How Much Can Uber Drivers Earn & Is It Worth It?

Let's delve into the financial realities of being an Uber driver, examining the potential earnings and weighing the pros and cons to determine if it's a worthwhile endeavor. This requires a nuanced perspective, considering not just the gross fares, but also the often-overlooked expenses and the opportunity cost of the time invested.

The income potential for Uber drivers is notoriously variable, heavily influenced by factors such as location, time of day, day of the week, driver availability, and even current promotions offered by Uber. Drivers in densely populated metropolitan areas with high demand, like New York City or Los Angeles, generally have the potential to earn more than those in smaller towns or rural areas. Similarly, driving during peak hours, such as rush hour commutes, weekend evenings, or during special events, typically yields higher fares due to surge pricing. Uber's algorithms dynamically adjust fares based on demand, incentivizing drivers to be available when and where they are needed most. However, this surge pricing is not always guaranteed and can fluctuate rapidly, making consistent income predictions challenging.

Furthermore, Uber drivers are classified as independent contractors, not employees. This distinction is crucial because it means they are responsible for all their own expenses. These expenses can be substantial and significantly impact the net earnings. The most significant cost is typically vehicle-related, including gasoline, maintenance (oil changes, tire rotations, brake repairs), car washes, and depreciation. Drivers also need to factor in insurance costs, which can be higher than personal auto insurance due to the commercial nature of the driving activity. Regular vehicle inspections may also be required, adding to the overall cost. Another often-overlooked expense is the self-employment tax, which drivers must pay on their earnings. This tax covers both the employer and employee portions of Social Security and Medicare taxes, and can represent a considerable chunk of the overall income.

Beyond direct expenses, consider the opportunity cost. The time spent driving for Uber could be used for other income-generating activities, personal pursuits, or further education. A careful assessment of these alternative uses of time is essential to determine if driving for Uber is the most efficient way to utilize one's resources. For example, someone with specialized skills might be able to earn significantly more per hour through freelancing or consulting.

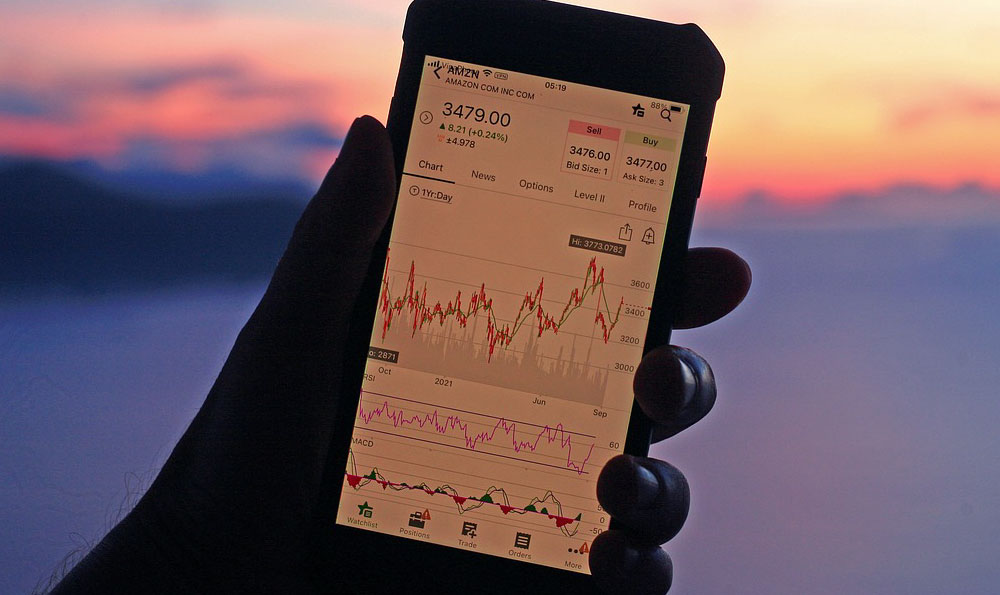

So, how can a prospective Uber driver estimate their potential earnings and make an informed decision? Gathering data is paramount. Researching the average fares in your specific location is a good starting point. Many online resources and driver forums provide anecdotal evidence and estimates of Uber driver earnings in different cities. Utilizing Uber's own driver app and experimenting with different driving times and locations can provide firsthand insights into potential earnings patterns. Crucially, meticulous record-keeping is essential. Track all income and expenses, including mileage, gasoline purchases, maintenance costs, and other related expenses. This data will allow you to calculate your net earnings accurately and assess the true profitability of driving for Uber.

Analyzing these factors through a critical lens is vital. Drivers should not solely focus on gross earnings, which can be misleading. Instead, calculate the net earnings after deducting all expenses and taxes. Divide the net earnings by the number of hours worked to determine the hourly rate. Compare this hourly rate to the potential earnings from other alternative activities. Additionally, consider the non-monetary factors. Driving for Uber can offer flexibility and autonomy, allowing drivers to set their own hours and work independently. This can be particularly appealing to individuals who value control over their work schedule. However, driving can also be physically demanding, involving long hours sitting in a car and dealing with unpredictable traffic conditions and passengers. The work environment can also be isolating, with limited interaction with colleagues.

To maximize earnings and mitigate risks, drivers should adopt proactive strategies. During periods of high demand, prioritize driving during surge pricing hours. Optimize routes to minimize mileage and fuel consumption. Maintain the vehicle diligently to prevent costly repairs. Provide excellent customer service to earn positive ratings, which can lead to more ride requests and higher tips. Explore strategies to minimize taxes, such as deducting eligible expenses and maximizing self-employment tax deductions. Consider investing in a fuel-efficient vehicle or exploring alternative fuel options to reduce fuel costs.

The answer to whether driving for Uber is "worth it" is highly subjective and depends on individual circumstances and priorities. For some, it may be a valuable source of supplemental income or a flexible way to earn a living. For others, the expenses, time commitment, and potential risks may outweigh the benefits. A thorough and realistic assessment of one's financial situation, driving habits, and alternative opportunities is crucial to make an informed decision. There's no universal answer; each individual must weigh the potential rewards against the inherent costs and risks. It demands a clear understanding of personal financial goals and a rigorous cost-benefit analysis to determine if Uber driving aligns with those objectives. Remember, informed decision-making is the cornerstone of any sound investment, even when that investment is your time and effort.