how to make free money online easily

Unlocking Sustainable Opportunities for Online Income through Strategic Cryptocurrency Investments

The digital landscape offers a myriad of avenues for individuals seeking to generate income beyond traditional methods, and cryptocurrency has emerged as a focal point for many. However, the allure of "free money" often disguises the complexities and risks inherent in such ventures. As a seasoned investor in this dynamic field, it is crucial to approach online earnings with a blend of mathematical precision, emotional discipline, and long-term vision. The goal is not to chase quick profits but to build a resilient framework that aligns with both market realities and personal financial objectives.

Cryptocurrency markets are inherently volatile, driven by factors that range from technological advancements to macroeconomic trends and regulatory shifts. This volatility necessitates a strategic mindset, where investors must balance risk and reward through calculated decision-making. One of the most critical aspects of sustainable gains in this space is understanding the interplay between market cycles and technical indicators. For instance, the Relative Strength Index (RSI) and Moving Averages often signal potential turning points, allowing traders to position themselves ahead of market movements. Unlike traditional markets, crypto trading operates in a 24/7 environment, which requires both adaptability and a structured approach to avoid impulsive decisions.

A key differentiator between successful investors and those who struggle is their ability to integrate fundamental analysis with technical strategies. Fundamentals—such as blockchain innovation, adoption rates, and community engagement—form the bedrock of long-term value. Projects with robust development teams and real-world applications, like DeFi platforms or NFT marketplaces, often outperform speculative assets over time. Conversely, over-reliance on short-term price fluctuations without considering underlying value can lead to减持 (a sudden drop in asset value). By combining these elements, investors can navigate uncertainty with a clearer understanding of potential outcomes.

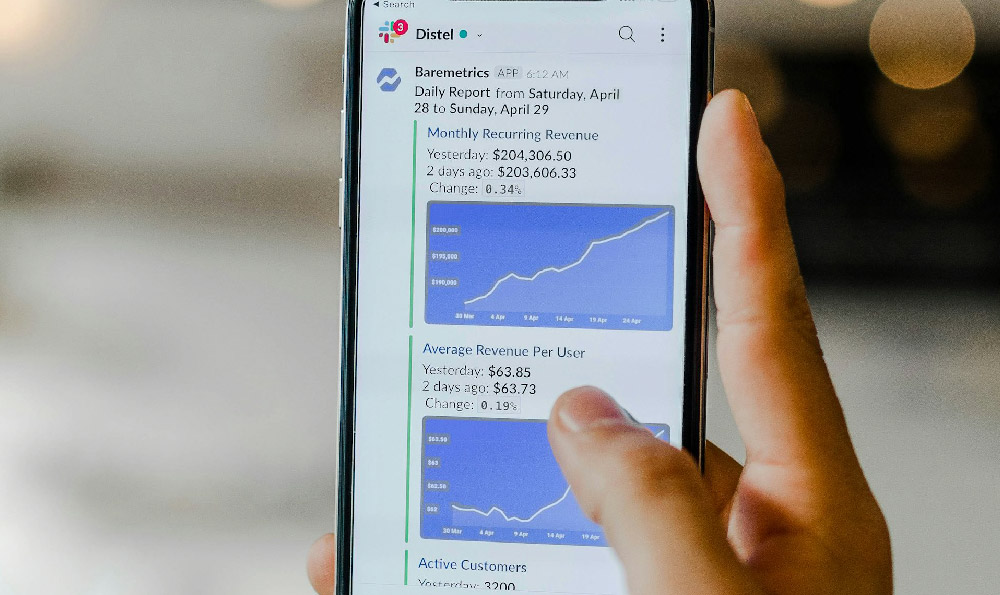

Another pillar of sustainable online income through cryptocurrency is the principle of dollar-cost averaging. Rather than attempting to time the market, this strategy involves consistently investing a fixed amount at regular intervals. It mitigates the impact of short-term volatility by spreading risk across different price levels, which is particularly effective in markets characterized by rapid price swings. For example, investing $100 daily in a diversified crypto portfolio over a year can yield substantial compounding returns, even during periods of market correction. This approach also fosters discipline, preventing the emotional pitfalls of buying high or selling low in response to market noise.

Risk management is the cornerstone of any profitable investment strategy. In the crypto sphere, where losses can materialize swiftly, it is essential to implement safeguards such as stop-loss orders and position sizing. Stop-loss orders automatically trigger a sale when an asset reaches a predetermined price, limiting potential losses. Position sizing ensures that no single trade consumes a disproportionate share of capital, preserving liquidity for future opportunities. Additionally, diversification across multiple assets and sectors reduces exposure to single-point failures, a lesson reinforced by the collapse of high-profile projects like FTX.

The trap of over-leveraging often lures inexperienced traders into unsustainable gains. While leverage can amplify profits, it also magnifies losses, particularly in a market as unpredictable as cryptocurrency. A prudent approach is to use leverage sparingly, ideally no more than 2-3x, and to ensure that trading accounts are insulated from excessive risk. This requires a clear understanding of margin requirements and the psychological impact of leverage on decision-making. Investors who prioritize capital preservation over short-term gains tend to outlast market downturns and build wealth over time.

Staying informed is another critical component of navigating the crypto markets. The blockchain industry evolves rapidly, with new protocols, regulations, and market dynamics emerging daily. Subscribing to reputable news sources, participating in community forums, and analyzing whitepapers can provide early insights into potential opportunities and threats. However, it is equally important to discern between credible information and market noise, as misinformation can lead to poor investment choices.

Ultimately, the path to sustainable online income through cryptocurrency is not a shortcut but a long-term endeavor. It requires patience, research, and a willingness to adapt to changing conditions. While it is possible to generate returns by leveraging market trends and sound strategy, the absence of "free money" underscores the importance of genuine effort. By cultivating a disciplined approach, investors can transform their online ventures into a profitable and secure financial pathway.

In conclusion, the intersection of cryptocurrency, online income, and strategic investment is complex yet rewarding. The key lies in embracing education, practicing restraint, and leveraging both technical and fundamental insights to navigate this space with confidence. Whether through trading, staking, or investing in promising projects, the foundation of success is built on meticulous planning and unwavering commitment to financial principles. By focusing on these elements, individuals can unlock opportunities that align with their goals while safeguarding their capital against the inherent risks of the market.