Investing in Stocks: What to Know? How to Learn?

Investing in the stock market can be a powerful tool for wealth creation and financial security. However, it's also an arena filled with potential pitfalls for the uninformed. Knowing where to begin and how to navigate the complexities of stock investing is crucial for maximizing your returns and minimizing your risks. This guide will provide a comprehensive overview of what you need to know and how to learn effectively to become a confident and successful stock market investor.

Understanding the Fundamentals of Stock Investing

Before diving into the specifics of buying and selling stocks, it's essential to grasp the foundational concepts. A stock, also known as equity, represents ownership in a company. When you buy a stock, you're essentially purchasing a small piece of that company. As the company grows and becomes more profitable, the value of your stock may increase, allowing you to sell it for a profit.

- Different Types of Stocks: Stocks are broadly classified into two categories: common stock and preferred stock. Common stock gives you voting rights in the company's shareholder meetings and the potential to receive dividends, which are portions of the company's profits distributed to shareholders. Preferred stock typically doesn't have voting rights but offers a fixed dividend payment, making it a more stable income stream.

- Market Capitalization: This refers to the total value of a company's outstanding shares. Companies are often categorized based on their market capitalization: large-cap (over $10 billion), mid-cap ($2 billion to $10 billion), and small-cap (under $2 billion). Large-cap stocks are generally considered more stable and less risky than small-cap stocks, which can offer higher growth potential but also come with greater volatility.

- Key Financial Metrics: Understanding basic financial metrics is essential for evaluating the health and potential of a company. These include earnings per share (EPS), price-to-earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE). Analyzing these metrics can help you assess whether a stock is undervalued or overvalued relative to its peers.

Developing a Learning Strategy for Stock Investing

The stock market is constantly evolving, so continuous learning is critical for staying ahead of the curve. Here's a structured approach to develop your investment knowledge:

1. Start with the Basics:

- Read Books: Invest in reputable books on stock investing, personal finance, and market analysis. Authors like Benjamin Graham ("The Intelligent Investor"), Peter Lynch ("One Up On Wall Street"), and Burton Malkiel ("A Random Walk Down Wall Street") offer invaluable insights into the principles of value investing and market behavior.

- Online Courses: Platforms like Coursera, Udemy, and edX offer courses on various aspects of investing, from fundamental analysis to technical analysis. These courses often provide structured learning paths and interactive exercises to reinforce your understanding.

2. Deepen Your Understanding:

- Follow Financial News: Stay informed about market trends and economic developments by reading reputable financial news sources such as The Wall Street Journal, Bloomberg, and Reuters. These sources provide up-to-date information on company performance, industry analysis, and macroeconomic factors that can impact stock prices.

- Analyze Company Reports: Learn to read and interpret company financial statements, including the balance sheet, income statement, and cash flow statement. This will enable you to assess a company's financial health, profitability, and growth prospects. Public companies are required to file these reports with the Securities and Exchange Commission (SEC), which are available on the SEC's website (EDGAR).

- Consider a Mentor: Seek out experienced investors who can provide guidance and insights. Learning from someone who has a proven track record can accelerate your learning process and help you avoid common mistakes.

3. Practice and Refine:

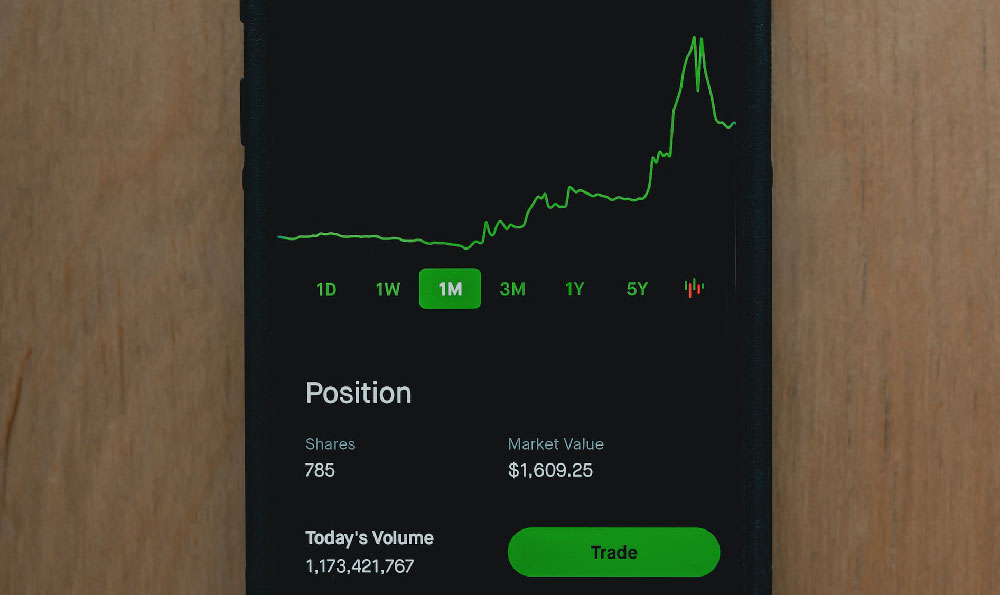

- Paper Trading: Before risking real money, practice your trading skills using a virtual stock trading platform. This allows you to simulate buying and selling stocks without any financial risk.

- Start Small: When you're ready to invest real money, start with a small amount that you can afford to lose. This will allow you to gain experience and confidence without exposing yourself to excessive risk.

- Review and Adjust: Regularly review your investment portfolio and track your performance. Identify what's working and what's not, and adjust your investment strategy accordingly. The market is dynamic, and your strategies need to be flexible enough to adapt.

Building a Diversified Portfolio

Diversification is a cornerstone of successful investing. Spreading your investments across different asset classes, industries, and geographic regions can help reduce your overall risk.

- Asset Allocation: Determine the appropriate mix of stocks, bonds, and other assets based on your risk tolerance, time horizon, and financial goals.

- Industry Diversification: Invest in companies across different industries to mitigate the risk of being overly exposed to a single sector.

- Geographic Diversification: Consider investing in international stocks to diversify your portfolio beyond domestic markets.

Managing Risk and Emotional Investing

Investing in the stock market involves inherent risks. It's crucial to understand these risks and develop strategies to manage them.

- Risk Tolerance: Assess your risk tolerance before making any investment decisions. Are you comfortable with the possibility of losing a portion of your investment in exchange for higher potential returns, or are you more risk-averse and prefer a more conservative approach?

- Stop-Loss Orders: Use stop-loss orders to limit your potential losses on individual stocks. A stop-loss order automatically sells a stock if it falls below a certain price, helping you protect your capital.

- Emotional Discipline: Avoid making impulsive decisions based on fear or greed. Stick to your investment plan and resist the urge to chase short-term gains or panic sell during market downturns.

Staying Informed and Adapting

The investment landscape is constantly changing, so it's essential to stay informed about market trends, economic developments, and regulatory changes. Continuously refine your investment knowledge and adapt your strategies to remain successful in the long run. Investing in stocks is a journey of continuous learning and adaptation. By understanding the fundamentals, developing a learning strategy, building a diversified portfolio, and managing risk, you can increase your chances of achieving your financial goals. Remember to stay informed, be patient, and always make informed investment decisions.