Investing for Rapid Returns: Strategy or Scam?

Investing in cryptocurrency with the primary goal of achieving "rapid returns" is a path fraught with peril, demanding a careful assessment of strategy versus the potential for scam. The allure of quick riches often overshadows the fundamental principles of sound investing, leading many into situations that are more akin to gambling than strategic asset allocation. It’s crucial to approach this landscape with a level head, informed caution, and a deep understanding of the risks involved.

The core problem lies in the inherent volatility of the cryptocurrency market. Unlike traditional asset classes with established histories and regulatory frameworks, cryptocurrencies are relatively young and subject to dramatic price swings. Factors such as regulatory announcements, technological advancements, and even social media sentiment can trigger significant market fluctuations within hours. Chasing "rapid returns" in such an environment requires either extraordinary luck or an unacceptable level of risk tolerance.

Before even considering specific investments, it’s imperative to understand your own risk profile. Are you comfortable with the possibility of losing a significant portion, or even all, of your investment? Can you emotionally handle the rollercoaster of market ups and downs? If the answer to either of these questions is "no," then pursuing rapid returns in cryptocurrency is simply not a viable strategy. More conservative approaches, such as long-term holding of established cryptocurrencies like Bitcoin or Ethereum, might be more suitable.

When evaluating potential investment opportunities, a critical eye is essential. The cryptocurrency space is rife with projects promising astronomical returns with little to no real-world utility. These "shitcoins," often fueled by hype and aggressive marketing, are prime examples of investments that can quickly turn sour. Rigorous due diligence is paramount. This includes thoroughly researching the project's whitepaper, the team behind it, the technology it utilizes, and its market capitalization. A whitepaper that is poorly written, lacks technical detail, or contains overly ambitious claims should be a major red flag. Similarly, a team with anonymous or inexperienced members should raise serious concerns.

Beyond the fundamentals of a project, it’s important to understand the underlying tokenomics. Is the token supply capped, or is it inflationary? What are the incentives for holding the token? A token with unlimited supply and weak utility is likely to depreciate in value over time, regardless of short-term price movements. Furthermore, be wary of projects that offer unrealistic staking rewards or other forms of yield farming. These high yields are often unsustainable and can lead to a "rug pull," where the project developers suddenly abandon the project and abscond with investor funds.

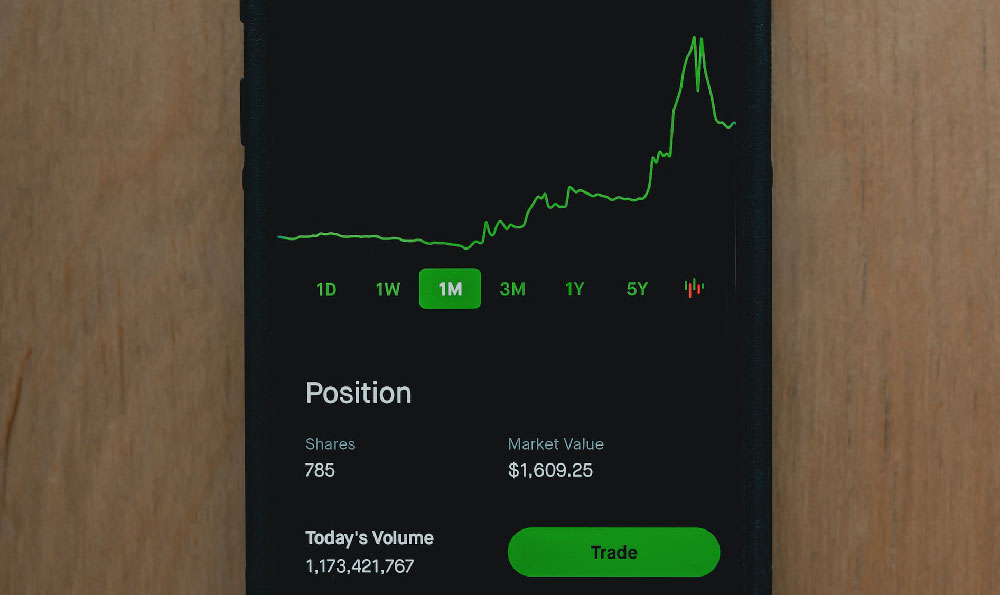

Another common pitfall is falling prey to pump-and-dump schemes. These schemes involve artificially inflating the price of a cryptocurrency through coordinated buying activity, often orchestrated through social media groups. Once the price has reached a predetermined level, the organizers dump their holdings, leaving unsuspecting investors holding worthless tokens. Identifying these schemes requires careful observation of trading volumes and price patterns. A sudden surge in volume accompanied by a rapid price increase, followed by a sharp decline, is a telltale sign of a pump-and-dump.

Leverage trading, while offering the potential for amplified returns, also magnifies losses. Using borrowed funds to trade cryptocurrency is extremely risky and should only be undertaken by experienced traders with a thorough understanding of risk management techniques. A small adverse price movement can quickly wipe out your entire position, leaving you owing money to the exchange.

Furthermore, be skeptical of guarantees. Any platform or individual promising guaranteed returns in cryptocurrency is almost certainly a scam. The market is inherently unpredictable, and no one can accurately forecast future price movements with certainty. Legitimate investment professionals will always emphasize the risks involved and avoid making unrealistic promises.

Diversification is a key principle of sound investing that applies equally to cryptocurrency. Don't put all your eggs in one basket. Spread your investments across a range of different cryptocurrencies and asset classes to mitigate risk. A diversified portfolio is less vulnerable to the failure of any single investment.

Finally, it's crucial to stay informed and continuously educate yourself about the cryptocurrency market. Follow reputable news sources, read academic papers, and engage with the community to stay abreast of the latest developments and trends. The more you understand about the market, the better equipped you will be to make informed investment decisions and avoid costly mistakes.

In conclusion, while the lure of rapid returns in cryptocurrency is tempting, it's crucial to approach this market with a healthy dose of skepticism and a commitment to sound investment principles. Due diligence, risk management, and continuous learning are essential for navigating this complex and volatile landscape. Remember that the path to sustainable wealth creation is rarely quick or easy. Focus on building a diversified portfolio of high-quality assets and avoid chasing get-rich-quick schemes. If it sounds too good to be true, it probably is.