Roth IRA Contribution Limit: How Much Can You Invest? What Are the Rules?

Investing for retirement is a crucial step toward financial security. Among the various retirement savings vehicles available, the Roth IRA stands out for its unique tax advantages. Understanding the Roth IRA contribution limit and its associated rules is paramount for maximizing its benefits. The Roth IRA, named after former Senator William Roth, offers a significant advantage: qualified distributions in retirement are tax-free. This is in contrast to traditional IRAs, where contributions might be tax-deductible now, but withdrawals are taxed as ordinary income in retirement.

So, how much can you contribute to a Roth IRA? The contribution limit is subject to annual adjustments by the IRS, reflecting changes in the cost of living. For example, in 2023, the contribution limit for individuals under age 50 was $6,500. This amount increases to $7,500 for those age 50 and older. It's essential to stay updated on the current year's contribution limits, as exceeding them can lead to penalties. Now, this might make you think that is all you need to know, but you need to consider your income.

However, simply wanting to contribute the maximum amount doesn't guarantee eligibility. A key factor determining your ability to contribute to a Roth IRA is your modified adjusted gross income (MAGI). The IRS imposes income limitations, and individuals exceeding these thresholds are either limited in how much they can contribute or are entirely ineligible. These income thresholds also change each year, so it is important to check them when tax season comes around. For instance, in 2023, for single filers, the ability to contribute to a Roth IRA began to phase out with a MAGI above $138,000 and was completely disallowed with a MAGI of $153,000 or more. For those married filing jointly, the phase-out range was between $218,000 and $228,000. If your income falls within these phase-out ranges, you can still contribute, but the amount you're allowed to contribute is reduced. The IRS provides worksheets and calculators to help determine your allowable contribution amount based on your MAGI.

Contributing to a Roth IRA involves adhering to certain rules and regulations. One critical aspect is the "earned income" requirement. To contribute to a Roth IRA, you must have earned income, meaning income from wages, salaries, tips, or self-employment. Investment income, such as dividends or capital gains, does not qualify as earned income for Roth IRA contribution purposes. The amount you contribute cannot exceed your earned income for the year. For example, if you only earned $3,000 during the year, your Roth IRA contribution limit is capped at $3,000, even if the general contribution limit is higher. The earned income also refers to the income earned by yourself, you can not contribute to a Roth IRA for your children who do not work for example.

Another important rule concerns excess contributions. If you contribute more than the allowable amount to your Roth IRA, you may be subject to a 6% excise tax on the excess contribution for each year it remains in the account. It's crucial to carefully calculate your allowable contribution amount and ensure you do not exceed it. If you inadvertently make an excess contribution, you can withdraw the excess contribution and any earnings attributable to it before the tax filing deadline to avoid the penalty. However, any earnings withdrawn will be subject to income tax and potentially a 10% early withdrawal penalty if you're under age 59 1/2.

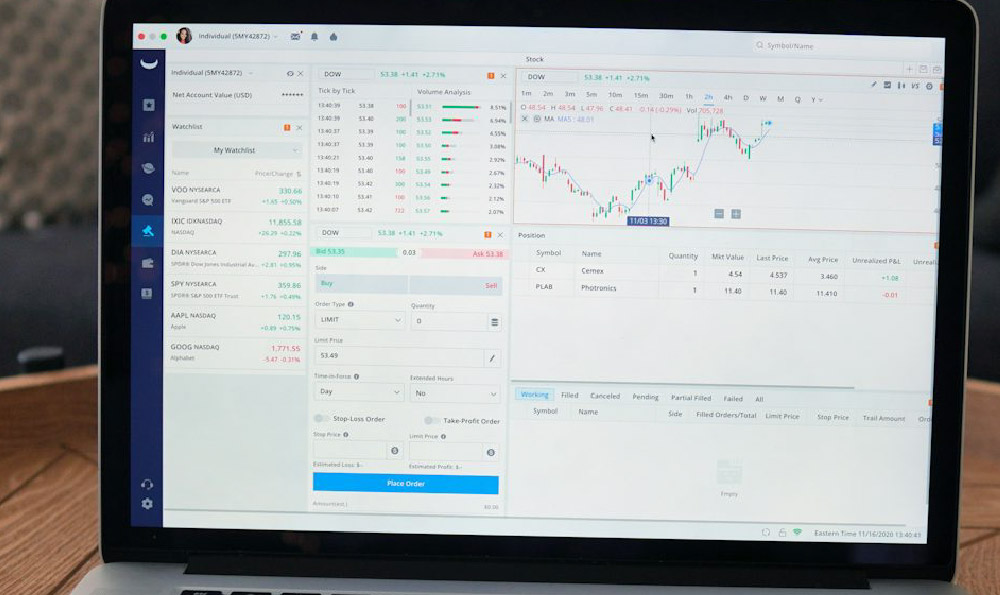

There are also rules regarding the types of investments you can hold within a Roth IRA. Generally, you can invest in a wide range of assets, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and certificates of deposit (CDs). However, certain investments, such as collectibles (e.g., art, antiques) and life insurance contracts, are prohibited within a Roth IRA. Engaging in prohibited transactions, such as borrowing money from your Roth IRA or using it as collateral for a loan, can also lead to adverse tax consequences, potentially resulting in the disqualification of the IRA.

One of the most significant benefits of a Roth IRA is the tax-free nature of qualified distributions in retirement. To qualify for tax-free treatment, distributions must be made at least five years after the first contribution to any Roth IRA and must meet one of the following conditions: you are age 59 1/2 or older, you become disabled, or you use the distribution to pay for qualified first-time homebuyer expenses (up to $10,000). If you take a distribution that does not meet these requirements, the earnings portion of the distribution will be subject to income tax and potentially a 10% early withdrawal penalty if you're under age 59 1/2. Contributions, however, can always be withdrawn tax-free and penalty-free, as they were made with after-tax dollars.

Understanding the Roth IRA contribution limit and its associated rules is crucial for maximizing its benefits and avoiding potential penalties. Staying informed about annual contribution limits, income limitations, earned income requirements, and qualified distribution rules is essential for making informed decisions and achieving your retirement savings goals. Consulting with a financial advisor can also provide personalized guidance and help you develop a comprehensive retirement plan that aligns with your individual circumstances and objectives. By carefully adhering to the rules and maximizing your contributions within the allowable limits, you can leverage the power of the Roth IRA to build a secure and tax-advantaged retirement nest egg.