Quick Money Tips to Earn Fast - How to Make Money Online

Understanding the Fine Line Between Quick Gains and Sustainable Wealth in the Digital Economy

In today’s fast-paced digital marketplace, the allure of rapid financial growth often tempts investors to chase short-term opportunities. However, the path to quick money, particularly in the realm of virtual currencies and online investments, is filled with complexities that require more than luck—it demands strategic foresight, disciplined execution, and a deep understanding of market dynamics. The key to navigating this landscape lies in balancing aggressive strategies with prudent risk management to avoid pitfalls that can erode long-term value.

The cryptocurrency sector has become a fertile ground for both innovation and speculation. While Bitcoin and Ethereum remain the most prominent names, the rise of decentralized finance (DeFi) protocols, non-fungible tokens (NFTs), and algorithmic trading platforms has further diversified the avenues for generating income. For those seeking to capitalize on these opportunities, the foundation begins with analyzing market trends. Price movements in digital assets are influenced by a mix of macroeconomic factors, institutional activity, and technological advancements. Monitoring indicators such as market capitalization, trading volume, and sentiment analysis can help identify potential entry points, but these signals must be interpreted in conjunction with broader economic contexts. For instance, rising inflation rates often drive investors toward assets with limited supply, like Bitcoin, while geopolitical instability may amplify volatility in altcoins, creating both risks and opportunities. A critical eye is essential to differentiate between genuine value creation and speculative bubbles.

Yet, the path to quick money is rarely linear. Market conditions are prone to swift shifts, often triggered by news events, regulatory changes, or technological breakthroughs. In 2022, the collapse of Terra Luna and the subsequent ripple effects across the DeFi ecosystem served as a stark reminder of the risks involved in overleveraged strategies. Investors who failed to hedge against these shocks faced significant losses, highlighting the importance of diversification. Even with crypto’s inherent volatility, a well-balanced portfolio that includes a mix of high-growth assets and stablecoins can mitigate exposure to sudden downturns. Diversification is not about spreading risk blindly, but about aligning investments with distinct risk profiles to ensure resilience during market fluctuations.

Beyond diversification, the strategic use of risk management tools is paramount. Stop-loss orders, for example, allow investors to automatically sell assets when they fall below a predetermined price, preventing emotional decision-making during sharp declines. Similarly, position sizing—allocating only a portion of available capital to a single trade or investment—ensures that no single event can cripple an entire portfolio. In the world of crypto, where prices can swing dramatically in hours, these techniques are not optional—they are necessities. Moreover, staying informed about regulatory developments is crucial; governments worldwide are increasingly scrutinizing the crypto industry, and compliance with local laws can protect investors from unexpected legal hurdles.

While risk mitigation is vital, the potential for passive income opportunities can further enhance financial strategies. Staking, for instance, allows crypto holders to earn rewards by validating transactions on blockchain networks, offering a steady return without the need for active trading. Yield farming on DeFi platforms provides similar benefits, though it often requires a higher level of technical expertise and exposes investors to additional risks such as smart contract vulnerabilities. For those looking to generate income with minimal effort, rental income through platforms like AirBNB or Turo offers a practical alternative, as does affiliate marketing or online content creation. These options require initial effort but can yield long-term benefits, particularly for individuals with unique skills or niche audiences.

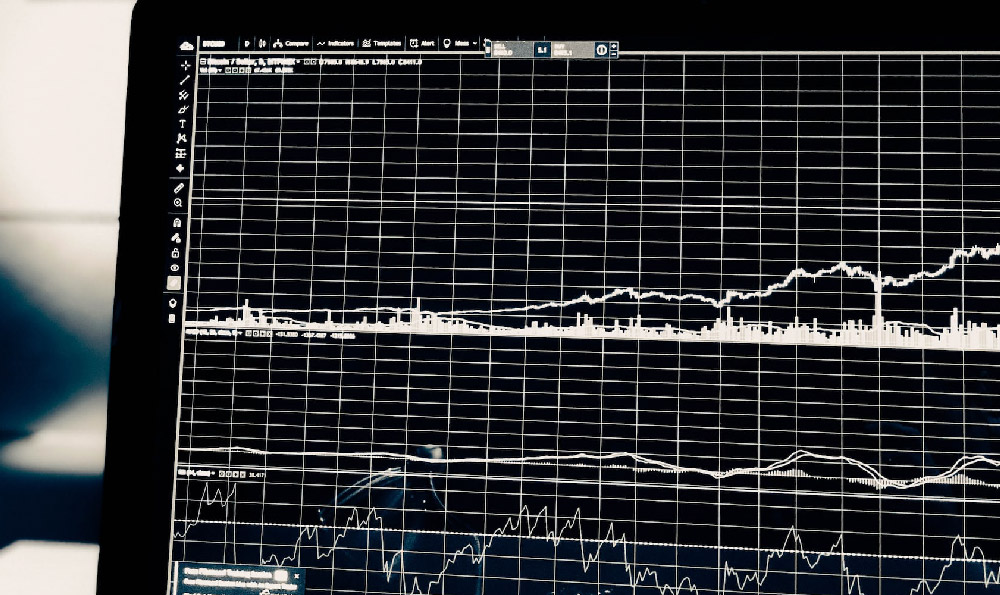

However, the most sustainable approach to quick money often involves a blend of short-term tactics and long-term planning. Short-term traders may exploit market inefficiencies through arbitrage opportunities or technical analysis, using tools like candlestick charts and moving averages to predict price movements. Yet, these strategies are inherently risky and require constant vigilance. In contrast, long-term investors benefit from the compounding potential of digital assets, which can appreciate significantly over time. A combination of both approaches—utilizing short-term gains to fund long-term projects—can create a dynamic financial strategy that adapts to changing market conditions.

For individuals new to the digital economy, education is the first step toward financial success. Learning the fundamentals of blockchain technology, understanding the risks of margin trading, and mastering the basics of market analysis can transform a novice into a more confident investor. Online courses, forums, and community discussions provide valuable resources, though they should be scrutinized for credibility. Ultimately, the more informed an investor is, the better equipped they are to make decisions that align with their financial goals and risk tolerance.

In conclusion, the pursuit of quick money in the digital economy requires a multifaceted strategy that prioritizes both profitability and protection. While the potential for rapid returns exists, it is equally important to recognize the risks associated with speculative investments. By combining market analysis, disciplined risk management, and a focus on sustainable opportunities, investors can navigate this complex landscape with confidence. The ultimate goal is not just to earn quickly, but to build a lasting financial foundation that withstands the inevitable challenges of the digital age.