that not only cater to traditional investors but also adapt to the evolving landscape of digital assets. Understanding how Etrade generates revenue provides insights into its financial resilience and the broader implications for those looking to engage with the market, whether through stocks, bonds, or cryptocurrencies.

At the core of Etrade's income model lies the commission-based trading structure, which accounts for a significant portion of its earnings. When investors execute trades on the platform, Etrade earns fees from each transaction, typically a fraction of a percent for stock and ETF trades, and variable rates for options and derivatives. These fees are competitive compared to other brokerages, allowing Etrade to attract a broad customer base while maintaining profitability. However, the commission model is not the sole driver of its financial success, as the company has diversified its offerings to include alternative revenue streams that enhance its market position.

One of Etrade's strategic advantages is its asset management segment, which contributes to its bottom line through advisory services and investment products. By providing retail investors with access to managed accounts, robo-advisors, and wealth management solutions, Etrade can charge fees based on the assets under management (AUM) or through performance-based structures. This approach aligns with the growing demand for personalized financial planning, especially among younger investors who seek hassle-free portfolio management. The integration of these services into the platform also allows Etrade to offer a seamless experience, bridging the gap between traditional investing and modern financial tools.

Another critical revenue source for Etrade is its focus on market data and research. By supplying real-time data, customizable watchlists, and analytical tools, the company monetizes its information through subscription models and premium plans. These services cater to both novice and experienced investors, enabling them to make informed decisions while paying for the value of data access. The importance of such services cannot be overstated, as financial markets are highly volatile and driven by information asymmetry. Etrade's ability to provide accurate, timely data ensures that users can navigate uncertain conditions with greater confidence.

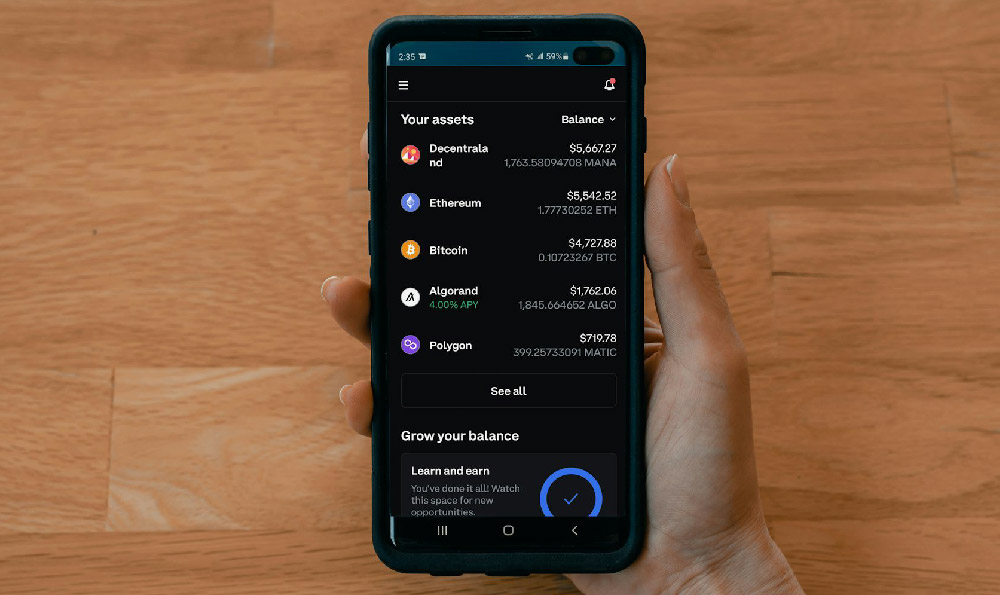

In addition to these traditional avenues, Etrade has expanded its footprint into the realm of cryptocurrencies, which has opened new revenue streams for the company. While it does not operate as a cryptocurrency exchange, Etrade allows users to trade popular digital assets like Bitcoin and Ethereum through its platform. This integration enables Etrade to charge transaction fees for crypto trades, leveraging the surge in interest and adoption of blockchain technology. Furthermore, the company's digital assets offerings include custodial services and secure wallet solutions, which generate income through fees for storage and management. As the crypto market continues to grow, Etrade's ability to adapt ensures it remains relevant in the financial industry.

Etrade's digital infrastructure also plays a pivotal role in its profitability. The company invests heavily in technology to enhance user experience, reduce latency in trades, and improve the security of digital assets. These investments are not only about maintaining a competitive edge but also about minimizing operational costs associated with manual processes. By adopting automation and blockchain solutions, Etrade ensures that its services are efficient, scalable, and secure, which in turn reduces overhead and increases profit margins. The importance of this cannot be ignored, as modern investors prioritize speed, security, and ease of use when managing their portfolios.

Beyond direct revenue from trading and services, Etrade generates income through its referral and partnership programs. By incentivizing users to bring in new clients or collaborate with other financial institutions, Etrade can benefit from additional fees, commissions, and cross-promotional opportunities. These programs reinforce the importance of community and ecosystem-building in the financial sector, creating a self-sustaining model that benefits both the company and its customers.

For investors, understanding Etrade's revenue streams is not just about financial analysis but also about strategic decision-making. Digital assets, such as cryptocurrencies, are inherently volatile and require careful management to avoid significant losses. Etrade's approach to profitability includes risk mitigation strategies that protect its clients, such as ensuring regulatory compliance, implementing security protocols, and offering educational resources on market trends. These measures are crucial for maintaining trust and attracting a steady flow of investors, even in an unpredictable market.

Moreover, Etrade's customer acquisition and retention strategies are designed to optimize operational efficiency. By leveraging data analytics and user insights, the company can tailor its services to meet the needs of different investor segments, thereby increasing user engagement and loyalty. This focus on customer-centric approaches not only enhances profitability but also fosters long-term growth in a competitive market.

In conclusion, Etrade's revenue streams are a testament to its ability to adapt and innovate in the financial industry. Whether through commission-based trading, asset management, market data, or digital assets, the company has established a diversified income model that ensures financial stability. For investors, these strategies offer both opportunities and lessons, emphasizing the importance of understanding the underlying mechanics of efficient financial platforms. By focusing on cost reduction, technology integration, and regulatory compliance, Etrade not only secures its financial position but also cultivates an environment where informed investment decisions can thrive. As the market continues to evolve, the company's adaptability ensures that it remains a key player in shaping the future of financial innovation.