Why XRP Location Matters? What's Keepbit Platform's Role?

Why XRP Location Matters? What's Keepbit Platform's Role?

The world of cryptocurrency is complex, often blurring the lines between technological innovation and financial strategy. Within this dynamic landscape, Ripple's XRP occupies a unique position. Understanding the nuances surrounding XRP, including its geographic implications and the role of platforms like Keepbit, is crucial for anyone navigating the digital asset space. This article will delve into the importance of XRP's location in regulatory terms and then explore Keepbit platform’s role in facilitating cross-border transactions with XRP.

The Regulatory Landscape and XRP's Location

The location of XRP becomes significant primarily due to differing regulatory frameworks across the globe. Cryptocurrencies, unlike traditional fiat currencies, exist outside the direct control of central banks. This decentralized nature presents challenges for regulators who strive to protect investors, combat money laundering, and ensure financial stability.

Different countries have adopted varying approaches to regulating cryptocurrencies, including XRP. Some jurisdictions have embraced cryptocurrencies, establishing clear legal frameworks that foster innovation while mitigating risks. Others have taken a more cautious approach, imposing strict regulations or even outright bans. The United States, for instance, has engaged in prolonged legal battles with Ripple Labs, focusing on whether XRP should be classified as a security. This classification has profound implications for how XRP is treated under US securities laws.

On the other hand, some countries in Asia, the Middle East and Europe, have shown more willingness to work with Ripple and establish favorable regulatory environments. This divergence creates a situation where the regulatory status of XRP is heavily dependent on its "location," or more accurately, the jurisdiction in which it's being used or traded.

The location-specific regulatory status impacts several key aspects:

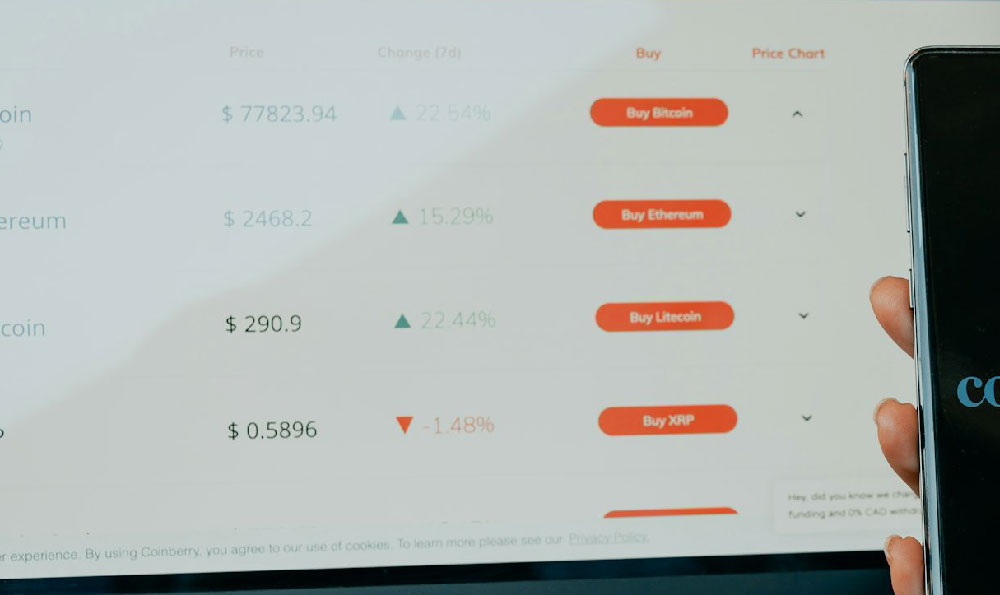

- Exchange Listings: Cryptocurrency exchanges must comply with the regulations of the countries in which they operate. If XRP is deemed a security in a particular jurisdiction, exchanges may be forced to delist it to avoid legal repercussions.

- Investor Protection: Regulatory frameworks often include provisions to protect investors from fraud and market manipulation. The level of protection available to XRP holders varies depending on the jurisdiction.

- Taxation: The tax treatment of XRP gains and losses also varies significantly across countries. Some countries treat XRP as property, subject to capital gains taxes, while others may have different classifications.

- Cross-Border Transactions: Regulatory differences can complicate cross-border transactions involving XRP. For example, transferring XRP from a jurisdiction with strict regulations to one with a more lenient approach may trigger scrutiny from regulators.

Therefore, understanding the regulatory landscape in different jurisdictions is essential for anyone dealing with XRP. It's crucial to be aware of the potential legal and financial implications associated with trading, holding, or using XRP in a particular location.

Keepbit Platform: Streamlining Cross-Border Transactions with XRP

Platforms like Keepbit play a crucial role in navigating the complexities of XRP's location-dependent regulations. They aim to facilitate seamless and compliant cross-border transactions, leveraging the unique capabilities of XRP while adhering to applicable legal frameworks.

Keepbit's role can be understood through several key functions:

-

Compliance Infrastructure: Keepbit, as a platform, develops robust compliance infrastructure that considers the regulatory requirements of different jurisdictions. This infrastructure includes Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures designed to identify and prevent illicit activities. The platform also actively monitors transactions to detect and report suspicious behavior.

-

Bridging Regulatory Gaps: Keepbit acts as a bridge between different regulatory environments. By implementing appropriate compliance measures, the platform enables users to transact with XRP across borders while minimizing the risk of violating local laws. This may involve utilizing specific transaction routing strategies that take into account the regulatory status of XRP in different regions.

-

Facilitating Liquidity: Platforms like Keepbit contribute to XRP's liquidity by connecting buyers and sellers from various locations. Increased liquidity makes it easier for users to buy and sell XRP at competitive prices, reducing the impact of location-specific regulatory restrictions.

-

User Education and Transparency: Keepbit will provide users with clear and concise information about the regulatory status of XRP in different jurisdictions. This empowers users to make informed decisions about their XRP transactions and understand the potential risks and benefits involved. Platforms should also be transparent about their compliance procedures and how they are designed to protect users and comply with applicable laws.

-

Adaptability and Innovation: The regulatory landscape for cryptocurrencies is constantly evolving. Platforms like Keepbit must remain adaptable and innovative to stay ahead of regulatory changes and ensure continued compliance. This may involve incorporating new technologies, such as blockchain analytics and regulatory reporting tools, to enhance compliance capabilities.

Keepbit, or other similar platforms, in essence aim to unlock XRP's potential for cross-border payments and remittances by navigating the complex web of international regulations. By establishing robust compliance frameworks, bridging regulatory gaps, and fostering liquidity, these platforms contribute to the growth and adoption of XRP in a compliant and responsible manner.

Conclusion

The location of XRP significantly impacts its regulatory status, influencing exchange listings, investor protection, taxation, and cross-border transactions. Platforms like Keepbit are instrumental in navigating this complexity by providing compliant infrastructure, bridging regulatory gaps, facilitating liquidity, educating users, and adapting to evolving regulatory landscapes. Understanding both the regulatory nuances and the role of facilitating platforms is crucial for anyone participating in the XRP ecosystem. As the cryptocurrency space continues to mature, platforms like Keepbit will likely play an increasingly important role in enabling seamless and compliant cross-border transactions, unlocking the full potential of XRP and other digital assets.