Binance Cards: Are They Right For You? How Do They Work?

Binance Cards: A Deep Dive into Their Functionality and Suitability

The world of cryptocurrency is rapidly evolving, and with it, the ways we interact with and spend our digital assets. Binance, a leading cryptocurrency exchange, offers a product called the Binance Card that aims to bridge the gap between the crypto world and everyday transactions. This article delves into the intricacies of Binance Cards, exploring their functionality, benefits, potential drawbacks, and ultimately, whether they are the right choice for you.

Understanding the Binance Card Ecosystem

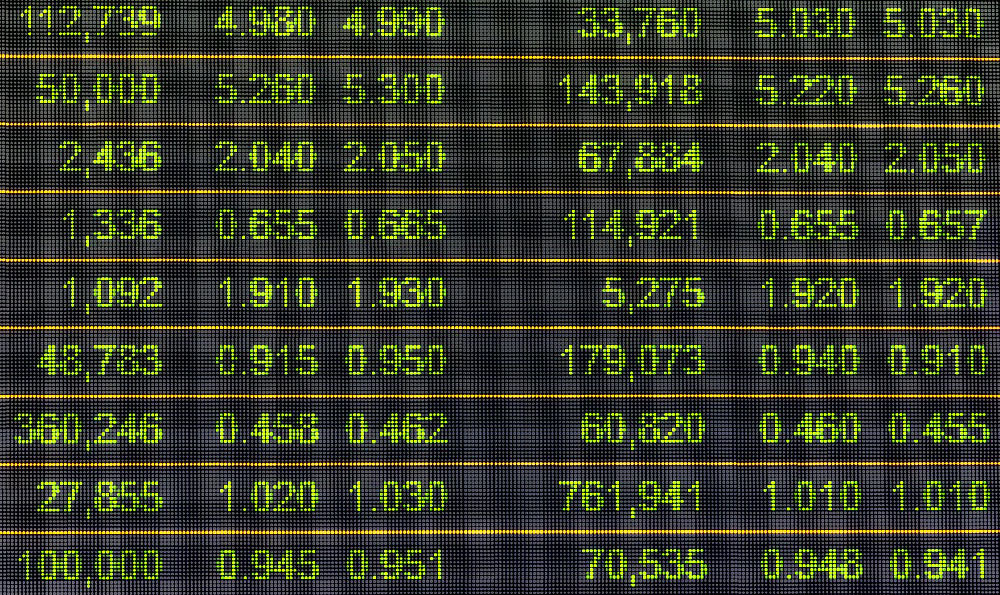

A Binance Card is essentially a debit card that allows you to spend your cryptocurrency holdings anywhere that accepts traditional debit cards. Think of it as a convenient tool to convert your crypto into fiat currency at the point of sale. The card is typically linked to your Binance account and can be funded with various cryptocurrencies supported by the exchange. When you make a purchase, Binance automatically converts the required amount of cryptocurrency into the local fiat currency, allowing you to pay seamlessly.

How Binance Cards Function: A Step-by-Step Guide

The process of using a Binance Card is relatively straightforward:

-

Funding Your Card: You begin by transferring cryptocurrency from your Binance spot wallet to your card wallet. The supported cryptocurrencies and conversion rates are displayed within the Binance app or website.

-

Making a Purchase: When you're ready to make a purchase, simply present your Binance Card as you would any other debit card. The merchant swipes or dips the card, or you can enter the card details for online purchases.

-

Automatic Conversion: Binance automatically converts the required amount of cryptocurrency from your card wallet into the local fiat currency (e.g., USD, EUR) at the prevailing exchange rate.

-

Transaction Completion: The transaction is completed, and the corresponding amount is deducted from your card wallet.

The Benefits of Using a Binance Card

Binance Cards offer several compelling advantages for crypto enthusiasts:

-

Convenience: They provide a seamless and convenient way to spend your cryptocurrency holdings in everyday situations, eliminating the need to constantly convert crypto to fiat and transfer funds to your bank account.

-

Accessibility: Binance Cards are accepted anywhere that accepts Visa or Mastercard, giving you global access to spend your crypto.

-

Cashback Rewards: Many Binance Cards offer cashback rewards on purchases, allowing you to earn crypto back on your spending. This can be a significant benefit for frequent users.

-

Spending Crypto Directly: It allows you to directly spend crypto, furthering its adoption and integration into daily life.

-

Potential for Investment Growth: Instead of selling your crypto holdings, you can hold them and potentially benefit from price appreciation while still having access to their value for spending.

Potential Drawbacks and Considerations

Despite their advantages, Binance Cards also have certain drawbacks and considerations that users should be aware of:

-

Fees: Conversion fees and transaction fees can eat into your profits. Always check the fee structure before using the card. Different cards may have different tiers of fees.

-

Volatility: The value of cryptocurrencies can fluctuate significantly. If you spend crypto with your card, you're essentially selling it at the current market price. If the price subsequently increases, you might regret having spent it.

-

Tax Implications: Spending cryptocurrency with a Binance Card can trigger taxable events. You'll need to track your transactions and report them to the relevant tax authorities. Consulting with a tax professional is highly recommended.

-

Regional Availability: Binance Cards are not available in all regions. Check if they are available in your country before applying.

-

Security Risks: As with any digital asset, there is always a risk of hacking or theft. Ensure you take appropriate security measures to protect your Binance account and card. Enable two-factor authentication and use strong passwords.

-

Exchange Rate Fluctuations: The exchange rate used for conversion may not always be the most favorable. Be mindful of exchange rate fluctuations, especially during volatile market conditions.

Is a Binance Card Right for You? Factors to Consider

Determining whether a Binance Card is suitable for you depends on your individual circumstances and financial goals. Consider the following factors:

-

Frequency of Crypto Spending: If you frequently spend cryptocurrency, a Binance Card can be a convenient and cost-effective solution.

-

Risk Tolerance: Are you comfortable with the volatility of cryptocurrencies? If not, a Binance Card may not be the best option for you.

-

Tax Planning: Have you considered the tax implications of spending cryptocurrency? Consult with a tax professional to ensure you comply with all relevant regulations.

-

Regional Availability and Fees: Is the Binance Card available in your region, and are you comfortable with the associated fees?

-

Security Awareness: Are you familiar with best practices for securing your cryptocurrency holdings and protecting your Binance account?

Optimizing Your Binance Card Usage

If you decide to use a Binance Card, here are some tips to optimize your experience:

-

Monitor Exchange Rates: Keep a close eye on exchange rates before making purchases to ensure you're getting a fair deal.

-

Utilize Cashback Rewards: Take advantage of cashback rewards to earn crypto back on your spending.

-

Track Your Transactions: Keep detailed records of your transactions for tax purposes.

-

Secure Your Account: Enable two-factor authentication and use strong passwords to protect your Binance account.

-

Diversify Your Holdings: Don't put all your eggs in one basket. Diversify your cryptocurrency holdings to mitigate risk.

Conclusion

Binance Cards offer a compelling way to bridge the gap between the crypto world and everyday spending. They provide convenience, accessibility, and potential cashback rewards. However, it's crucial to be aware of the potential drawbacks, including fees, volatility, tax implications, and security risks. By carefully considering your individual circumstances and financial goals, you can determine whether a Binance Card is the right choice for you and optimize your usage for maximum benefit. Remember to stay informed, stay vigilant, and always prioritize your financial security.