Is VUG a Worthwhile Investment? Or Should You Consider Alternatives?

VUG, the Vanguard Growth ETF, is a popular choice for investors seeking exposure to large-cap growth stocks. Its attractiveness stems from its low expense ratio, broad diversification within the growth sector, and the historical performance of its holdings. However, determining whether VUG is a "worthwhile" investment necessitates a deeper analysis considering individual investment goals, risk tolerance, and the broader market landscape. Furthermore, comparing VUG to potential alternatives is crucial for making a well-informed decision.

One of the primary reasons investors gravitate towards VUG is its simplicity and cost-effectiveness. The expense ratio is exceptionally low, meaning a minimal portion of your investment is consumed by management fees. This is a significant advantage, especially for long-term investors where even small fee differences can compound significantly over time. VUG also offers immediate diversification. It holds hundreds of growth stocks, mitigating the risk associated with investing in individual companies. This broad exposure ensures that your portfolio isn't overly reliant on the success of a few specific entities.

The historical performance of VUG has also been compelling. Growth stocks, in general, have outperformed value stocks in recent years, driven by factors like technological innovation and low interest rates. VUG, as a concentrated play on these growth titans, has benefited from this trend. However, past performance is never a guarantee of future returns. Market dynamics shift, and what worked yesterday may not work tomorrow.

Before committing to VUG, a critical self-assessment is required. What are your investment goals? Are you saving for retirement, a down payment on a house, or another long-term objective? What is your risk tolerance? Growth stocks, by their nature, tend to be more volatile than value stocks or the broader market. Can you stomach potential short-term losses in pursuit of long-term gains? VUG, being heavily weighted towards technology stocks, is particularly susceptible to fluctuations in that sector. If you are nearing retirement or have a low-risk tolerance, a more conservative investment strategy might be more appropriate.

Understanding the composition of VUG is also paramount. The ETF is market-cap weighted, meaning the largest companies in the index receive the biggest allocations. This often leads to significant concentration in a handful of mega-cap tech companies like Apple, Microsoft, Amazon, and Alphabet (Google). While these are undoubtedly strong companies, such concentration introduces its own set of risks. If the performance of these giants falters, VUG's overall returns will be negatively impacted disproportionately. Furthermore, a large allocation to a single sector, in this case, technology, can make the ETF vulnerable to sector-specific downturns.

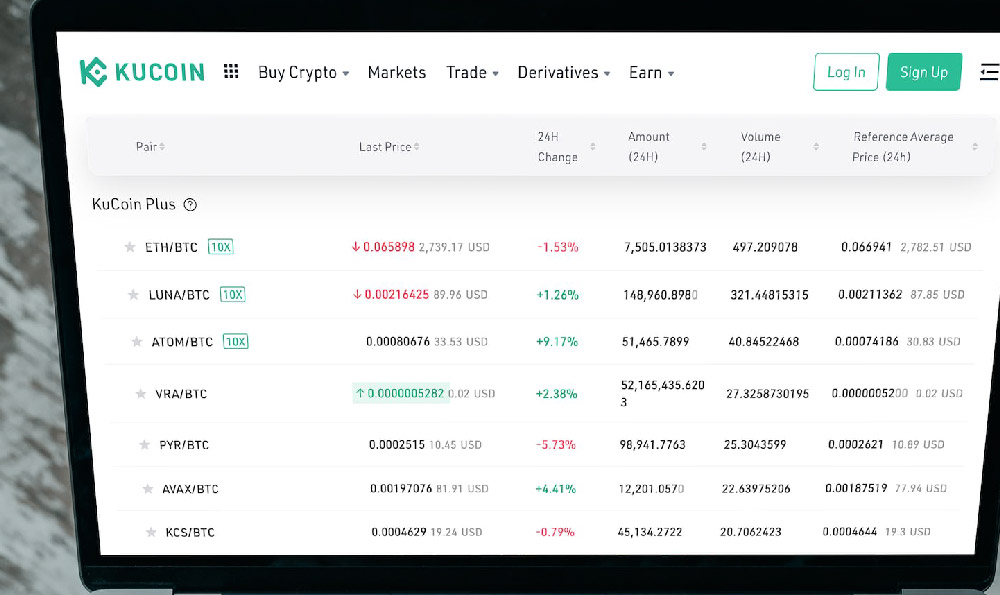

Now, let's consider some alternatives to VUG. Several other growth ETFs exist, each with slightly different investment strategies and compositions. Some may focus on small-cap or mid-cap growth stocks, offering potentially higher growth but also greater volatility. Others may employ different weighting methodologies, such as equal weighting, to reduce concentration risk. Researching and comparing these alternatives based on factors like expense ratio, holdings, historical performance, and tracking error is crucial.

Another alternative is to consider actively managed growth funds. These funds are managed by professional investors who actively select and trade stocks based on their own research and analysis. While actively managed funds typically have higher expense ratios than passive ETFs like VUG, they also have the potential to outperform the market. The success of an actively managed fund hinges on the skill of the fund manager. Careful research and due diligence are necessary to identify skilled managers with a proven track record.

Beyond growth-specific funds, investors should also consider diversifying their portfolios across different asset classes, such as value stocks, international stocks, bonds, and real estate. This diversification can help reduce overall portfolio risk and potentially enhance returns over the long term. A balanced portfolio that includes a mix of asset classes is often more resilient to market fluctuations than a portfolio that is heavily concentrated in a single asset class, such as growth stocks.

Finally, it's essential to stay informed about market trends and economic conditions. Interest rate hikes, inflation, and geopolitical events can all impact the performance of growth stocks and the overall market. Regularly reviewing your portfolio and making adjustments as needed is crucial for staying on track towards your investment goals. This doesn't mean constantly chasing the latest hot stocks or making rash decisions based on short-term market fluctuations. Instead, it means periodically reassessing your investment strategy and making adjustments to reflect your changing circumstances and the evolving market landscape.

In conclusion, VUG can be a worthwhile investment for investors seeking exposure to large-cap growth stocks and who understand the associated risks. However, it's not a one-size-fits-all solution. A thorough understanding of your own investment goals, risk tolerance, and the composition of VUG is essential. Comparing VUG to potential alternatives, such as other growth ETFs, actively managed funds, and a diversified portfolio of asset classes, is also crucial for making a well-informed decision. Remember to prioritize long-term thinking and stay informed about market trends to protect your investments and achieve your financial objectives. Don’t fall into the trap of chasing high returns without considering the underlying risk. A balanced and well-researched approach is always the best strategy for long-term financial success.