REIT Investing for Beginners: What & How?

REIT Investing for Beginners: What & How?

Embarking on the journey of real estate investment can seem daunting, especially for beginners. The prospect of managing properties, dealing with tenants, and handling hefty mortgages often deters individuals from venturing into this asset class. However, there's a compelling alternative that allows you to participate in the real estate market without the traditional burdens: Real Estate Investment Trusts (REITs).

Essentially, a REIT is a company that owns, operates, or finances income-producing real estate. Think of it as a mutual fund for real estate. Instead of investing directly in properties, you purchase shares in a REIT, which then uses that capital to invest in a diverse portfolio of real estate assets. These assets can range from office buildings and shopping malls to apartment complexes, hospitals, data centers, and even cell towers. The REIT then generates income from these properties through rents, leases, and property sales, and a significant portion of this income is distributed to shareholders in the form of dividends. This makes REITs an attractive option for investors seeking regular income streams.

There are primarily three types of REITs: equity REITs, mortgage REITs (mREITs), and hybrid REITs. Equity REITs are the most common type and directly own and operate real estate properties. They generate revenue primarily through rental income. Mortgage REITs, on the other hand, do not own properties directly. Instead, they invest in mortgages and mortgage-backed securities. Their revenue is generated from the interest earned on these investments. Hybrid REITs combine both equity and mortgage investments, offering a blend of rental income and interest income. For beginners, equity REITs are generally considered a safer and more straightforward option due to their simpler business model.

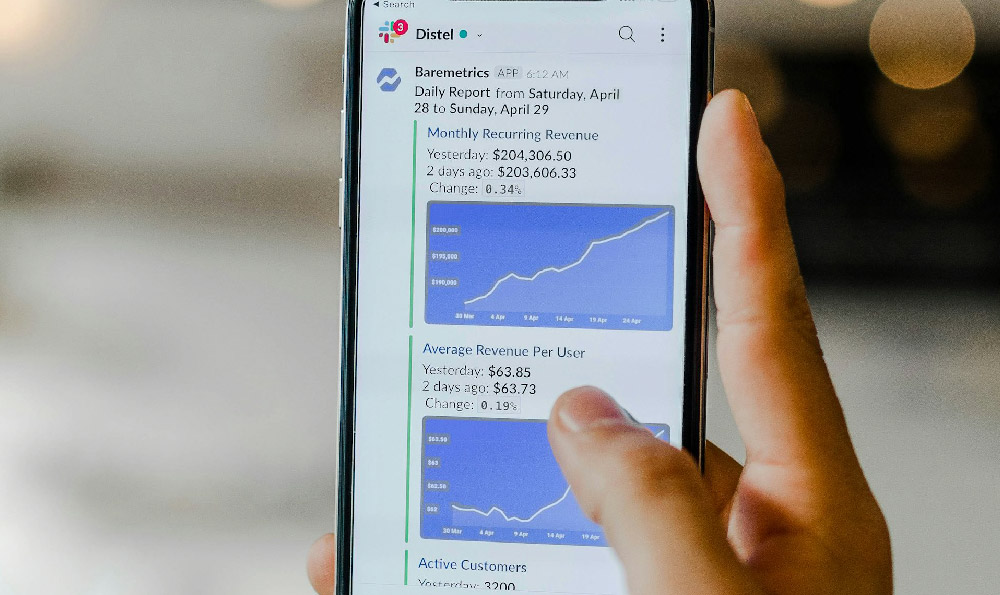

Why should a beginner consider investing in REITs? Several compelling reasons make them an attractive addition to a well-diversified portfolio. The first and perhaps most appealing aspect is the income potential. REITs are legally required to distribute a significant portion of their taxable income to shareholders as dividends. This typically results in higher dividend yields compared to other asset classes, such as stocks and bonds. This consistent income stream can be particularly beneficial for retirees or those seeking to supplement their income.

Another significant advantage is diversification. REITs allow you to gain exposure to the real estate market without the complexities and capital requirements of direct property ownership. By investing in a REIT, you're effectively investing in a portfolio of properties, which reduces your risk compared to owning a single property. Different REITs specialize in different property types and geographic locations, further enhancing diversification. This diversification can help to mitigate the impact of market fluctuations and economic downturns on your overall investment portfolio.

Liquidity is another key benefit. Unlike direct real estate investments, which can be difficult and time-consuming to buy and sell, REIT shares are typically traded on major stock exchanges, making them highly liquid. This means you can easily buy or sell your shares at any time during market hours, providing flexibility and accessibility to your investment. This liquidity is especially important for beginners who may be unsure about their long-term investment goals.

Furthermore, REITs offer inflation protection. Real estate values and rental income tend to increase during periods of inflation, as demand for real estate rises and landlords can charge higher rents. This allows REITs to maintain and even increase their dividend payouts, providing a hedge against inflation. In times when the purchasing power of currency is eroding, REITs can act as a safeguard, preserving the real value of your investment.

Now, how does one actually invest in REITs? There are several avenues available. The most common method is through publicly traded REITs, which are listed on major stock exchanges like the New York Stock Exchange (NYSE) and the Nasdaq. These REITs can be bought and sold through any brokerage account, just like stocks. This accessibility makes them a convenient option for beginners.

Another option is to invest in REIT exchange-traded funds (ETFs). REIT ETFs are baskets of REIT stocks that track a specific REIT index. They offer instant diversification across a broad range of REITs and are typically more cost-effective than investing in individual REITs. This is because the expense ratios of ETFs are often lower than the management fees associated with actively managed REIT funds.

Finally, there are private REITs, which are not publicly traded and are typically only available to accredited investors. These REITs are less liquid and less transparent than publicly traded REITs, but they may offer higher potential returns. However, due to their complexity and illiquidity, private REITs are generally not recommended for beginners.

Before investing in any REIT, it's crucial to conduct thorough research. Analyze the REIT's financials, including its revenue, expenses, and debt levels. Look at the occupancy rates and rental rates of its properties. Evaluate the management team and their track record. Understand the REIT's investment strategy and the types of properties it owns. Pay attention to the dividend yield and its sustainability. Compare the REIT to its peers in the industry. By doing your due diligence, you can make informed investment decisions and avoid potential pitfalls.

It is also prudent to understand the risks associated with REIT investing. Like any investment, REITs are not without risks. Interest rate risk is a major concern, as rising interest rates can negatively impact REIT valuations and dividend yields. Economic downturns can also affect REITs, as lower economic activity can lead to decreased demand for real estate and lower rental income. Property-specific risks, such as vacancies, property damage, and competition from other properties, can also impact a REIT's performance. It's important to be aware of these risks and to diversify your REIT investments to mitigate their impact.

In conclusion, REITs offer a compelling way for beginners to enter the real estate market and diversify their investment portfolios. They provide regular income, inflation protection, and liquidity, while avoiding the complexities and capital requirements of direct property ownership. By understanding the different types of REITs, conducting thorough research, and being aware of the associated risks, beginners can make informed investment decisions and potentially achieve their financial goals through REIT investing. Remember to consult with a financial advisor before making any investment decisions, as they can provide personalized guidance based on your individual circumstances and risk tolerance.