How to invest money? And how to make money fast?

Investing and the pursuit of rapid wealth accumulation are two distinct concepts often intertwined, yet requiring vastly different approaches, especially within the volatile landscape of cryptocurrencies. Understanding this fundamental difference is the cornerstone of any successful financial strategy. Let's dissect these aspects and explore how to navigate the digital asset space responsibly and effectively.

The question, "How to invest money?" necessitates a long-term perspective, prioritizing capital preservation and steady growth over impulsive gambles. It’s about building a diversified portfolio aligned with your risk tolerance, financial goals, and time horizon. This involves thorough research, disciplined execution, and a willingness to adapt to evolving market conditions.

Before even considering cryptocurrencies, establish a solid financial foundation. This entails paying down high-interest debt, creating an emergency fund sufficient to cover 3-6 months of living expenses, and understanding your risk profile. Only then should you allocate a portion of your investment capital to cryptocurrencies, recognizing that they represent a high-risk, high-reward asset class.

Choosing which cryptocurrencies to invest in requires careful consideration. Avoid chasing hype and instead focus on projects with strong fundamentals, a clear use case, a robust development team, and a vibrant community. Research the underlying technology, the tokenomics, and the competitive landscape. Examine the project's whitepaper, audit reports, and developer activity on platforms like GitHub. Look for established cryptocurrencies like Bitcoin and Ethereum, which have proven track records and widespread adoption. Consider allocating a smaller portion of your portfolio to promising altcoins with innovative technologies or addressing specific market needs.

Diversification is crucial in mitigating risk. Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies, sectors (e.g., decentralized finance, layer-2 solutions, NFTs), and blockchain ecosystems. This way, if one investment performs poorly, the impact on your overall portfolio will be limited.

Dollar-cost averaging (DCA) is a proven strategy for reducing the impact of market volatility. Instead of trying to time the market, invest a fixed amount of money at regular intervals, regardless of the price. This allows you to buy more when prices are low and less when prices are high, smoothing out your average purchase price over time.

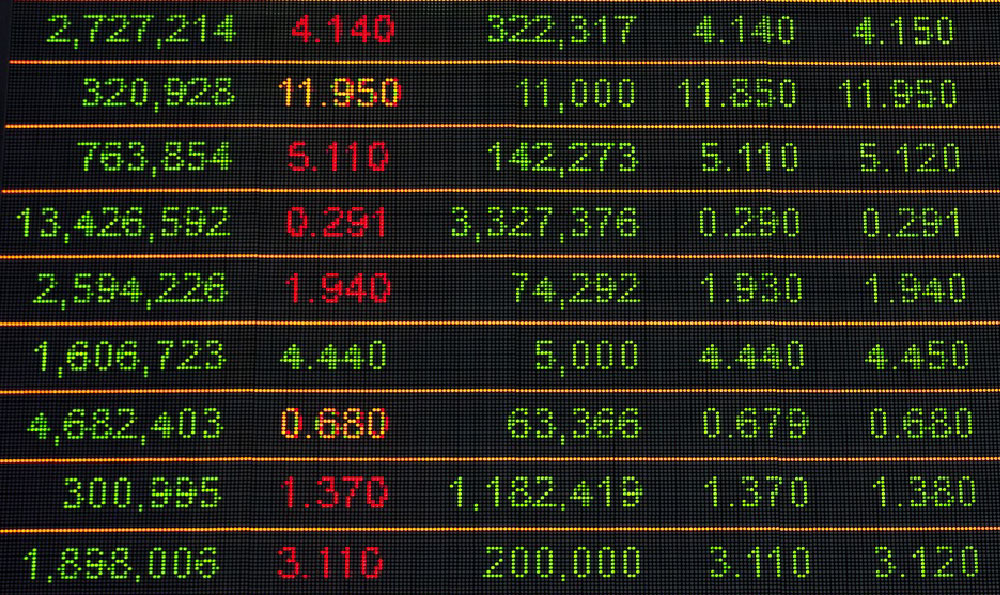

Cryptocurrency markets are highly volatile, and prices can fluctuate dramatically in short periods. Avoid emotional trading decisions driven by fear or greed. Develop a trading plan and stick to it. Set realistic profit targets and stop-loss orders to protect your capital. Regularly review your portfolio and rebalance as needed to maintain your desired asset allocation.

Security is paramount in the cryptocurrency world. Use strong, unique passwords for all your cryptocurrency accounts. Enable two-factor authentication (2FA) whenever possible. Store your cryptocurrencies in a secure wallet, such as a hardware wallet or a reputable software wallet. Be wary of phishing scams and never share your private keys with anyone. Stay informed about the latest security threats and best practices.

The question of "How to make money fast?" is fraught with peril, especially in the context of cryptocurrencies. The promise of overnight riches can lead to reckless decisions and devastating losses. While it's possible to experience rapid gains, it's equally likely to suffer significant setbacks.

Day trading involves buying and selling cryptocurrencies within the same day, aiming to profit from short-term price fluctuations. This requires technical analysis skills, a high tolerance for risk, and the ability to make quick decisions under pressure. The vast majority of day traders lose money, and it's not a sustainable way to build wealth.

High-yield DeFi protocols, such as yield farming and liquidity mining, offer the potential for significant returns. However, these opportunities come with substantial risks, including impermanent loss, smart contract vulnerabilities, and rug pulls. Thoroughly research any DeFi protocol before investing and understand the associated risks. Only invest what you can afford to lose.

Participating in initial coin offerings (ICOs) and initial exchange offerings (IEOs) can be lucrative if you identify promising projects early. However, the vast majority of ICOs and IEOs fail, and many are outright scams. Exercise extreme caution when investing in these offerings and conduct thorough due diligence. Evaluate the team, the technology, the tokenomics, and the regulatory environment.

Memecoins, cryptocurrencies based on internet memes, can experience explosive growth in short periods. However, they are highly speculative and driven by hype. Investing in memecoins is akin to gambling and should be approached with extreme caution. Be prepared to lose your entire investment.

Ultimately, the pursuit of rapid wealth accumulation in cryptocurrencies is a risky proposition. It's far more prudent to focus on long-term investing strategies, building a diversified portfolio, and managing risk effectively. While the allure of quick profits is tempting, it's essential to prioritize capital preservation and sustainable growth. Remember that investing is a marathon, not a sprint. Patience, discipline, and continuous learning are the keys to success. The crypto market rewards those who do their homework, manage their risk, and remain grounded in sound investment principles.