Is Making Money Fast and Easy Possible? How Can You Do It?

The allure of rapid and effortless wealth creation is a siren song that has captivated humanity for centuries. In the modern digital age, this siren’s call often manifests in the realm of cryptocurrency, promising astronomical returns with seemingly minimal effort. However, the reality of achieving fast and easy money, particularly in the volatile world of crypto, is far more nuanced and requires a healthy dose of skepticism, strategic planning, and diligent risk management.

While the narrative of instant riches in crypto is often amplified by success stories and viral social media posts, it's crucial to understand that these instances are the exception, not the rule. The vast majority of individuals who approach cryptocurrency with the expectation of quick and easy gains often find themselves disappointed, and in some cases, significantly poorer. The market is inherently unpredictable, driven by a complex interplay of factors including regulatory changes, technological advancements, market sentiment, and the actions of large institutional investors (often referred to as "whales").

Therefore, the fundamental question isn't really about whether making money fast and easy is possible, but rather about redefining what "fast" and "easy" truly mean within the context of cryptocurrency investment. A more realistic and sustainable approach focuses on building a portfolio over time, leveraging informed decision-making, and embracing a long-term perspective. This doesn't preclude the possibility of realizing substantial returns within a shorter timeframe, but it emphasizes the importance of a well-considered strategy as opposed to chasing fleeting trends or relying on pure luck.

So, how can you navigate the cryptocurrency landscape to potentially accelerate your wealth accumulation while minimizing the risk of catastrophic losses? The answer lies in a multifaceted approach encompassing education, due diligence, strategic asset allocation, and ongoing portfolio management.

Firstly, education is paramount. Before investing a single dollar, immerse yourself in understanding the underlying technology of blockchain and cryptocurrencies. Learn about different blockchain architectures, consensus mechanisms (Proof-of-Work, Proof-of-Stake, etc.), and the various types of cryptocurrencies that exist (Bitcoin, Ethereum, altcoins, stablecoins, etc.). Delve into concepts such as decentralized finance (DeFi), Non-Fungible Tokens (NFTs), and the metaverse to gain a comprehensive understanding of the broader ecosystem. Numerous resources are available online, including reputable websites, academic papers, industry reports, and educational courses. Be wary of relying solely on social media influencers or unsubstantiated claims.

Secondly, conduct rigorous due diligence on any cryptocurrency or project you are considering investing in. Don't fall prey to "FOMO" (Fear of Missing Out) or the allure of guaranteed returns. Analyze the project's whitepaper, which outlines its purpose, technology, team, and roadmap. Scrutinize the team's credentials and experience, assess the project's technological feasibility, and evaluate its market potential. Look for evidence of a strong community, active development, and a clear use case. Critically examine the project's tokenomics (the supply, distribution, and utility of its tokens) to determine its long-term sustainability. Investigate whether the project has undergone audits by reputable security firms to identify and address potential vulnerabilities.

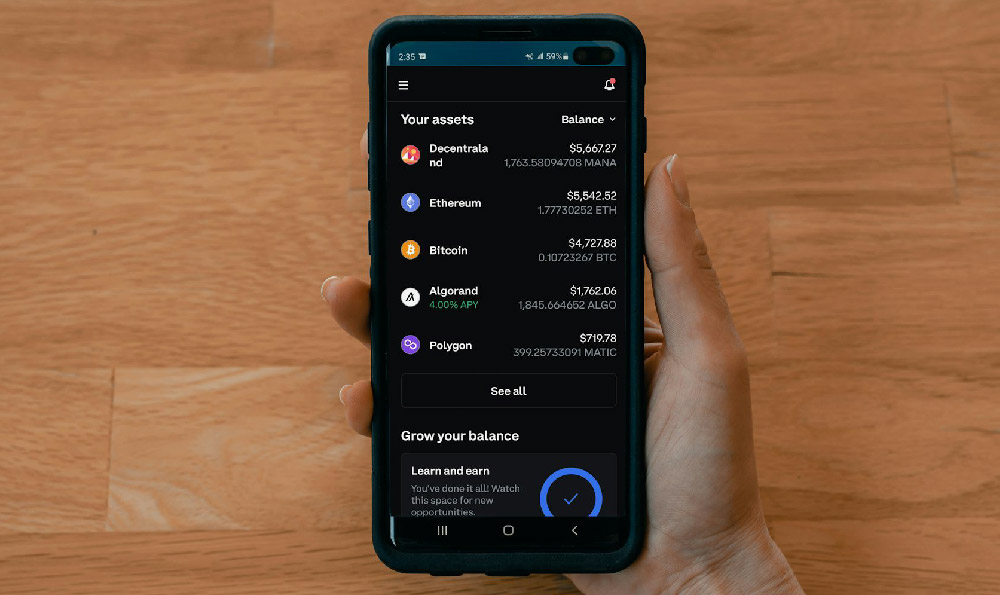

Thirdly, adopt a strategic asset allocation approach. Diversification is crucial in mitigating risk. Don't put all your eggs in one basket. Spread your investments across different cryptocurrencies, sectors, and asset classes. Consider allocating a portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum, which have a proven track record and greater liquidity. Explore promising altcoins with strong fundamentals and disruptive potential, but allocate a smaller percentage of your portfolio to these higher-risk assets. Furthermore, diversify beyond cryptocurrency altogether. Consider investing in traditional assets such as stocks, bonds, and real estate to create a more balanced and resilient portfolio.

Fourthly, continuously monitor and manage your portfolio. The cryptocurrency market is dynamic and requires constant vigilance. Stay informed about market trends, regulatory changes, and technological advancements. Rebalance your portfolio periodically to maintain your desired asset allocation. Take profits when appropriate, and cut losses when necessary. Don't be afraid to adjust your investment strategy based on changing market conditions. Implement stop-loss orders to automatically sell your holdings if the price falls below a predetermined level, protecting you from significant losses.

Finally, be aware of the common pitfalls and scams that plague the cryptocurrency space. Avoid participating in initial coin offerings (ICOs) or initial exchange offerings (IEOs) that lack transparency or legitimacy. Be wary of Ponzi schemes or pyramid schemes that promise unrealistic returns. Don't fall for phishing scams or social engineering attacks that attempt to steal your private keys or personal information. Use strong, unique passwords for all your cryptocurrency accounts, and enable two-factor authentication (2FA) for added security. Store your cryptocurrencies in a secure wallet, such as a hardware wallet or a reputable software wallet.

In conclusion, while the promise of making money fast and easy in cryptocurrency can be enticing, it's essential to approach the market with a realistic mindset and a well-defined strategy. Education, due diligence, strategic asset allocation, and continuous portfolio management are crucial for maximizing your potential returns while minimizing your risk. By adopting a long-term perspective and avoiding common pitfalls, you can increase your chances of achieving sustainable financial growth in the exciting, yet challenging, world of cryptocurrency. Remember, responsible investing is a marathon, not a sprint.