How Do Dean and Sam Earn Money in Supernatural?

Dean and Sam Winchester, the central figures of the supernatural television series, navigate a world where their financial stability is as much a product of their relentless pursuit of the paranormal as it is of their resourcefulness and adaptability. Their journey through the vicious cycles of the supernatural realm, haunted by the loss of their mother and burdened by the complexities of their father's legacy, demands not only physical bravery and supernatural skills but also a nuanced understanding of financial planning and risk management. While their sources of income may seem unconventional to the untrained eye, dissecting their financial strategies reveals a fascinating interplay of necessity, ingenuity, and the unpredictable nature of capital markets.

Their early years are marked by a struggle to maintain a semblance of normalcy while grappling with the emotional scars of their mother's death and the enigmatic disappearance of their father. Initially, they rely on the modest savings accrued from their father's work in the supernatural community, but these funds are quickly depleted as they undertake increasingly dangerous missions. This situation mirrors the challenges faced by investors in volatile markets, where initial capital may not be sufficient to sustain long-term growth. To fill this gap, they often resort to unorthodox means, such as selling rare supernatural artifacts, which can be likened to investing in niche or high-value assets that require careful research and evaluation. These transactions, though risky, occasionally yield substantial returns, much like venture capital investments or speculative trading in commodities and real estate. However, the transient nature of these gains also underscores the importance of diversification.

As their adventures progress, Dean and Sam develop a more structured approach to managing their finances. They establish a system of emergency funds, often using the proceeds from successful hunts to cover unexpected expenses. This practice aligns with prudent financial planning, where maintaining a liquidity reserve is crucial for mitigating risks. Their ability to anticipate and prepare for crises—whether it’s a supernatural threat or a financial setback—demonstrates the value of foresight in asset management. For instance, after a particularly perilous encounter with a powerful demon, they allocate a portion of their earnings to fortify their financial buffers, ensuring they are not left vulnerable to future shocks. This mirrors the concept of risk mitigation in investing, where setting aside a portion of profits for contingencies allows for greater resilience during market downturns.

Their financial strategies also reflect a balance between immediate needs and long-term ambitions. While Dean is often willing to take on high-risk ventures, such as confronting ancient evils or engaging in morally ambiguous deals with otherworldly entities, Sam tends to prioritize stability and reliability. This dynamic interplay between risk and caution is akin to the traditional approach to portfolio management, where individuals must weigh their risk tolerance against their financial goals. Dean’s willingness to invest in high-impact opportunities, even at the cost of short-term losses, can be compared to the philosophy of growth investing, where the potential for significant returns justifies the associated risks. Conversely, Sam’s more conservative approach mirrors value investing, where the focus is on securing capital gains through thorough analysis and patience.

Moreover, their reliance on external sources of income, such as their father's debts or the assistance of their sister Jo, highlights the importance of leveraging networks and partnerships in wealth creation. This is a principle that applies to real-world investing where diversifying one's sources of income through strategic alliances or collaborative ventures can enhance financial security. However, their experiences also serve as a cautionary tale about the risks of overextending oneself financially. When they take on too many responsibilities at once, their inability to manage resources efficiently leads to significant financial strain, a scenario that resonates with the pitfalls of overleveraging in investment portfolios.

Their entrepreneurial endeavors, such as operating a salvage yard or running a small business, showcase a rudimentary understanding of capital allocation and operational costs. These ventures, though often fraught with danger and uncertainty, require careful planning, budgeting, and risk assessment. The lessons they learn from these experiences—such as the importance of reinvesting profits and managing debt—are relevant to any investor seeking to build and sustain wealth. However, the chaotic nature of their financial journey also underscores the volatility inherent in many investment choices. Their sudden influxes and outflows of capital are akin to the fluctuations in stock markets or the unpredictable nature of cryptocurrency trading, where the key to long-term success lies in adapting to changing conditions and managing expectations.

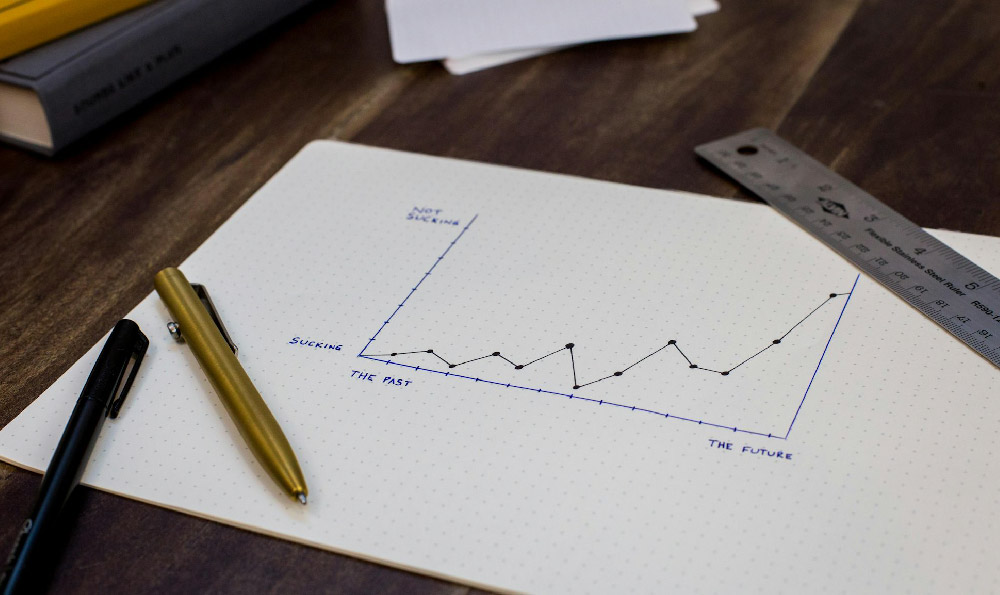

Ultimately, the financial practices of Dean and Sam, while rooted in a fictional context, offer valuable insights into the complexities of managing wealth in an unpredictable environment. Their journey serves as a reminder that financial success is not solely dependent on the amount of capital one possesses, but on the ability to navigate risks, make informed decisions, and adapt to changing circumstances. Whether through unconventional sources of income, strategic resource management, or the balance between risk and caution, their experiences provide a compelling narrative of how to approach financial planning in a world where the variables are as unknown as the future of any investment.