Is Making Easy Money Possible? How Can You Do It?

The allure of effortless wealth, the promise of "easy money," has captivated humanity for centuries. While the idea of instant riches without significant effort is largely a myth, the pursuit of financial gains that require less intensive labor or specialized skill is a legitimate and achievable goal. The key lies in understanding the nuances of "easy money," separating it from unrealistic fantasies, and focusing on strategies that leverage existing resources and market opportunities.

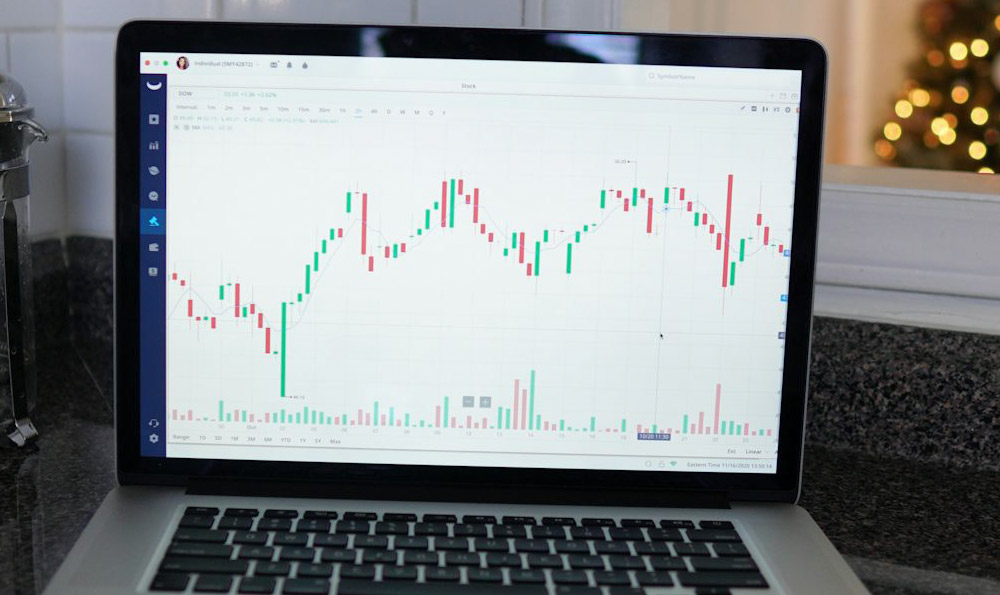

One of the most common misconceptions surrounding "easy money" is the idea of overnight success through luck or chance. Lottery tickets, speculative investments in meme stocks, and get-rich-quick schemes all fall into this category. While occasional windfalls may occur, these avenues are inherently risky and unsustainable. They rely on chance rather than sound financial principles and often lead to significant losses for the majority of participants. True financial success is rarely achieved through sheer luck. It requires careful planning, disciplined execution, and a willingness to learn and adapt.

A more realistic approach to seeking less laborious financial gains involves identifying and capitalizing on existing assets and skills. This could mean leveraging rental properties to generate passive income. If you own a home or other property, renting it out, either on a long-term basis or through platforms like Airbnb, can provide a steady stream of income with minimal ongoing effort beyond property management. The initial investment of purchasing the property is significant, but the subsequent income stream can be relatively passive. The returns on investment are not instant, and of course property management is a job that does require work, but the income can be easily obtained with some effort.

Another avenue involves monetizing existing skills and hobbies. In the digital age, numerous platforms connect individuals with clients seeking specific services. If you possess expertise in writing, graphic design, web development, or any other marketable skill, freelancing platforms offer a readily available marketplace for your services. The effort required involves creating a compelling profile, bidding on projects, and delivering quality work, but the potential for income is directly proportional to your skills and dedication. Many people start small, building up clients and scaling up their prices as their skills get recognized.

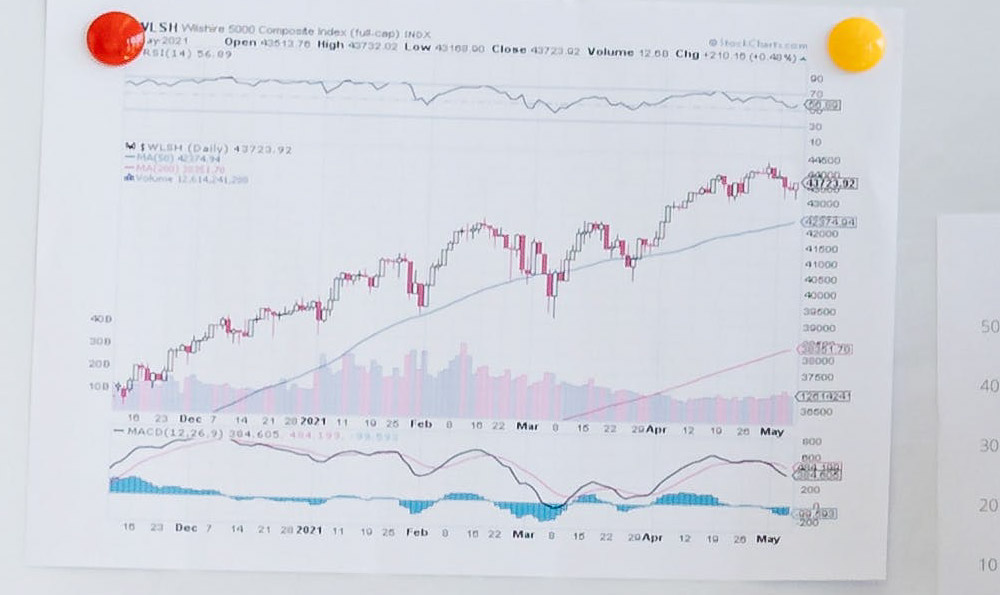

Investing in dividend-paying stocks can also be a strategy for generating passive income. Dividend stocks represent ownership in companies that distribute a portion of their profits to shareholders in the form of dividends. By carefully selecting companies with a history of consistent dividend payments and strong financial performance, investors can create a portfolio that generates a regular income stream. The initial research and due diligence are crucial, but once the portfolio is established, the income generated is relatively passive. However, it's crucial to remember that dividends are not guaranteed and can be reduced or eliminated by the company.

Furthermore, consider the power of automation and outsourcing. Many tasks that consume significant time and energy can be automated or outsourced to others. For example, if you run an online business, you can automate email marketing campaigns, social media posting, and customer service inquiries. You can also outsource tasks like bookkeeping, administrative work, and content creation to freelancers or virtual assistants. By automating or outsourcing these tasks, you free up your time to focus on higher-value activities that generate greater returns. The initial investment in automation tools or outsourcing services can be offset by the increased efficiency and productivity.

Creating and selling digital products is another avenue for generating passive income. Digital products, such as ebooks, online courses, software applications, and templates, can be created once and sold repeatedly with minimal ongoing effort. The initial investment involves creating the product and setting up a sales platform, but once the product is launched, it can generate income for years to come. The key is to identify a niche market with a demand for your expertise and create a high-quality product that provides value to your customers.

Affiliate marketing is a strategy that involves promoting other companies' products or services and earning a commission on each sale generated through your referral link. You can promote products or services on your website, blog, social media channels, or email list. The effort required involves building an audience and creating engaging content that promotes the products or services you are affiliated with. The income generated is proportional to the size and engagement of your audience. This method takes time and patience, but the income is easy to obtain once you have an audience.

Finally, consider the value of continuous learning and adaptation. The financial landscape is constantly evolving, and new opportunities for generating income emerge regularly. By staying informed about market trends, emerging technologies, and innovative business models, you can position yourself to capitalize on these opportunities. Attend industry conferences, read financial publications, and network with other professionals in your field. The more you know, the better equipped you will be to identify and pursue opportunities for generating income with less effort.

In conclusion, while the idea of "easy money" in the purest sense is an illusion, generating income that requires less intensive labor or specialized skill is achievable through strategic planning, leveraging existing assets and skills, and continuously adapting to market opportunities. It requires understanding the difference between get-rich-quick schemes and legitimate strategies, focusing on building sustainable income streams, and being willing to invest time and effort upfront to reap the rewards later. The path to financial well-being is not always easy, but it is undoubtedly possible with the right mindset and approach. The key is to prioritize smart work over hard work and to constantly seek ways to optimize your efforts and maximize your returns.