How to Earn Money at 17? What Are the Best Options?

Turning 17 is a pivotal moment, a time when the allure of financial independence starts to shimmer on the horizon. While traditional employment like part-time jobs remains a viable option, the digital age has opened up a plethora of opportunities, particularly in the realm of investments. However, it's crucial to approach these ventures with a clear head, a disciplined strategy, and an understanding of the inherent risks involved. Investing, especially in volatile markets like cryptocurrency, requires more than just a lucky guess; it demands knowledge, patience, and a willingness to learn continuously.

Let’s address the core question: how can a 17-year-old earn money, and what are the best investment options, especially considering the landscape of cryptocurrencies? The answer isn't a simple one, but rather a multi-faceted exploration of potential avenues.

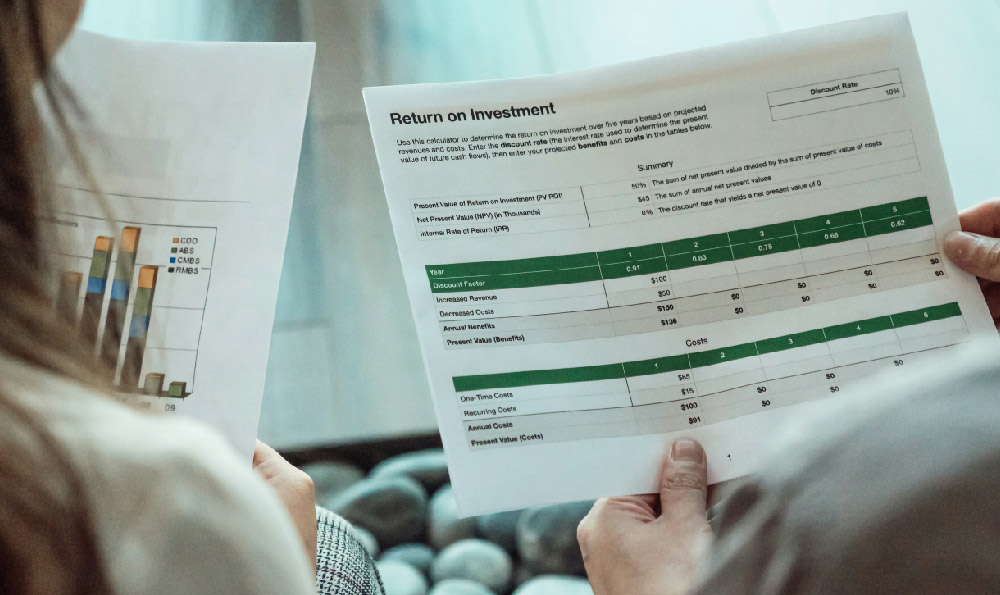

Before diving into specific cryptocurrencies, it’s paramount to establish a solid foundation of financial literacy. Understanding concepts like compound interest, inflation, risk tolerance, and diversification are crucial before committing any capital. Several online platforms offer free educational resources on these topics. Furthermore, learning how to read and interpret financial statements, analyze market trends, and understand basic economic principles will provide a significant advantage. This knowledge will not only benefit investment decisions but will also serve as a valuable asset throughout life.

Now, concerning cryptocurrencies, it's important to acknowledge the associated risks. The market is notoriously volatile, prone to sudden and dramatic price swings. Investing in cryptocurrencies should only be considered with money you can afford to lose. Furthermore, the regulatory landscape is constantly evolving, adding another layer of uncertainty.

With that said, there are several avenues to explore:

Fractional Investing in Established Cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH) are considered the "blue chips" of the crypto world. Their market capitalization is significantly larger, and they have a longer track record compared to altcoins. Fractional investing allows you to purchase a small portion of a Bitcoin or Ethereum, making it accessible even with limited capital. Platforms like Coinbase, Binance, and Kraken offer fractional trading options and provide educational resources for beginners. However, even with established cryptocurrencies, thorough research is essential. Understand the underlying technology, the supply and demand dynamics, and the potential use cases.

Cryptocurrency Savings Accounts and Staking: Some platforms offer cryptocurrency savings accounts that pay interest on your holdings. These accounts can be a relatively low-risk way to earn passive income. Similarly, staking involves holding certain cryptocurrencies to support the network and earn rewards in return. However, it's crucial to research the platform and the specific cryptocurrency being staked, as some platforms may have lock-up periods or higher risks associated with them. Evaluate the annual percentage yield (APY), the security measures implemented by the platform, and the potential for impermanent loss, especially in decentralized finance (DeFi) protocols.

Cryptocurrency Index Funds: Similar to traditional index funds, cryptocurrency index funds offer diversification by tracking a basket of different cryptocurrencies. This approach can reduce risk compared to investing in a single cryptocurrency. However, it's important to understand the methodology used to construct the index and the fees associated with the fund. Research the individual cryptocurrencies included in the index and assess their potential.

Learning Blockchain Development or Cryptocurrency Trading: While requiring a more significant time investment, learning blockchain development or cryptocurrency trading can be a lucrative path. Blockchain developers are in high demand, and skilled traders can profit from market fluctuations. Numerous online courses and tutorials are available, ranging from beginner-friendly introductions to advanced technical analysis. However, be prepared for a steep learning curve and the need for continuous practice and adaptation. Trading, in particular, requires discipline, emotional control, and a well-defined trading strategy. Avoid emotional trading and always use stop-loss orders to limit potential losses.

Cautionary Notes and Risk Management:

- Avoid "Get Rich Quick" Schemes: The cryptocurrency market is rife with scams and fraudulent projects promising unrealistic returns. Be wary of any opportunity that sounds too good to be true. Thoroughly research any project before investing, and never invest more than you can afford to lose.

- Secure Your Cryptocurrency: Use strong passwords, enable two-factor authentication, and consider using a hardware wallet to store your cryptocurrency offline. Protect your private keys at all costs, as they are the keys to accessing your funds.

- Diversify Your Investments: Don't put all your eggs in one basket. Diversify your investments across different asset classes to reduce risk. Consider investing in stocks, bonds, or real estate in addition to cryptocurrencies.

- Consult with a Financial Advisor: If you are unsure about any aspect of cryptocurrency investing, consult with a qualified financial advisor who can provide personalized guidance based on your financial situation and risk tolerance.

It is also crucial for a 17-year-old to understand the legal and regulatory aspects of cryptocurrency investing. While the regulations are still evolving, it is important to be aware of the potential tax implications and reporting requirements. Keeping accurate records of all transactions is essential for tax purposes.

Finally, remember that building wealth is a marathon, not a sprint. While cryptocurrency investing can offer the potential for high returns, it also carries significant risks. By approaching it with a disciplined strategy, a commitment to learning, and a healthy dose of skepticism, a 17-year-old can potentially leverage the opportunities presented by the cryptocurrency market to achieve long-term financial goals. However, prioritize financial education, risk management, and responsible investing practices above all else. Consider paper trading (simulated trading with virtual money) before investing real capital to practice your strategies and gain experience without risking actual funds. The most important investment at this age is in yourself and your education. Investing in knowledge and skills will provide returns far beyond any short-term market gains.