Real-Time Order Book Sync: How and Why Does it Matter?

Real-time order book synchronization is the linchpin of fair, efficient, and robust markets in the digital age, particularly in the high-frequency trading (HFT) and algorithmic trading domains. It's more than just a technical detail; it's the foundation upon which trust, price discovery, and regulatory compliance are built. Understanding how it works and why it's vital is crucial for anyone involved in financial markets, from retail investors to institutional traders and regulators.

At its core, an order book is a digital ledger that compiles all outstanding buy (bid) and sell (ask) orders for a specific asset at a particular exchange or trading venue. It represents the current supply and demand for that asset. The order book displays the prices at which traders are willing to buy or sell and the quantities they're willing to trade at those prices. This data is crucial for traders making informed decisions about where and when to execute their orders. The "real-time" aspect signifies that the order book is constantly updated with every new order, cancellation, or trade execution.

The "synchronization" part of the phrase refers to the process of maintaining an identical, up-to-date copy of the order book across multiple systems and locations. This is where the complexity arises. In a world where speed is paramount, even the slightest discrepancies in the order book's information can lead to arbitrage opportunities, market manipulation, and significant financial losses. Different exchanges and data providers, as well as internal trading systems, must have access to the same view of the market at nearly the same instant. Achieving this requires sophisticated technology and infrastructure.

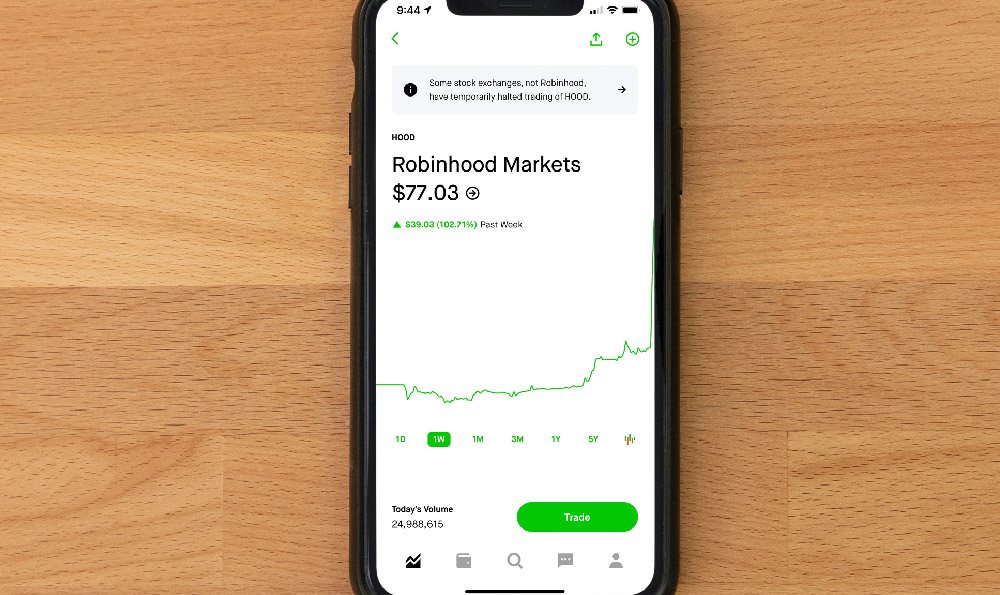

One of the primary reasons real-time order book synchronization is essential is to prevent stale or incomplete data from influencing trading decisions. Imagine a scenario where a trader's system displays an outdated order book. This trader might believe there's significant liquidity available at a particular price, leading them to place a large order. However, if other traders have already taken that liquidity, the trader's order could be filled at a much worse price, or not filled at all, resulting in a loss. Real-time synchronization minimizes the risk of such errors by ensuring that traders have the most accurate and up-to-date information available.

For algorithmic traders, particularly those employing high-frequency strategies, real-time order book synchronization is not just important; it's absolutely critical. HFT algorithms rely on extremely fast data processing and order execution to capitalize on fleeting price discrepancies. These algorithms constantly analyze the order book for patterns and opportunities, and even a microsecond delay in receiving updates can render their strategies unprofitable or even detrimental. A misinformed algorithm could trigger a cascade of unintended trades, potentially destabilizing the market.

Moreover, real-time order book synchronization plays a critical role in arbitrage. Arbitrage involves exploiting price differences for the same asset across different exchanges or trading venues. An arbitrageur monitors multiple order books simultaneously, looking for opportunities to buy low in one market and sell high in another. These opportunities are often short-lived, so speed and accuracy are essential. Without synchronized order books, arbitrageurs would be unable to effectively identify and exploit these opportunities, leading to less efficient markets.

The benefits extend beyond the realm of sophisticated trading firms. Regulators also rely on real-time order book data to monitor market activity, detect potential manipulation, and enforce fair trading practices. They need to be able to see a consolidated view of the market across different exchanges to identify suspicious patterns and ensure that all participants are playing by the rules. Inaccurate or delayed data would hinder their ability to effectively oversee the markets and protect investors.

The technical challenges of achieving real-time order book synchronization are considerable. The sheer volume of data flowing through financial markets is immense, and it's constantly increasing. Exchanges and data providers need to invest in high-bandwidth networks, ultra-low-latency hardware, and efficient data processing algorithms to keep up with the demand. Furthermore, they need to address issues of data normalization, as different exchanges may use different formats and protocols for transmitting order book data. This requires sophisticated mapping and translation systems to ensure that all data is consistent and comparable.

Another challenge is ensuring data integrity. Order book data is highly sensitive, and even small errors can have significant consequences. Exchanges and data providers need to implement robust error detection and correction mechanisms to prevent data corruption. They also need to have backup systems in place to ensure that data is not lost in the event of a system failure.

Furthermore, latency is a constant concern. The speed of light itself becomes a limiting factor when transmitting data across long distances. Exchanges and data providers need to carefully consider the location of their servers and network infrastructure to minimize latency. They also need to use advanced network optimization techniques to reduce the time it takes to transmit data packets.

In conclusion, real-time order book synchronization is a vital component of modern financial markets. It ensures fair and efficient price discovery, prevents market manipulation, and enables sophisticated trading strategies. While achieving it is technically challenging, the benefits are substantial. As markets become increasingly complex and interconnected, the importance of real-time order book synchronization will only continue to grow. Investing in the technology and infrastructure necessary to achieve it is essential for maintaining the integrity and stability of the financial system. It fosters trust among market participants, leading to increased participation and, ultimately, a more robust and dynamic economy.