Is BTC a wise investment? What is Keepbit Platform for it?

Is BTC a wise investment? Evaluating Bitcoin's Potential and Exploring Keepbit Platform

Bitcoin, the pioneering cryptocurrency, continues to spark debate and captivate investors worldwide. The question of whether BTC constitutes a wise investment is complex, demanding a nuanced understanding of its potential benefits, inherent risks, and the evolving landscape of the digital asset market. This exploration delves into the merits and drawbacks of Bitcoin investment, further introducing Keepbit Platform as a potential tool to navigate this dynamic terrain.

Understanding Bitcoin's Investment Proposition

Bitcoin's appeal lies in its decentralized nature, scarcity, and potential as a store of value. Unlike traditional currencies controlled by central banks, Bitcoin operates on a distributed ledger technology called blockchain, making it resistant to censorship and manipulation. The limited supply of 21 million Bitcoins, coupled with increasing adoption, theoretically drives up its value over time.

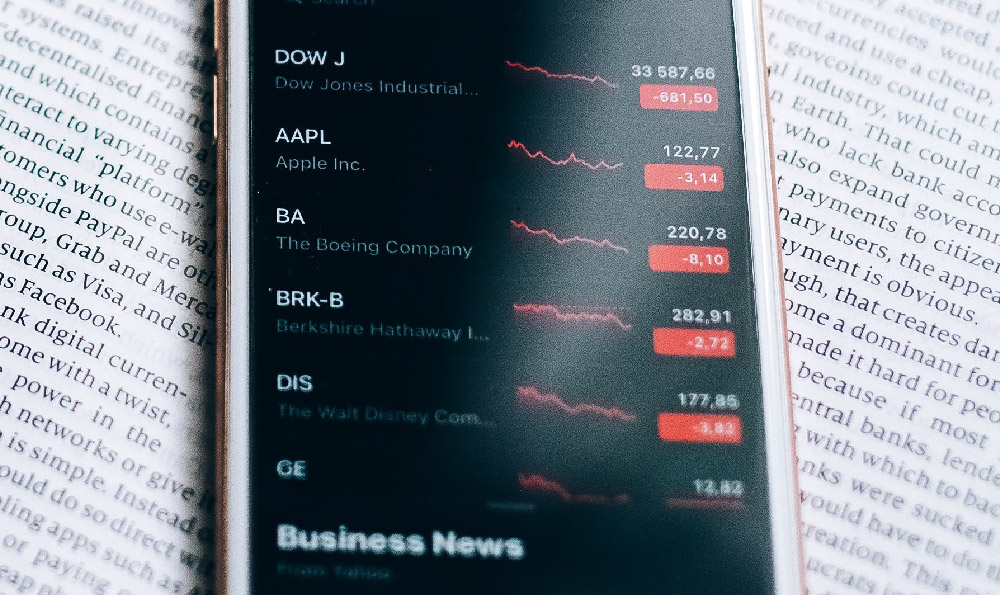

Furthermore, Bitcoin has demonstrated the potential to act as a hedge against inflation and economic instability. In times of uncertainty, investors often seek safe-haven assets, and Bitcoin has, on occasion, exhibited a negative correlation with traditional markets, offering a degree of protection against market downturns.

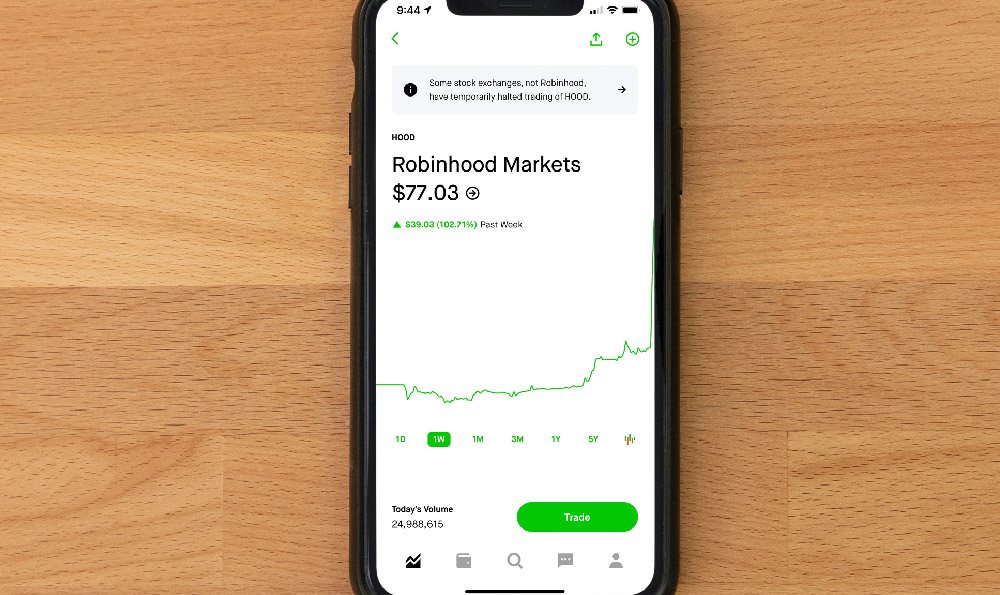

However, Bitcoin investment is not without its risks. Volatility remains a significant concern. Bitcoin's price can experience dramatic swings within short periods, exposing investors to potential losses. Regulatory uncertainty also looms large. Governments worldwide are grappling with how to regulate cryptocurrencies, and unfavorable policies could negatively impact Bitcoin's value.

Moreover, the security of Bitcoin wallets and exchanges is paramount. Hackers constantly target these platforms, and investors can lose their holdings due to security breaches or scams. Understanding these risks is crucial before venturing into Bitcoin investment.

Mitigating Risks and Maximizing Potential

While Bitcoin's volatility presents a challenge, it also offers opportunities for skilled traders. Implementing sound risk management strategies, such as diversification, stop-loss orders, and position sizing, can help mitigate potential losses. Diversification involves allocating capital across various asset classes, reducing the impact of any single investment's performance on the overall portfolio. Stop-loss orders automatically sell Bitcoin when it reaches a predetermined price, limiting potential losses. Position sizing involves carefully determining the amount of capital to allocate to each trade based on risk tolerance and market conditions.

Long-term investing, also known as "hodling," is another strategy that involves holding Bitcoin for an extended period, regardless of short-term price fluctuations. This approach is based on the belief that Bitcoin's value will increase over time as adoption grows and its scarcity becomes more pronounced.

Staying informed about market trends, technological developments, and regulatory changes is crucial for making informed investment decisions. Following reputable news sources, attending industry events, and engaging with the Bitcoin community can provide valuable insights.

Keepbit Platform: A Gateway to Bitcoin Investment?

Keepbit Platform emerges as a player in the Bitcoin landscape, aiming to simplify and enhance the investment experience. While a thorough, independent evaluation is always recommended before engaging with any platform, Keepbit potentially offers certain features worth considering.

From what is publicly available, Keepbit Platform may provide users with a user-friendly interface to buy, sell, and store Bitcoin. Integrated wallets can streamline the management of Bitcoin holdings. Advanced charting tools and market analysis features can empower traders to make informed decisions. The platform could also implement security measures such as multi-factor authentication and cold storage to protect users' assets.

Furthermore, Keepbit might offer educational resources and customer support to guide new investors through the complexities of Bitcoin investment. Access to reliable information and assistance can significantly improve the investment experience and reduce the risk of errors.

However, it is imperative to approach Keepbit Platform, like any other platform, with caution. Verify its security protocols, review its terms of service, and understand its fee structure. Seek independent reviews and conduct due diligence to ensure its legitimacy and suitability for your investment needs. Do not solely rely on information provided by the platform itself. Always prioritize the security of your Bitcoin holdings and never share your private keys with anyone.

Conclusion: Informed Investment in a Dynamic Landscape

The question of whether Bitcoin is a wise investment remains open to individual interpretation and depends on personal circumstances, risk tolerance, and investment goals. Bitcoin offers potential benefits as a store of value, a hedge against inflation, and a decentralized alternative to traditional currencies. However, it also carries significant risks, including volatility, regulatory uncertainty, and security vulnerabilities.

Successful Bitcoin investment requires a thorough understanding of these factors, a sound risk management strategy, and a commitment to staying informed. Platforms like Keepbit might offer tools and resources to facilitate Bitcoin investment, but users must exercise caution and conduct due diligence before engaging with them.

Ultimately, the decision to invest in Bitcoin rests with the individual. By carefully weighing the potential rewards against the inherent risks, and by implementing prudent investment strategies, investors can navigate the Bitcoin landscape and potentially reap its benefits while mitigating potential losses. Remember that all investment decisions should be made after consulting with a qualified financial advisor who can assess your individual needs and circumstances.