Dogelon Mars: Good Investment, or Risky Bet?

Dogelon Mars (ELON) presents a fascinating, albeit highly speculative, case study in the world of cryptocurrency investments. Categorizing it as either a "good investment" or a "risky bet" requires a deep dive into its origins, utility (or lack thereof), market performance, community support, and inherent risks associated with meme coins. Ultimately, the answer is nuanced and depends entirely on an individual investor's risk tolerance, investment horizon, and understanding of the volatile cryptocurrency landscape.

Dogelon Mars, like many meme coins, originated as a satirical response to the burgeoning crypto market and Elon Musk's influence on the industry, particularly his affinity for Dogecoin. Its whitepaper, if it can even be called that, offers little in the way of concrete technological innovation or real-world application. Instead, it leans heavily on community-driven adoption and aspirations of funding interplanetary colonization, echoing Musk's ambitious goals. This inherently makes it a speculative asset driven primarily by hype and social sentiment rather than fundamental value.

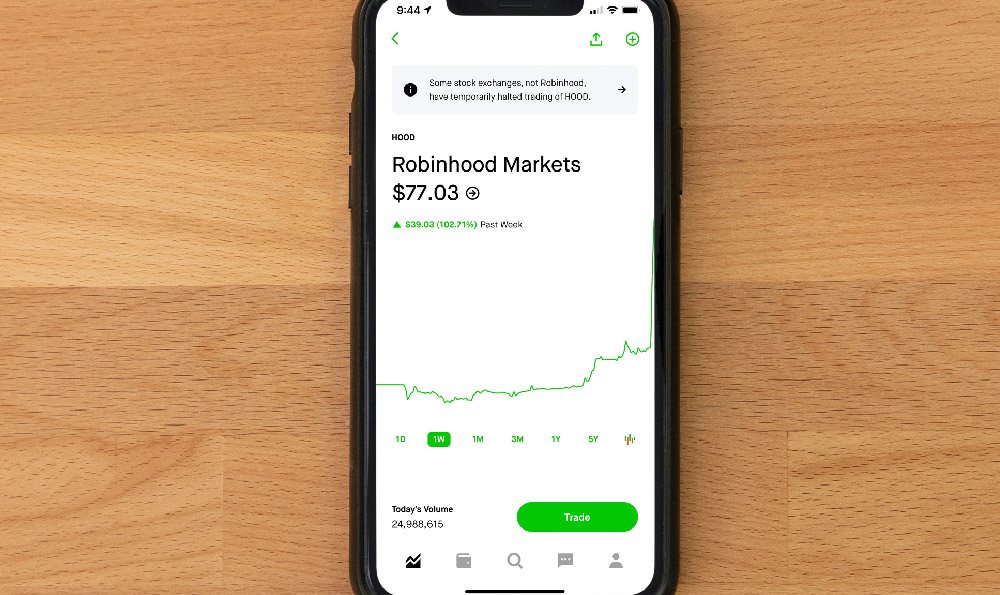

The potential rewards, which fuel the "good investment" argument, are undeniably attractive. Early investors in Dogecoin, Shiba Inu, and other meme coins experienced exponential returns, transforming modest investments into significant wealth. Dogelon Mars similarly held the promise of replicating this success. Fueled by online communities, aggressive marketing, and listing on various exchanges, ELON witnessed significant price surges, attracting a wave of new investors hoping to "get in early." The fear of missing out (FOMO) is a powerful driver in these situations, creating a self-fulfilling prophecy where rising prices attract more buyers, further inflating the value. However, this rapid ascent is often followed by an equally dramatic correction.

The "risky bet" perspective stems from several critical factors. First and foremost is the lack of underlying utility. Unlike cryptocurrencies like Bitcoin or Ethereum, which have practical applications in decentralized finance (DeFi), smart contracts, or as a store of value, Dogelon Mars offers virtually nothing beyond its meme status. This means its value is entirely dependent on continued hype and community support. If interest wanes, the price can plummet rapidly, leaving investors holding a worthless asset.

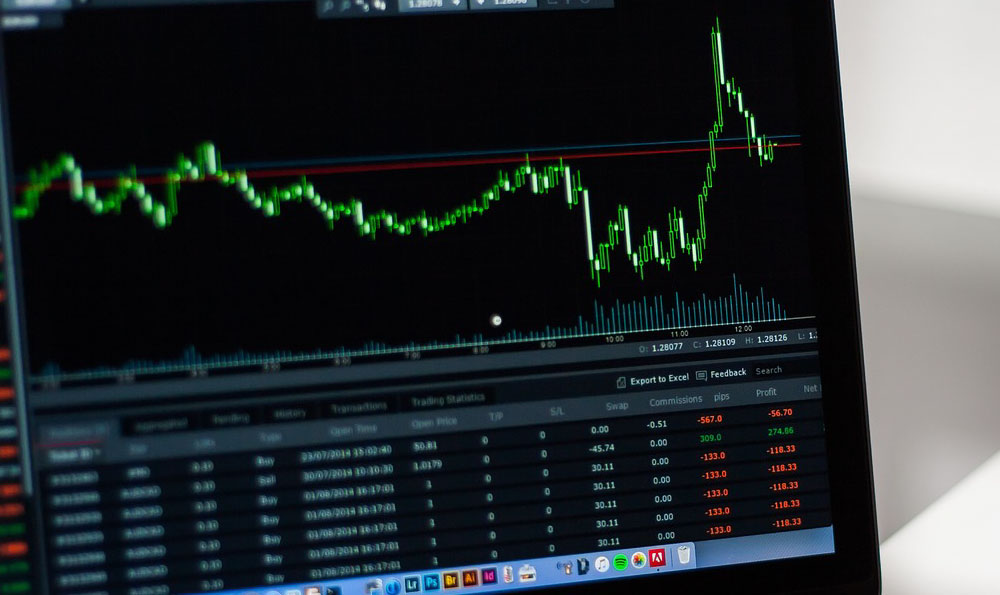

Secondly, meme coins are inherently susceptible to pump-and-dump schemes. Large holders, often referred to as "whales," can manipulate the market by accumulating significant amounts of the coin and then artificially inflating the price through coordinated buying activity. Once the price reaches a certain peak, these whales can dump their holdings, leaving unsuspecting retail investors with massive losses. The lack of transparency in many meme coin ecosystems makes it difficult to identify and prevent such manipulations.

Thirdly, the Dogelon Mars project is relatively centralized, relying heavily on a core team (whose identities are often obscured) to manage its development and marketing efforts. This centralization poses a risk, as any misstep or malicious intent from the team could severely impact the project's future. Decentralized governance, where the community plays a more active role in decision-making, is generally considered a more robust and sustainable model for cryptocurrency projects.

Furthermore, the cryptocurrency market is already known for its extreme volatility. Adding a layer of speculation with a meme coin amplifies this volatility exponentially. Dogelon Mars has experienced dramatic price swings, making it unsuitable for investors with a low-risk tolerance or those seeking stable returns. Investing in ELON is akin to gambling, where the odds are stacked against the average investor.

Finally, regulatory uncertainty surrounding cryptocurrencies adds another layer of risk. Governments around the world are still grappling with how to regulate digital assets, and any unfavorable regulatory changes could significantly impact the value of meme coins like Dogelon Mars. Taxation, security classifications, and exchange listing regulations are all potential areas of concern.

In conclusion, Dogelon Mars cannot be definitively classified as a "good investment." While the potential for high returns exists, it is overshadowed by the significant risks associated with meme coins. It is a speculative asset driven by hype and community sentiment, lacking inherent utility and susceptible to market manipulation. Investing in Dogelon Mars should only be considered by individuals with a high-risk tolerance who are prepared to lose their entire investment. Thorough research, a deep understanding of the cryptocurrency market, and a cautious approach are essential. It's crucial to remember that past performance is not indicative of future results, and the meme coin market is notoriously unpredictable. A diversified portfolio that includes more established and fundamentally sound cryptocurrencies is generally a more prudent approach to investing in the digital asset space. Consider Dogelon Mars a gamble, not an investment, and only allocate funds you can afford to lose without impacting your financial well-being.