How to Uber for Profit: Is it Really Possible to Earn?

Uber, a ubiquitous presence in modern transportation, presents itself as a flexible income opportunity. The allure of being your own boss, setting your own hours, and potentially earning significant profit is undeniably attractive. However, the reality of Uber driving as a truly profitable venture is far more complex than its marketing suggests. A clear-eyed, analytical approach, coupled with proactive financial management, is crucial to determining whether Uber can genuinely serve as a vehicle for financial gain.

The first, and perhaps most critical, consideration is understanding the true cost structure associated with Uber driving. While Uber promotes the idea of simply using your existing car to generate income, the reality is that driving for Uber significantly accelerates wear and tear. This translates to increased maintenance costs – more frequent oil changes, tire replacements, brake repairs, and potentially more substantial repairs down the line. Failing to account for these incremental maintenance expenses will paint a deceptively rosy picture of profitability. A meticulous driver should maintain detailed records of all car-related expenditures, allocating a portion of these costs to their Uber driving activities based on mileage or usage.

Beyond maintenance, fuel consumption is a substantial and fluctuating expense. The profitability of each ride is directly impacted by gas prices, which can vary significantly depending on location and time of year. Drivers should actively monitor gas prices and strategically plan their routes to minimize fuel consumption. This might involve driving in areas known for lower gas prices or adjusting driving times to avoid peak traffic congestion where idling consumes more fuel. Fuel efficiency is not just about the car itself, but also about driving habits. Avoiding aggressive acceleration and braking, maintaining proper tire inflation, and reducing unnecessary weight in the vehicle can all contribute to lower fuel consumption and increased profits.

Furthermore, insurance coverage presents a significant consideration. Standard personal auto insurance policies typically do not cover driving for commercial purposes like Uber. Drivers are required to have specific ride-sharing insurance that covers them during the periods when they are logged into the Uber app and available to accept rides. This insurance can be significantly more expensive than personal auto insurance and should be factored into the overall cost analysis. Failing to secure adequate insurance coverage exposes drivers to substantial financial risk in the event of an accident.

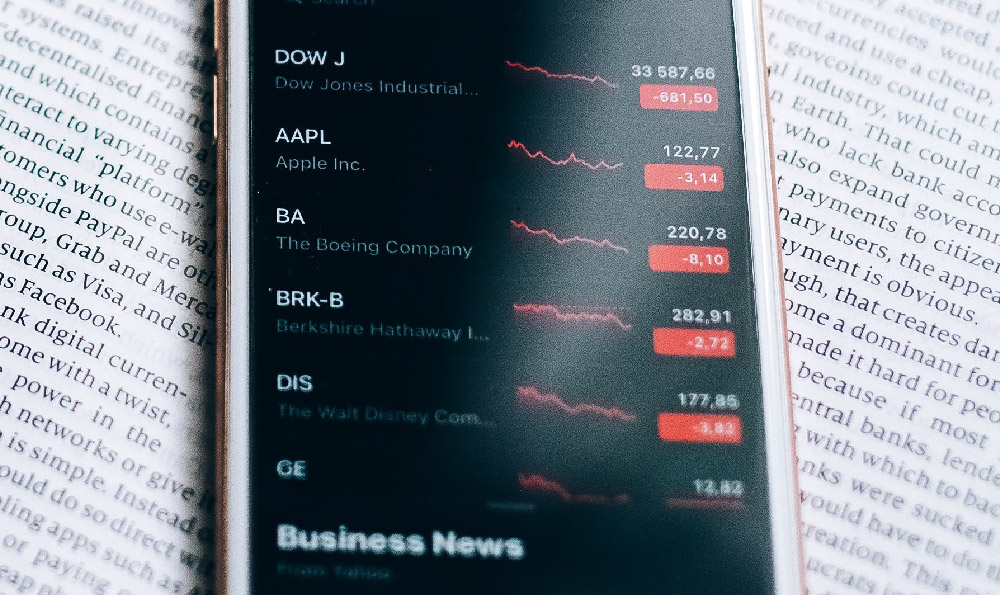

After carefully accounting for all expenses, it's time to analyze the revenue side of the equation. Uber drivers are paid based on a combination of factors, including the base fare, per-mile rate, and per-minute rate. However, Uber also takes a commission from each ride, which can significantly reduce the driver's earnings. The commission rate can vary depending on the market and the type of Uber service being offered. Drivers need to be aware of the exact commission rate in their area and factor it into their profitability calculations.

Understanding surge pricing is crucial for maximizing earnings. Surge pricing occurs when demand for Uber rides is high and the number of available drivers is limited. During surge periods, Uber increases the fare to incentivize more drivers to become available. Savvy drivers can strategically position themselves in areas experiencing surge pricing to significantly increase their earnings per ride. However, it's important to remember that surge pricing is not guaranteed and can fluctuate rapidly. Relying solely on surge pricing for profitability is a risky strategy.

Strategic decision-making regarding driving times and locations is another key element. Analyzing historical data on Uber driver forums or using third-party apps can provide valuable insights into the busiest and most profitable times and locations. For example, driving during weekday mornings when people are commuting to work or during weekend evenings when people are going out can be more lucrative than driving during off-peak hours. Similarly, driving in areas with high demand for Uber rides, such as airports, business districts, or entertainment venues, can lead to higher earnings.

Effective financial management is paramount to achieving profitability as an Uber driver. Keeping meticulous records of all income and expenses is essential for tracking profitability and identifying areas for improvement. Creating a budget and sticking to it can help drivers avoid overspending and ensure that they are saving enough money to cover expenses and invest in their future. Consider setting aside a portion of earnings specifically for vehicle maintenance and repairs. This creates a financial buffer to mitigate the impact of unexpected repair costs.

The impact of taxes cannot be overlooked. As independent contractors, Uber drivers are responsible for paying their own self-employment taxes, including Social Security and Medicare taxes. These taxes can significantly reduce the driver's net income. It's advisable to consult with a tax professional to understand the tax implications of Uber driving and to ensure that you are properly reporting your income and expenses. Claiming all eligible deductions, such as mileage, car expenses, and phone expenses, can help reduce your tax liability.

Finally, it’s important to realistically assess your personal circumstances and risk tolerance. Driving for Uber can be physically and mentally demanding. It requires long hours, navigating traffic, dealing with unpredictable passengers, and managing the stress of driving in unfamiliar areas. Before committing to Uber driving, consider whether you have the time, energy, and temperament to handle the demands of the job. Analyze whether the potential financial rewards outweigh the inherent risks and challenges.

In conclusion, while the promise of earning substantial profits as an Uber driver is enticing, it requires a disciplined and analytical approach. By meticulously tracking expenses, strategically maximizing revenue, practicing sound financial management, and realistically assessing personal circumstances, it is possible to "Uber for Profit." However, it's crucial to approach Uber driving as a business, not just a casual side hustle, to truly realize its potential for financial gain. Without careful planning and diligent execution, the dream of Uber profitability can quickly turn into a financial drain.