Is VTSAX Worth It? Should You Invest?

Okay, I understand. Here's an article addressing the question of whether VTSAX is a worthwhile investment, written as a financial expert and geared towards providing a comprehensive assessment for potential investors.

Is VTSAX a sound investment choice? This question resonates with both seasoned investors and those just beginning their financial journey. VTSAX, Vanguard Total Stock Market Index Fund Admiral Shares, represents a cornerstone investment for many portfolios, but determining its suitability requires a nuanced understanding of its benefits and limitations. Let's delve into a comprehensive evaluation.

At its core, VTSAX offers unparalleled diversification. It mirrors the performance of the entire U.S. stock market, encompassing small-cap, mid-cap, and large-cap companies. This broad exposure mitigates the risk associated with investing in individual stocks or specific sectors. Imagine trying to pick the next winning stock – the odds are stacked against you. VTSAX, however, captures the overall market growth, ensuring you benefit from the collective success of American businesses. It eliminates the need for constant monitoring and rebalancing, a significant advantage for passive investors. This diversified nature also means that while some individual companies within the fund may falter, the overall impact on your investment is minimized. You're essentially spreading your bets across the entire U.S. economy.

One of VTSAX's most appealing features is its remarkably low expense ratio. Vanguard is renowned for its commitment to minimizing investment costs, and VTSAX exemplifies this philosophy. The minuscule expense ratio means that a very small percentage of your investment is used to cover the fund's operating expenses, leaving the vast majority of your returns to compound over time. This seemingly small difference in expense ratios can have a profound impact on your long-term returns. Consider two similar funds, one with a slightly higher expense ratio – over decades, the lower expense ratio of VTSAX can translate into tens of thousands of dollars in additional returns.

Furthermore, VTSAX's structure as an index fund contributes to its cost-effectiveness. Unlike actively managed funds, which employ teams of analysts and portfolio managers to select investments, VTSAX simply tracks the performance of the underlying index. This passive management approach eliminates the high salaries and research costs associated with active management, further reducing expenses for investors. The fund's performance is transparent and predictable, mirroring the broad market's movements. You're not relying on the skill or luck of a fund manager; you're participating directly in the growth of the American economy.

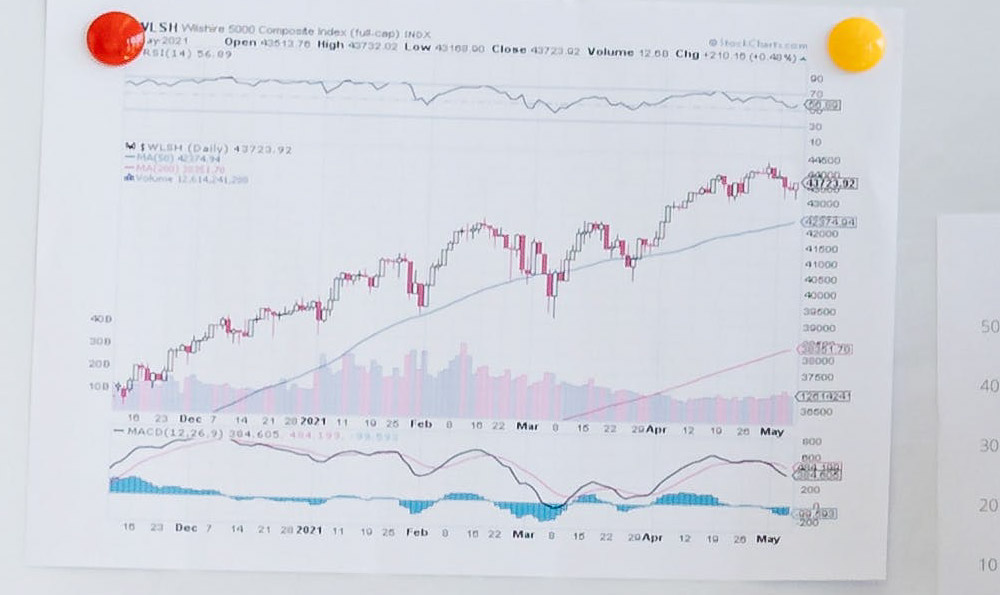

The historical performance of VTSAX has been impressive, closely tracking the overall market's gains. While past performance is not indicative of future results, the fund's consistent performance provides a degree of confidence and predictability. It allows investors to reasonably project potential returns based on historical market trends, aiding in financial planning and goal setting. Investing in VTSAX allows one to capture the long-term growth potential of the US economy.

However, it's crucial to acknowledge the potential drawbacks. Because VTSAX tracks the entire U.S. market, its performance is directly tied to the overall health of the U.S. economy. During periods of economic recession or market downturn, VTSAX will inevitably experience losses. While diversification mitigates risk, it doesn't eliminate it entirely.

Another point to consider is that VTSAX is heavily weighted towards large-cap companies. This means that a significant portion of the fund's assets is invested in a relatively small number of large, established corporations. While these companies provide stability, they may not offer the same growth potential as smaller, more agile companies. Investors seeking higher growth opportunities may consider supplementing their VTSAX holdings with investments in small-cap or international stocks.

Furthermore, VTSAX, by its nature, cannot outperform the market. It aims to replicate the market's performance, not beat it. Investors seeking to generate above-average returns may consider actively managed funds, although these funds typically come with higher fees and the risk of underperforming the market. The consistent and dependable nature of VTSAX is great for the average investor.

So, should you invest in VTSAX? The answer depends on your individual circumstances, risk tolerance, and investment goals. If you're seeking broad diversification, low costs, and a passive investment approach, VTSAX is an excellent choice. It's particularly well-suited for long-term investors who are comfortable with market fluctuations and are willing to ride out the inevitable ups and downs. It's a simple, low-cost solution to capture the performance of the whole market.

Before investing, carefully consider your own financial situation and consult with a qualified financial advisor. Assess your risk tolerance, understand your investment time horizon, and determine whether VTSAX aligns with your overall financial plan. While VTSAX is a solid foundation for many portfolios, it's essential to ensure that it complements your other investments and contributes to achieving your financial objectives. Remember to consider all of the potential advantages and disadvantages before investing.