How to Get Rich Fast: Quick Wealth Strategies for Success

In today's fast-paced world, the allure of quick wealth has become more intense than ever. As digital currencies, emerging markets, and unconventional investment avenues expand, savvy individuals are increasingly seeking strategies to accelerate their financial growth. Unlike traditional methods that emphasize long-term planning, the modern approach to financial success often blends innovation, discipline, and leveraging opportunities that mainstream finance may overlook. While the path to rapid wealth creation is not without risks, understanding the underlying principles can help investors navigate this terrain with greater confidence.

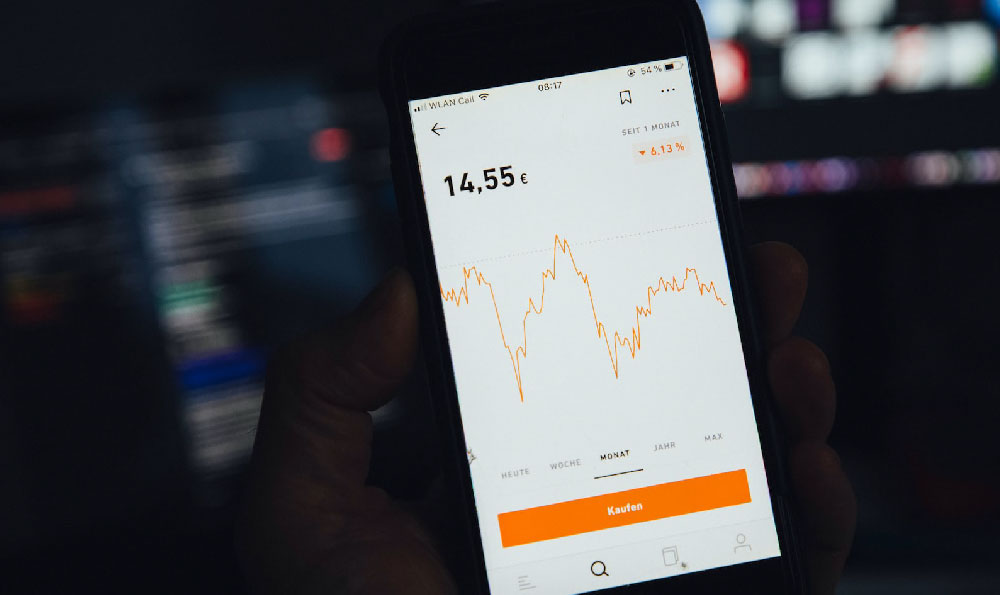

Capital markets have long offered pathways to wealth-building, but the acceleration of trade and the speed of financial transactions present new possibilities. Leveraging trends such as algorithmic trading, short-term equity investments, or speculative assets can yield significant returns, provided investors possess the necessary expertise and risk tolerance. For instance, high-frequency trading firms operate by executing thousands of trades per second, capitalizing on minute market fluctuations. Similarly, trading cryptocurrencies like Bitcoin or Ethereum has gained traction as a means to generate substantial gains in a short period. However, such strategies require not only technical knowledge but also access to real-time data and advanced tools, which may not be readily available to all.

Beyond financial markets, entrepreneurship has emerged as a viable route to rapid wealth accumulation. With the growth of the gig economy and digital platforms, individuals can monetize niche skills or passions in ways that were previously unimaginable. A prime example is the success of freelance content creators or app developers who launch products with minimal upfront costs. These innovators often capitalize on market demand through social media exposure, direct audience engagement, or referral networks. The key to this strategy lies in identifying underserved markets and offering unique value propositions that resonate with specific consumer groups. Beyond cybersecurity or fintech, fields like SaaS (Software as a Service) or online education have also demonstrated rapid scalability, enabling entrepreneurs to generate passive income through recurring payments or subscriptions.

However, the most effective quick wealth strategies often combine multiple approaches rather than relying on a single method. For example, investors who diversify their portfolios through a mix of high-yield savings accounts, peer-to-peer lending, and short-term real estate investments can leverage compounding effects to accelerate their returns. Similarly, those who allocate time to both active trading and passive income streams may benefit from a more balanced approach. The importance of time management cannot be overstated, as many successful individuals invest in skill development or education to enhance their ability to generate income rapidly. Whether through online courses, certifications, or self-directed learning, knowledge is a powerful tool in the pursuit of financial freedom.

Another critical factor in achieving rapid wealth is the ability to identify and mitigate financial risks. While high-risk investments often offer higher rewards, they also come with the potential for significant loss. Therefore, successful investors frequently employ risk management techniques such as stop-loss orders, diversification, or hedging strategies to protect their capital. Additionally, understanding the psychological aspects of investing, such as emotional control and decision-making under pressure, can help individuals avoid common pitfalls like overtrading or panic selling. The mind plays a crucial role in financial decisions, and cultivating a disciplined mindset greatly enhances the likelihood of long-term success.

The role of technology in wealth creation has also evolved, with automated systems and algorithm-driven models enabling individuals to optimize their investment strategies. For instance, robo-advisors use artificial intelligence to make investment decisions based on an individual's risk profile and financial goals. Similarly, trading algorithms can execute strategies with precision, eliminating human error and emotional bias. However, while automation offers efficiency, it does not replace the need for human oversight. Understanding how these tools function and ensuring they align with one's financial objectives is essential to leveraging their full potential.

Finally, the concept of "quick wealth" often intersects with lifestyle and mindset shifts. Many individuals who achieve rapid financial success do so by rethinking their approach to spending, saving, and investing. For example, adopting a frugal lifestyle while simultaneously investing in high-growth opportunities allows individuals to accumulate wealth faster than those who prioritize immediate consumption. Additionally, setting clear, measurable financial goals and maintaining a consistent income stream through side hustles or passive income sources can create a snowball effect, where initial gains lead to increased capital for further opportunities.

The journey to rapid wealth creation is not solely about financial tactics—it is also about mindset, adaptability, and the ability to capitalize on opportunities. Whether through active trading, entrepreneurship, or leveraging technology, the key lies in understanding the underlying principles and integrating them into a cohesive financial strategy. By focusing on long-term value creation while maintaining flexibility to seize short-term opportunities, individuals can position themselves for sustained success in the ever-evolving landscape of wealth-building.