Investing in Compound Interest: What is it and How Do You Do It?

Investing in Compound (COMP), a governance token of the Compound protocol, presents a unique opportunity within the decentralized finance (DeFi) landscape. It's crucial to approach this investment with a thorough understanding of what COMP represents, how the Compound protocol functions, and the inherent risks and potential rewards involved.

Compound is, at its core, a decentralized lending and borrowing protocol built on the Ethereum blockchain. It allows users to supply their crypto assets to a liquidity pool and earn interest, while others can borrow these assets by providing collateral. The interest rates are algorithmically adjusted based on supply and demand, creating a dynamic and transparent marketplace. The COMP token governs this entire ecosystem. Holding COMP grants the holder voting rights, enabling them to participate in proposals that shape the future development and direction of the Compound protocol. This governance aspect is a key differentiator and a major factor influencing COMP's value.

Investing in COMP involves several avenues. The most straightforward method is purchasing COMP tokens on a cryptocurrency exchange. Major exchanges like Coinbase, Binance, and Kraken typically list COMP, providing a relatively easy entry point for investors. Before purchasing, research the exchange thoroughly, ensuring it has robust security measures and complies with regulatory requirements in your jurisdiction. Consider factors such as trading volume, liquidity, and withdrawal fees.

Another avenue involves participating directly in the Compound protocol. By supplying crypto assets to a Compound market (e.g., supplying ETH, DAI, or USDC), you earn interest in the form of cTokens (Compound tokens). These cTokens represent your deposit in the protocol and accrue interest continuously. You can then use these cTokens as collateral to borrow other assets within the protocol. While this method doesn't directly involve purchasing COMP, it can be a means of earning COMP. Historically, Compound has distributed COMP tokens to both lenders and borrowers on the platform as an incentive for participation. The distribution rate and methodology can change based on governance proposals, so staying informed is crucial.

Yield farming is a more advanced strategy that involves leveraging COMP and other DeFi protocols to maximize returns. This can involve strategies like providing liquidity to COMP liquidity pools on decentralized exchanges (DEXs) like Uniswap or Sushiswap. Liquidity providers earn trading fees and potentially receive additional rewards in the form of COMP or other tokens. However, yield farming also carries increased risks, including impermanent loss, which can occur when the price of the deposited assets diverges significantly.

Before investing in COMP, it's essential to conduct thorough due diligence. Start by understanding the underlying technology and the competitive landscape. Research the Compound protocol itself, its strengths, weaknesses, and the team behind it. Analyze the tokenomics of COMP, including its total supply, distribution schedule, and governance mechanisms. Pay close attention to the vesting schedules of team members and early investors, as these can impact the token's price.

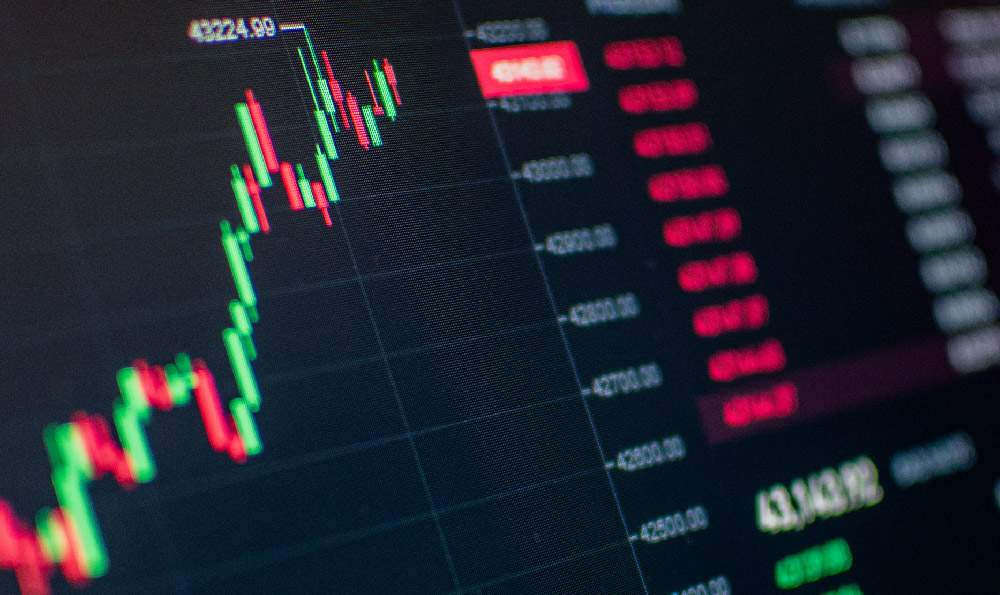

Market analysis is crucial. Evaluate the current market sentiment towards COMP and the broader DeFi sector. Look at trading volume, price charts, and technical indicators to identify potential entry and exit points. Monitor news and social media channels to stay informed about developments that could affect COMP's price, such as regulatory changes, protocol upgrades, or security vulnerabilities. Remember that the cryptocurrency market is highly volatile, and past performance is not indicative of future results.

Risk management is paramount when investing in any cryptocurrency, including COMP. DeFi, while promising, is still a relatively new and rapidly evolving space. Smart contract risks are a significant concern. A bug in the Compound protocol's smart contracts could lead to a loss of funds. It's crucial to understand that interacting with smart contracts always carries inherent risks. Furthermore, regulatory uncertainty surrounding DeFi and cryptocurrencies could significantly impact the value of COMP. Regulations can change rapidly, and it's important to stay informed about the legal and regulatory landscape in your jurisdiction.

Avoid putting all your eggs in one basket. Diversify your portfolio across different asset classes and cryptocurrencies to mitigate risk. Determine your risk tolerance and invest only what you can afford to lose. Set stop-loss orders to limit potential losses if the price of COMP drops unexpectedly. Regularly review your portfolio and rebalance as needed to maintain your desired asset allocation.

Stay informed about the latest developments in the Compound protocol and the broader DeFi ecosystem. Follow reputable news sources, read research reports, and participate in online communities to stay up-to-date on the latest trends and challenges. The DeFi space is constantly evolving, and continuous learning is essential for making informed investment decisions. Understand the risks of impermanent loss when participating in liquidity pools. This risk can be mitigated by choosing stablecoin pairs or assets with low volatility.

Finally, be wary of scams and fraudulent schemes. The cryptocurrency space is rife with scams, and it's crucial to be vigilant. Never share your private keys or seed phrases with anyone. Be suspicious of unsolicited offers or promises of guaranteed returns. Do your own research and only invest in projects that you understand and trust. Scrutinize the team behind the project, their track record, and their reputation.

Investing in COMP, like any cryptocurrency investment, requires careful consideration, thorough research, and a strong understanding of the underlying technology and risks involved. By approaching this investment with a cautious and informed mindset, you can increase your chances of success and potentially benefit from the growth of the Compound protocol and the DeFi ecosystem. Always remember to prioritize risk management and never invest more than you can afford to lose.