Is Making Money in America Possible? How Can You Do It?

The allure of the American Dream, often intertwined with the pursuit of financial success, continues to draw individuals from all walks of life to the United States. Is making money in America possible? Absolutely. However, achieving significant financial success requires more than just aspiration; it demands a strategic approach, informed decision-making, and a willingness to adapt to the ever-changing economic landscape.

The American economy, despite its inherent volatility, presents a multitude of avenues for wealth creation. One of the foundational pillars of financial well-being is securing stable and well-paying employment. The skills and education one possesses directly impact their earning potential. Investing in higher education, vocational training, or acquiring in-demand skills is crucial. The job market is constantly evolving, with sectors like technology, healthcare, and renewable energy experiencing significant growth. Identifying these trends and tailoring one's skillset to meet the demands of these industries can provide a significant advantage. Networking and building professional relationships are equally important for career advancement and uncovering hidden job opportunities. Don't underestimate the power of mentorship – seeking guidance from experienced professionals can provide invaluable insights and support.

Beyond securing a good job, effective money management is paramount. Creating a budget is the first step towards understanding your income and expenses. Track your spending habits to identify areas where you can cut back and save more. Differentiate between needs and wants, prioritizing essential expenses over discretionary purchases. Setting realistic financial goals, such as saving for a down payment on a house, paying off debt, or building a retirement fund, provides a clear roadmap for your financial journey. Automating savings ensures consistency and helps you avoid the temptation to spend your savings.

Debt management is another critical aspect of financial success. High-interest debt, such as credit card debt, can quickly erode your financial stability. Develop a plan to pay down your debt as quickly as possible, prioritizing high-interest debts first. Consider consolidating your debt into a lower-interest loan or balance transfer credit card. Avoiding unnecessary debt is crucial, and responsible credit card usage, such as paying off your balance in full each month, can help you build a good credit score, which is essential for accessing loans, mortgages, and even renting an apartment.

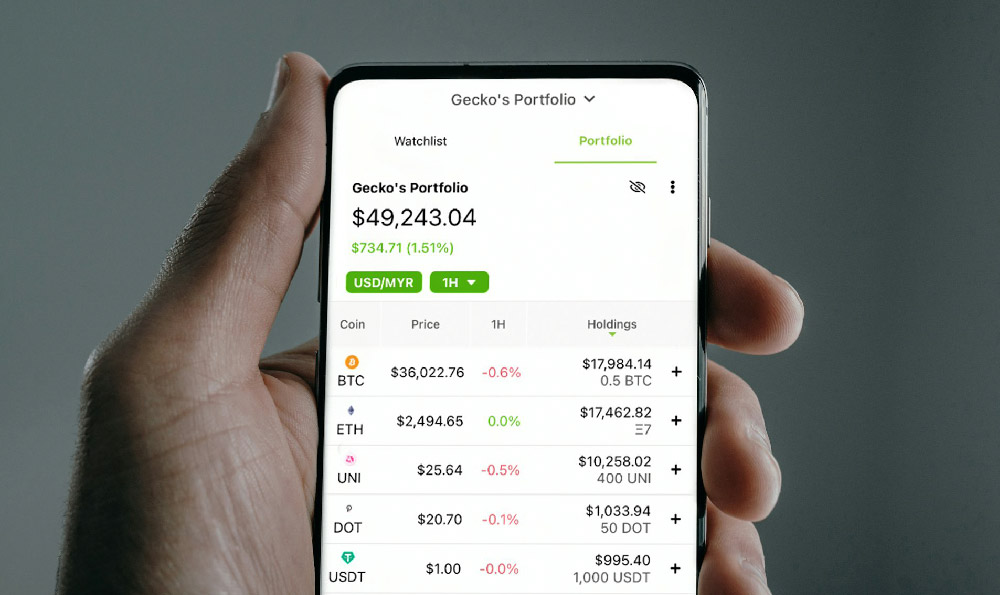

Investing is arguably the most effective way to grow your wealth over the long term. However, it's crucial to approach investing with a well-defined strategy and a clear understanding of your risk tolerance. Diversification is key – spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk. For beginners, consider investing in low-cost index funds or exchange-traded funds (ETFs), which offer instant diversification and require minimal management. As you gain more experience and knowledge, you can explore other investment options, such as individual stocks, real estate, or alternative investments. Remember, investing is a long-term game, and it's important to stay patient and avoid making impulsive decisions based on short-term market fluctuations. Seek advice from a qualified financial advisor who can help you develop a personalized investment plan tailored to your specific needs and goals.

Entrepreneurship presents another pathway to financial independence in America. Starting your own business can be incredibly rewarding, but it also requires significant dedication, hard work, and a willingness to take risks. Conducting thorough market research is essential to identify a viable business opportunity. Develop a solid business plan that outlines your goals, strategies, and financial projections. Secure adequate funding through loans, grants, or personal savings. Building a strong team and creating a supportive network of mentors and advisors is crucial for success. Be prepared to adapt and innovate as your business evolves.

Real estate is a common avenue for building wealth in America. Buying a home can provide a sense of security and stability, and it can also be a valuable investment. However, it's important to carefully consider your financial situation and the local real estate market before making a purchase. Save for a substantial down payment to avoid high mortgage insurance costs. Get pre-approved for a mortgage to understand your borrowing capacity. Work with a reputable real estate agent who can help you find a suitable property and negotiate a fair price. Consider the long-term costs of homeownership, such as property taxes, insurance, and maintenance. Investing in rental properties can also be a lucrative way to generate passive income and build equity over time.

Beyond these specific strategies, cultivating a positive mindset and a commitment to lifelong learning are essential for achieving financial success. Stay informed about economic trends, financial news, and investment opportunities. Read books, attend seminars, and network with other financially successful individuals. Develop a growth mindset – believe in your ability to learn and improve your financial skills. Be persistent and resilient in the face of setbacks. Embrace challenges as opportunities for growth.

Making money in America is indeed possible, but it requires a combination of education, hard work, strategic planning, and disciplined execution. By focusing on career development, effective money management, smart investing, and continuous learning, anyone can improve their financial situation and work towards achieving their financial goals. It's a marathon, not a sprint, so be patient, stay focused, and never give up on your dreams. The American Dream is still within reach for those who are willing to put in the effort.