How Did Jay Gatsby Become Rich? Unravel the Mystery

Jay Gatsby's path to wealth, as depicted in F. Scott Fitzgerald's novel, serves as a cautionary tale that transcends the realm of fiction to offer insights into the complexities of financial success. While the story is steeped in the lush backdrop of the 1920s American Jazz Age, the mechanisms through which Gatsby amasses his fortune mirror real-world investment strategies, albeit with a heavy dose of moral ambiguity and risk. His rise from a modest background to one of opulence is not merely a product of luck or genius but a calculated interplay of opportunity, resourcefulness, and, perhaps most notably, an insatiable desire to transcend social boundaries. This narrative invites a deeper exploration of how individuals can build wealth, the trade-offs they might encounter, and the philosophical questions surrounding the pursuit of material success.

At the heart of Gatsby's financial journey lies the strategic exploitation of illegal opportunities. The Prohibition era, which mandated the closure of saloons and the banning of alcohol, inadvertently created a black market ripe for exploitation. Gatsby, whose origins are shrouded in mystery, leverages this void through ventures such as bootlegging and smuggling, activities that, while lucrative, carry inherent risks. His involvement with organized crime, particularly through figures like Meyer Wolfsheim, underscores the role of connections and the willingness to operate outside conventional financial systems. This approach, while effective in generating rapid wealth, exposes the individual to legal scrutiny, moral dilemmas, and the volatility of illicit markets. The contrast between Gatsby's methods and modern, legal investment practices highlights the importance of aligning financial goals with ethical considerations and regulatory compliance.

Yet, Gatsby's success is not solely predicated on illegal activity. His ability to reinvent himself and create a persona that is both aspirational and socially acceptable plays a crucial role in his financial ascent. By cultivating an image of wealth and status, he attracts the attention of individuals with disposable income, thereby creating a network of patrons who fund his extravagant lifestyle. This phenomenon echoes the principles of networking in finance, where relationships and reputation can significantly influence access to capital and business opportunities. However, the reliance on a fabricated identity to sustain financial success raises questions about the sustainability of such strategies in the long term. In reality, financial stability often requires a foundation of trust and transparency, which a constructed persona may lack.

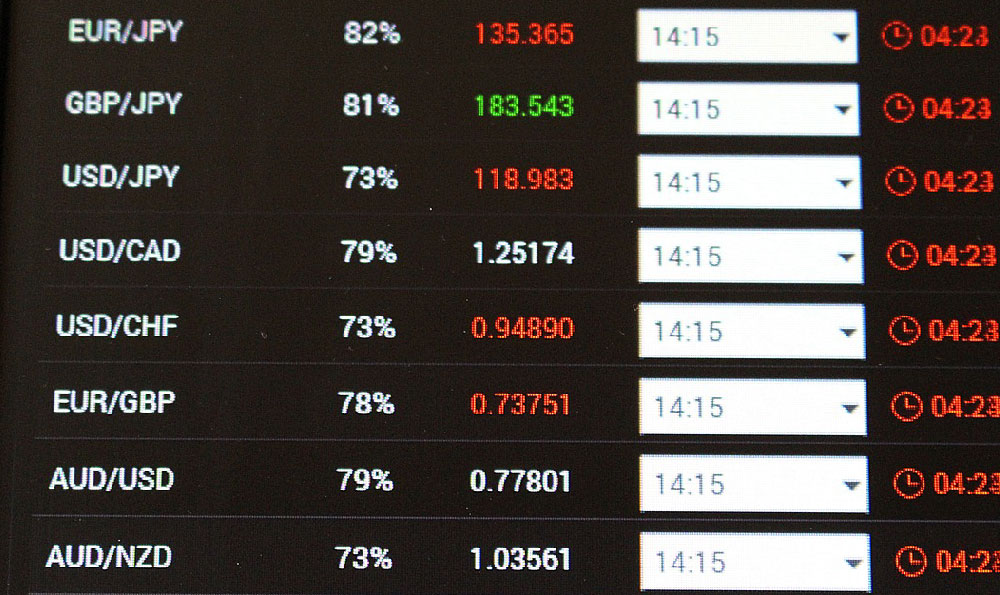

Moreover, Gatsby's wealth accumulation is driven by a combination of high-risk investments and a focus on speculative ventures. The stock market, real estate development, and other high-reward industries require not only capital but also an understanding of market trends and the ability to take calculated risks. Gatsby's choices, while fueled by personal ambition, reflect a lack of diversification and a tendency to concentrate resources in volatile sectors. This mirrors the pitfalls of overexposure in financial markets, where excessive risk-taking without adequate safeguards can lead to catastrophic losses. The lesson here is that sustainable wealth requires a balanced approach, where diversification and risk management are prioritized over the pursuit of quick gains.

Gatsby's story also reveals the role of psychological factors in wealth accumulation. His relentless pursuit of Daisy Buchanan, a symbol of his dream of reinvention, is intertwined with his financial goals. This illustrates how emotional motivations can influence financial decisions, sometimes leading to irrational choices. In the real world, investors must navigate the tension between emotional desires and rational strategies, ensuring that their financial plans are not driven by personal aspirations but by objective analysis. The importance of separating personal goals from investment decisions is a critical aspect of long-term financial planning.

Additionally, Gatsby's wealth is characterized by its ephemeral nature. His mansion, parties, and lifestyle are all temporary manifestations of his financial success, designed to impress rather than endure. This ephemeral quality reflects the broader concept of wealth versus assets. In reality, true financial security is built upon physical assets, investments, and financial instruments that appreciate in value over time. The distinction between wealth as a measure of status and wealth as a measure of enduring value is essential for investors to understand. By focusing on tangible assets such as real estate, stocks, and businesses, individuals can create a foundation for sustainable wealth that is not dependent on fleeting luxuries.

The novel also highlights the importance of timing and market conditions in wealth creation. Gatsby's ventures flourish during the economic boom of the 1920s, a period of unprecedented growth and speculation. However, as the market crashes and the excesses of the era give way to austerity, his financial empire begins to crumble. This serves as a reminder that financial success is often contingent on the broader economic environment. Investors must recognize that market cycles are inevitable and that the ability to adapt to changing conditions is crucial for long-term prosperity. The key lies in maintaining a diversified portfolio that can withstand economic downturns while continuing to grow in periods of expansion.

In summary, Gatsby's journey to wealth is a multifaceted narrative that intertwines illegal activity, speculative investments, and psychological motivations. While his methods offer insights into the potential for rapid financial growth, they also underscore the risks associated with operating outside legal frameworks and the importance of sustainable, diversified investment strategies. For modern investors, the story of Gatsby serves as a reminder to pursue financial success through ethical means, to remain vigilant against the allure of quick gains, and to prioritize long-term stability over short-term spectacle. By learning from the pitfalls of Gatsby's approach, individuals can craft more resilient financial plans that align with their values and goals.