Copper ETF Investing: What is it, and is it Right for You?

Okay, I'm ready. Here's an article based on the title you provided:

Copper, often dubbed "Dr. Copper" by market participants, holds a unique position in the global economy. This reddish-brown metal isn't just a pretty material; its widespread use in construction, manufacturing, and especially the burgeoning electric vehicle sector makes it a reliable barometer of economic health. As economies expand, demand for copper typically rises, pushing prices upward, and vice versa. This correlation has made copper an intriguing asset for investors seeking to diversify their portfolios and potentially profit from global economic trends. One popular way to gain exposure to copper is through Copper ETFs, or Exchange Traded Funds. But what exactly are they, and more importantly, are they a suitable investment for you?

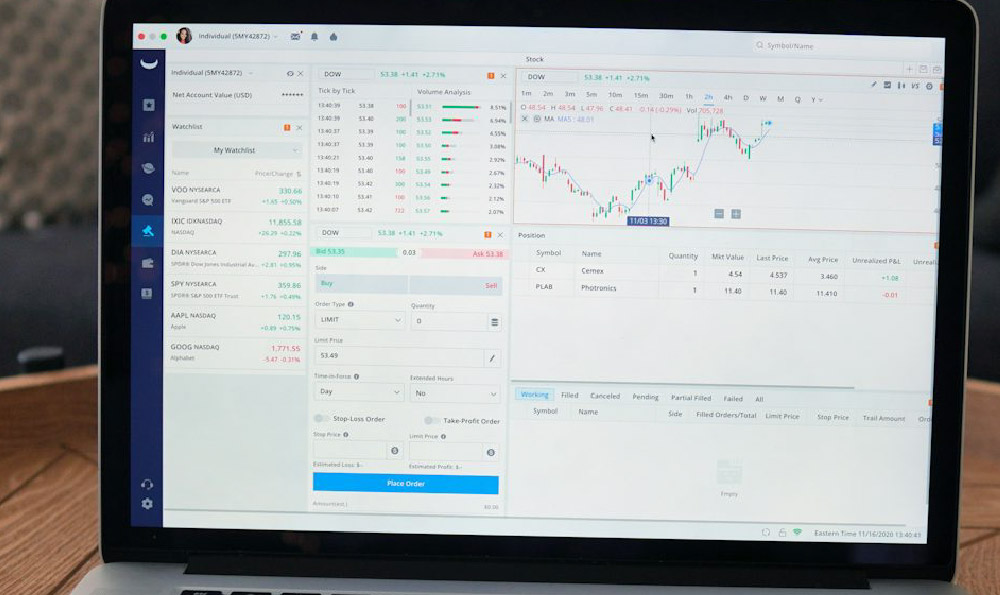

Copper ETFs are investment funds that aim to track the price of copper. They allow investors to participate in the copper market without needing to physically buy and store the metal. There are primarily two types of Copper ETFs: those that directly hold physical copper (or warehouse receipts representing physical copper) and those that invest in copper futures contracts.

ETFs that hold physical copper offer a direct link to the spot price of the metal. They purchase and store copper bullion, and the ETF's share price reflects the current market value of those holdings, minus expenses related to storage and management. These ETFs provide the most straightforward and transparent way to invest in copper, as they closely mirror the real-time price fluctuations of the metal. However, because of the logistical challenges and costs associated with storing large quantities of copper, these ETFs often have higher expense ratios compared to futures-based ETFs.

On the other hand, copper futures ETFs invest in contracts that obligate the holder to buy or sell copper at a predetermined price on a future date. Instead of owning physical copper, these ETFs hold a portfolio of these futures contracts, typically rolling them over before they expire to maintain continuous exposure. While futures-based ETFs offer greater liquidity and potentially lower expense ratios, they also come with complexities. The process of "rolling" futures contracts—selling near-term contracts and buying more distant ones—can lead to what's known as "contango" or "backwardation." Contango occurs when futures prices are higher than the spot price, resulting in a potential loss as the ETF must sell its cheaper near-term contracts and buy more expensive ones. Backwardation, conversely, occurs when futures prices are lower than the spot price, which can generate positive returns as the ETF rolls its contracts. Therefore, understanding the dynamics of futures markets is crucial when considering this type of Copper ETF.

The appeal of investing in Copper ETFs stems from several factors. As mentioned earlier, copper's role as an economic indicator makes it attractive to investors who believe in global growth. Emerging markets, with their rapid industrialization and infrastructure development, are significant consumers of copper, so a bullish outlook on these economies can translate into increased demand for copper. Furthermore, the transition towards a "green" economy is expected to further bolster copper demand. Electric vehicles, renewable energy infrastructure (such as solar and wind farms), and energy-efficient buildings all require substantial amounts of copper. Therefore, investing in copper can be viewed as a way to capitalize on these long-term trends.

Portfolio diversification is another compelling reason to consider Copper ETFs. Copper's price movements often have a low correlation with traditional asset classes like stocks and bonds. Including copper in a portfolio can potentially reduce overall volatility and improve risk-adjusted returns. In times of economic uncertainty or inflation, copper can act as a hedge, as its price tends to rise when investors seek safe-haven assets.

However, before diving into Copper ETF investing, it's essential to consider the risks involved. Commodity markets, including copper, can be highly volatile. Prices can fluctuate dramatically based on shifts in supply and demand, geopolitical events, and macroeconomic factors. A slowdown in global economic growth, increased copper production from new mines, or changes in government policies can all negatively impact copper prices.

Moreover, investing in futures-based Copper ETFs carries its own set of risks, as discussed earlier. Contango can erode returns over time, and the complexities of futures markets may be difficult for novice investors to grasp. It's also crucial to understand the specific investment strategy and expense ratio of the ETF you're considering, as these factors can significantly impact your overall returns.

Ultimately, deciding whether or not to invest in Copper ETFs depends on your individual investment goals, risk tolerance, and investment time horizon. If you're looking for a way to diversify your portfolio, capitalize on global economic trends, and have a long-term investment perspective, Copper ETFs may be a worthwhile consideration. However, it's crucial to conduct thorough research, understand the risks involved, and consult with a financial advisor before making any investment decisions. If you are averse to volatility or prefer simpler investment strategies, other asset classes may be more suitable. Remember that past performance is not indicative of future results, and all investments carry risk. Only invest what you can afford to lose, and always diversify your portfolio to mitigate risk. Copper might be essential to modern society, but careful consideration is paramount before making it essential to your investment strategy.