How to Make Money Fast with Investing Strategies

Investing in cryptocurrencies has become a focal point for those seeking to capitalize on the evolving financial landscape, offering both lucrative opportunities and complex risks. To navigate this domain effectively, it is essential to adopt a structured approach that balances informed decision-making with disciplined execution. While the allure of quick profits can be tempting, sustainable success in this market requires a nuanced understanding of trends, technical indicators, and risk mitigation techniques. This article explores strategies that align with long-term growth, while addressing the realities of short-term speculation and its pitfalls, providing readers with a comprehensive roadmap to thrive in the crypto space.

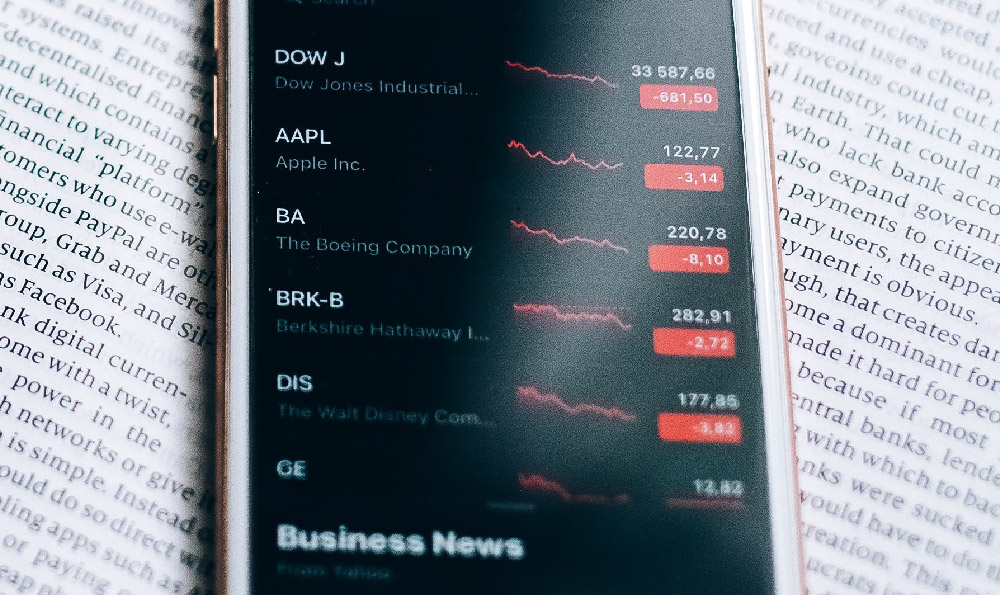

Understanding market dynamics is the cornerstone of any profitable investment strategy. Cryptocurrencies are inherently volatile, influenced by a cocktail of factors including regulatory changes, technological advancements, macroeconomic conditions, and sentiment shifts. For instance, the adoption of blockchain technology by mainstream institutions can trigger a bullish trend, while geopolitical instability might lead to sharp sell-offs. Traders who can anticipate these movements by analyzing news cycles and industry developments often find themselves ahead of the curve. However, it is crucial to recognize that market predictions are not infallible—emotional biases and misinformation can cloud judgment. Success lies in distinguishing between actionable insights and speculative hype, a skill honed through continuous learning and data-driven analysis.

Technical analysis techniques offer a framework to decode market behavior, enabling investors to identify patterns and potential entry/exit points. Tools such as moving averages, relative strength index (RSI), and Fibonacci retracements help assess price trends and volatility. For example, a trader might use the RSI to detect overbought or oversold conditions, signaling potential reversals. However, these indicators should not be viewed in isolation. Combining them with volume analysis and on-chain data provides a more holistic perspective. Volume spikes during a price surge can indicate strong institutional interest, whereas declining volume might suggest waning momentum. The key takeaway is that technical analysis serves as a guide, not a guarantee, and its effectiveness depends on context and timing.

For those with a higher risk tolerance, short-term trading strategies such as day trading, swing trading, or arbitrage can yield significant returns. Day trading involves exploiting intraday price fluctuations, while swing trading captures medium-term trends. Arbitrage, on the other hand, capitalizes on price differences across exchanges, offering a lower-risk opportunity for profit. However, these strategies demand constant vigilance and technical expertise. The fast-paced nature of crypto markets means that even minor delays can result in substantial losses. Traders must be prepared to monitor multiple platforms, execute trades swiftly, and manage leverage responsibly. It is also vital to diversify across assets and timeframes to avoid overexposure to a single market event.

Risk management is an often-overlooked yet critical component of any investment strategy. The volatility of cryptocurrencies necessitates a proactive approach to safeguarding capital. Diversification, position sizing, and stop-loss orders are fundamental tools. By spreading investments across different coins and sectors, investors reduce the impact of a single asset’s decline. Position sizing ensures that no single trade consumes excessive capital, while stop-loss orders protect against sudden market reversals. Additionally, maintaining a cash reserve for emergencies and avoiding emotional decisions can prevent costly mistakes. The adage "only risk what you can afford to lose" holds particular weight in this market, where algorithms and market sentiment can drive unpredictable outcomes.

Investing in cryptocurrencies also requires a deep understanding of the underlying technology, as this provides insight into long-term value potential. Projects with robust fundamentals, such as scalable blockchains, active developer communities, and clear use cases, tend to outperform speculative assets. For example, the implementation of Layer 2 solutions in Ethereum has addressed scalability concerns, boosting investor confidence. Conversely, projects with unclear roadmaps or dubious tokens often face regulatory scrutiny or market rejection. Investors should prioritize research, relying on credible sources such as whitepapers, team backgrounds, and community engagement metrics to evaluate projects.

The psychological aspects of investing cannot be ignored, as they significantly influence decision-making. Fear and greed often drive market behavior, creating opportunities for those who can maintain emotional discipline. For instance, panic selling during a market crash can lead to buying low, while overconfidence might result in holding onto underperforming assets. Developing a trading plan with predefined rules and adhering to it consistently can mitigate the impact of emotional biases. Moreover, staying informed about market psychology and adopting a mindset of patience and adaptability can enhance long-term success.

In conclusion, the quest to make money quickly in the crypto market is achievable but fraught with challenges. A combination of market analysis, technical indicators, and disciplined risk management forms the backbone of a resilient strategy. By focusing on fundamental strengths, leveraging diverse tools, and maintaining emotional control, investors can navigate this complex terrain with confidence. Remember, while the potential for rapid returns exists, it is the meticulous approach that transforms speculation into sustainable growth, ensuring that the journey toward financial success is both strategic and secure.