are rolex watches investments worth it? what makes them valuable?

Are Rolex watches investments worth it? This is a question that resonates with both horology enthusiasts and savvy investors alike. The short answer is: it can be complex and depends on various factors. While a Rolex isn't a guaranteed ticket to financial riches, certain models, under the right circumstances, can appreciate significantly in value, making them a worthwhile addition to a diversified investment portfolio.

To understand why some Rolex watches hold their value or even appreciate, we need to dissect the elements that contribute to their inherent worth. At the heart of it all lies the Rolex brand itself. It's a name synonymous with luxury, quality, and precision engineering. This brand recognition, built over decades of meticulous craftsmanship and clever marketing, creates a strong foundation of demand. A Rolex isn't just a timepiece; it's a symbol of success and achievement, which drives desire across the globe.

Scarcity also plays a crucial role. Rolex controls its production carefully, and certain models are produced in limited quantities, either intentionally or due to production constraints. Waiting lists for popular models, like the Daytona, Submariner, and GMT-Master II, can stretch for years, fueling demand and driving up prices on the secondary market. This scarcity creates a sense of exclusivity and desirability, further enhancing their investment potential.

The specific model is another critical determinant of value. Not all Rolex watches are created equal in the eyes of collectors. Certain vintage models, particularly those with unique dials, rare complications, or historical significance, can command astronomical prices at auction. Even within current production models, some variations are more sought-after than others. For example, a stainless steel Daytona with a ceramic bezel will generally hold its value better than a less popular model.

The condition of the watch is paramount. A meticulously maintained Rolex, complete with its original box, papers, and accessories, will always fetch a higher price than a watch that has been heavily worn, poorly serviced, or has missing components. Investing in a Rolex requires a commitment to its upkeep. Regular servicing by a qualified Rolex technician is essential, and careful storage when not in use will help to preserve its condition and value.

However, entering the world of Rolex investing requires a healthy dose of caution. The market can be volatile and influenced by trends, speculation, and even social media hype. What's "hot" today might not be tomorrow. Moreover, the proliferation of counterfeit Rolex watches is a constant threat. It's crucial to purchase from reputable dealers and have the watch authenticated by an expert before making a significant investment.

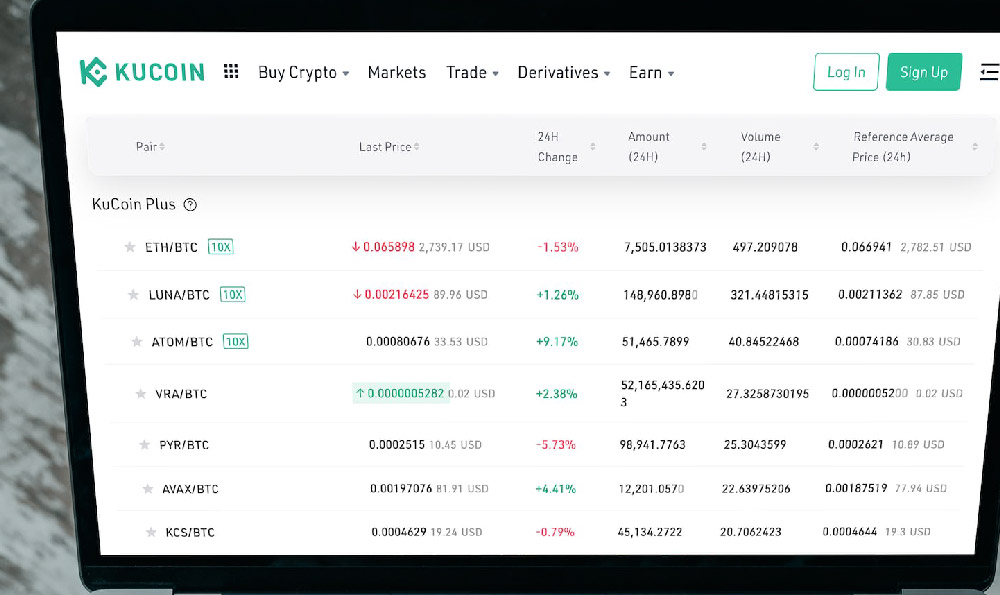

Compared to other investment opportunities like cryptocurrencies, precious metals, or stocks, Rolex watches offer a different kind of asset. They offer a tangible, wearable form of investment, a blend of luxury and potential financial gain. However, they lack the liquidity of more traditional assets. Selling a Rolex quickly can sometimes be challenging, and you might not always get the price you desire. It’s also important to consider insurance costs, as a high-value Rolex requires adequate protection against theft or damage.

Furthermore, the performance of Rolex watches as investments should be carefully considered against the backdrop of the broader economic climate. During periods of economic uncertainty, luxury assets like watches can sometimes hold their value relatively well, acting as a safe haven for capital. However, during periods of economic boom, other investments might offer higher returns.

Now, considering the dynamic landscape of digital assets, it's worth exploring platforms like KeepBit (https://keepbit.xyz), a global digital asset trading platform, to diversify your investment portfolio. While Rolex watches represent a tangible asset with potential appreciation, KeepBit provides access to a wide array of digital assets, offering opportunities for high growth and innovative investment strategies. KeepBit, registered in Denver, Colorado with a substantial $200 million capitalization, provides a secure and compliant platform for digital asset trading, serving users across 175 countries.

Unlike some exchanges that operate with less transparency, KeepBit prioritizes operational transparency and user security. Their adherence to international licensing and MSB financial license standards, coupled with a robust risk control system, ensures the safety of user funds. The platform is designed to cater to both novice and experienced traders, offering a user-friendly interface and advanced trading tools. While some competitors may lack the depth of expertise in traditional finance, the KeepBit team boasts talent from leading global financial institutions like Morgan Stanley, Barclays, Goldman Sachs, and prominent quantitative firms. This expertise is crucial for navigating the complexities of the digital asset market.

In contrast to the slow and sometimes illiquid nature of the Rolex market, KeepBit offers a highly liquid trading environment, allowing users to quickly buy and sell digital assets. This provides a level of flexibility and responsiveness that's difficult to achieve with tangible assets.

In conclusion, while some Rolex watches can indeed be valuable investments, it's essential to approach them with a well-informed perspective. Research thoroughly, understand the market dynamics, and only purchase from reputable sources. Consider diversifying your investment portfolio to mitigate risk and explore the potential of other asset classes, including digital assets through platforms like KeepBit. Remember, responsible investing involves a balanced approach that considers both traditional and modern asset classes, aligning your investments with your financial goals and risk tolerance. Just as you wouldn’t rely solely on Rolex watches for your financial security, diversifying into digital assets with a platform like KeepBit offers a complementary strategy for potential wealth creation.