How to Invest in Stocks? Where Should I Start?

Investing in the stock market can seem daunting, especially if you're just starting. The sheer volume of information and the perceived risks can be overwhelming. However, with a measured approach, a solid understanding of the fundamentals, and a long-term perspective, investing in stocks can be a powerful tool for wealth creation.

The very first step, and perhaps the most critical, is self-assessment. Before putting any money at risk, ask yourself: What are my financial goals? What is my risk tolerance? What is my time horizon? Are you saving for retirement in 30 years, a down payment on a house in 5 years, or something else entirely? The answers to these questions will fundamentally shape your investment strategy. A young professional with a long time horizon can generally afford to take on more risk, investing in growth stocks or even smaller companies with high potential, while someone closer to retirement may prioritize capital preservation and seek lower-risk investments like dividend-paying stocks or bonds. Your risk tolerance dictates how comfortable you are with the possibility of losing money. Some people are naturally risk-averse and prefer the stability of lower-yielding investments, while others are willing to accept higher risks for the potential of greater returns. Be honest with yourself about your comfort level. There's no point in investing in volatile stocks if you're going to lose sleep every time the market dips.

Once you have a clear picture of your financial goals and risk tolerance, it's time to educate yourself. Don't blindly follow investment advice from friends, family, or online forums without understanding the rationale behind it. Learn the basic terminology – stocks, bonds, mutual funds, ETFs, dividends, P/E ratio, market capitalization, and so on. There are countless resources available, from online courses and financial websites to books and educational seminars. Familiarize yourself with different investment styles, such as value investing, growth investing, and dividend investing. Understand the difference between fundamental analysis (evaluating a company's financial health and prospects) and technical analysis (studying price charts and trading patterns). While both approaches have their proponents, a solid understanding of fundamental analysis is generally considered more crucial for long-term investing.

Next, consider the different ways to access the stock market. You have essentially two primary options: individual stocks and diversified investment vehicles. Investing in individual stocks allows you to have direct ownership in a company and potentially benefit from its growth. However, it also requires significant research and due diligence. You need to thoroughly analyze the company's financials, its competitive position, and its industry outlook. Furthermore, concentrating your investments in a few individual stocks can significantly increase your risk. If one of those companies performs poorly, your entire portfolio could suffer.

Diversified investment vehicles, such as mutual funds and Exchange Traded Funds (ETFs), offer a more convenient and less risky approach. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. A professional fund manager makes the investment decisions, relieving you of the burden of individual stock picking. However, mutual funds typically charge higher fees than ETFs. ETFs are similar to mutual funds, but they trade like stocks on an exchange, offering greater flexibility and lower expense ratios. Index ETFs, in particular, are a popular choice for beginners. These ETFs track a specific market index, such as the S&P 500, providing instant diversification across a broad range of companies.

Now, let's talk about choosing a brokerage account. Several online brokers offer commission-free trading and a wide range of investment options. Consider factors such as the fees charged, the trading platform's usability, the availability of research tools, and the quality of customer service. Once you've chosen a brokerage, you'll need to fund your account. Start with a small amount that you're comfortable losing. Don't feel pressured to invest all your money at once. Consider using a strategy called dollar-cost averaging, where you invest a fixed amount of money at regular intervals, regardless of the market's performance. This can help you reduce the risk of buying high and selling low.

Once you've made your first investments, it's crucial to monitor your portfolio regularly. However, avoid the temptation to constantly tinker with your investments based on short-term market fluctuations. Remember that investing is a long-term game. Stay focused on your financial goals and stick to your investment strategy. Regularly rebalance your portfolio to maintain your desired asset allocation. For example, if your target asset allocation is 70% stocks and 30% bonds, you may need to sell some stocks and buy some bonds if the stock market has performed exceptionally well.

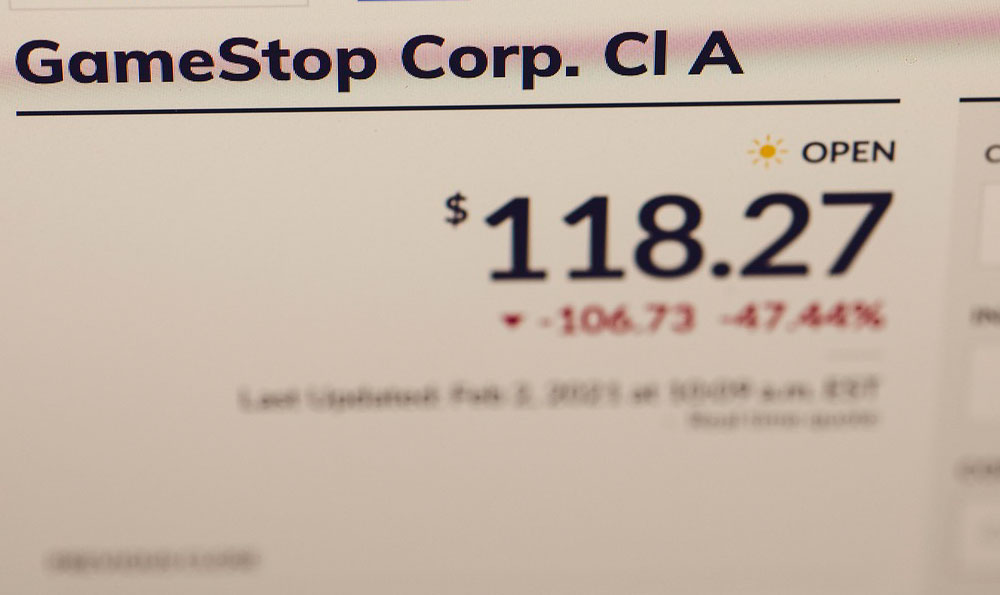

Finally, be aware of the potential pitfalls of investing in the stock market. Avoid speculative investments, such as penny stocks or meme stocks, unless you fully understand the risks involved. Be wary of investment scams and get-rich-quick schemes. Never invest money that you can't afford to lose. And most importantly, never stop learning. The stock market is constantly evolving, and staying informed is essential for making sound investment decisions.

Investing in the stock market requires discipline, patience, and a commitment to continuous learning. By following these guidelines, you can increase your chances of achieving your financial goals and building long-term wealth. Remember to consult with a qualified financial advisor if you need personalized advice tailored to your specific circumstances. Good luck, and happy investing!