How much revenue did the Titanic movie make?

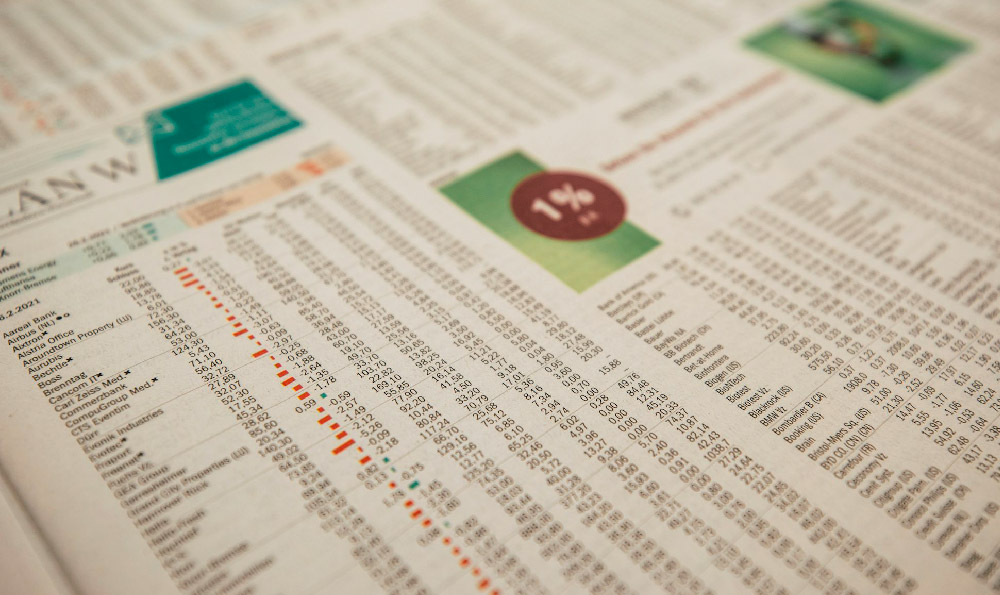

Investing in cryptocurrencies has become a cornerstone of modern financial strategies, with its potential to yield substantial returns while navigating the complexities of market volatility. However, the journey is as much about discipline and foresight as it is about technical analysis. To uncover the true value of this digital frontier, it's essential to understand the factors that drive performance, the risks that can erode gains, and the principles that can safeguard your capital in an unpredictable landscape.

One of the most critical aspects of cryptocurrency investment is the ability to interpret market dynamics with a long-term perspective. Unlike traditional markets where macroeconomic indicators often dictate trends, the crypto sphere is influenced by a unique combination of technological innovation, regulatory developments, and market sentiment. For instance, the advent of new blockchain protocols or the adoption of decentralized finance (DeFi) platforms can create waves of demand, while geopolitical shifts or policy changes can introduce unexpected volatility. Tracking these trends requires more than just observing price movements; it demands a deep dive into the underlying narratives that shape the industry.

A key tool for evaluating opportunities lies in the analysis of technical indicators, which provide quantitative insights into market behavior. Metrics such as moving averages, relative strength index (RSI), and volume patterns can help identify potential entry and exit points. For example, a crossover of the 50-day and 200-day moving averages often signals a shift in momentum, while an RSI reading above 70 may indicate overbought conditions. However, technical analysis should never be viewed as a standalone strategy. It must be layered with fundamental research to assess the intrinsic value of projects. Consider the team behind a blockchain initiative, the roadmap of development, and the utility of the token—these elements collectively determine the sustainability of growth.

The allure of high returns in the crypto market often comes at the expense of overexposure to risk. Many investors fall into the trap of chasing quick profits, only to be caught off guard by market crashes or regulatory crackdowns. For example, the 2018 bear market saw Bitcoin lose over 80% of its value, striking fear into even the most seasoned participants. To mitigate such risks, it's crucial to adopt a diversified approach, allocating capital across multiple assets rather than concentrating it in a single coin. This strategy not only spreads risk but also ensures that you're not wholly dependent on the performance of any one project.

Another vital component of successful investment is the understanding of market cycles. The crypto market is notoriously cyclical, with periods of rapid appreciation followed by sharp declines. Recognizing these cycles allows investors to position themselves strategically. For instance, during a market downturn, the best opportunities often emerge—tokens with strong fundamentals may become undervalued, presenting a chance for long-term gains. Conversely, at the peak of a bullish cycle, it's essential to remain cautious and avoid the trap of overleveraging, which can amplify losses when the market reverses.

In addition to technical and fundamental analysis, behavioral finance plays an equally important role in shaping investment outcomes. Emotions such as fear and greed can lead to impulsive decisions, often resulting in poor timing. The key to overcoming this is to establish a robust risk management framework. This includes setting stop-loss orders to limit downside, maintaining a consistent rebalancing strategy to adapt to changing conditions, and avoiding the temptation to hold onto losing positions for too long. Discipline is the cornerstone of resilience in a market where panic is inevitable.

The rise of institutions and regulatory frameworks has also reshaped the crypto landscape, introducing both challenges and opportunities. While increased oversight can reduce fraud and enhance transparency, it may also impose restrictions on certain activities. For example, the introduction of regulated exchanges has made it easier for retail investors to participate, but it has also led to a concentration of liquidity in dominant coins. Navigating this environment requires adaptability—whether by focusing on niche projects or by leveraging stablecoins to hedge against volatility.

Finally, the integration of AI and machine learning into trading strategies has opened new avenues for generating returns. These technologies can process vast amounts of data, identifying patterns that may not be visible to the human eye. However, relying solely on algorithmic tools is a double-edged sword. While they can improve efficiency, they may also lack the contextual understanding needed to navigate uncharted territory. The best approach is to combine data-driven insights with human judgment, ensuring that decisions are grounded in both logic and experience.

In conclusion, the path to profitable cryptocurrency investment is paved with knowledge, patience, and a proactive mindset. By analyzing market trends, employing technical tools, and adhering to sound risk management principles, investors can position themselves to thrive in this dynamic environment. Remember, the goal is not to chase the next big opportunity but to build a strategy that aligns with your financial objectives and risk tolerance. With the right approach, the crypto market can be a powerful tool for achieving growth, but it demands the same level of care and foresight as any other investment.