How Does an IRA Grow, and Is It Right for You?

An Individual Retirement Account (IRA) is a powerful tool designed to help individuals save and invest for retirement. Understanding how an IRA grows and whether it’s the right fit for your financial situation is crucial for building a secure future. The growth of an IRA hinges on several factors, including the type of IRA, the investments held within it, and the overall performance of the market.

There are primarily two main types of IRAs: Traditional and Roth. A Traditional IRA allows for pre-tax contributions, meaning the money you contribute may be tax-deductible in the year you make the contribution. This can lower your taxable income now. However, withdrawals in retirement are taxed as ordinary income. The growth within a Traditional IRA is tax-deferred, so you don't pay taxes on dividends, interest, or capital gains until you withdraw the money in retirement.

A Roth IRA, on the other hand, operates differently. Contributions are made with after-tax dollars, meaning you don't get a tax deduction in the year you contribute. However, the significant advantage of a Roth IRA is that all qualified withdrawals in retirement are tax-free. This includes both the contributions you made and the earnings generated within the account. Again, the growth inside a Roth IRA is tax-free, so no taxes are owed as the investments appreciate over time.

The growth potential of an IRA is directly tied to the investment options you choose to hold within the account. Most IRA providers offer a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and certificates of deposit (CDs). The appropriate investment strategy will depend on your risk tolerance, time horizon until retirement, and financial goals.

For individuals with a long time horizon (e.g., decades until retirement), a more aggressive investment strategy may be appropriate. This might involve allocating a larger portion of the portfolio to stocks, which historically have provided higher returns than bonds, although with greater volatility. Stocks represent ownership in companies, and their value can fluctuate significantly based on market conditions, company performance, and economic factors. However, over the long term, stocks have generally outperformed other asset classes.

As retirement approaches, it’s often prudent to gradually shift towards a more conservative investment strategy. This involves increasing the allocation to bonds and other fixed-income investments, which tend to be less volatile than stocks. Bonds represent loans to corporations or governments, and they typically provide a fixed income stream through interest payments. A more conservative approach helps to protect the accumulated savings from significant market downturns in the years leading up to retirement.

Mutual funds and ETFs offer a diversified approach to investing. Mutual funds pool money from multiple investors to purchase a portfolio of securities, managed by a professional fund manager. ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks. They often track a specific index, such as the S&P 500, providing broad market exposure. These diversified investment vehicles can help to reduce risk by spreading investments across a wide range of assets.

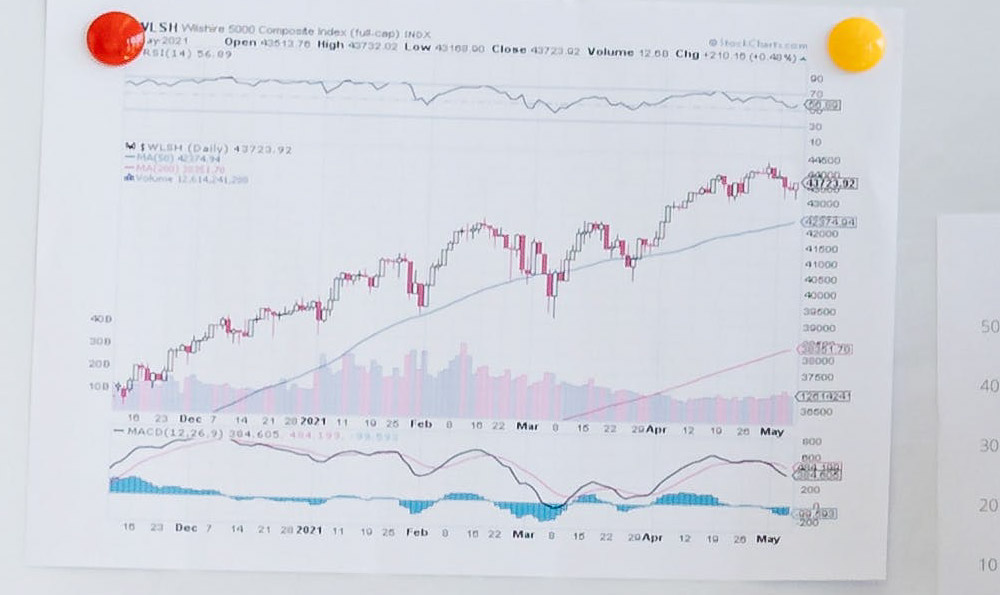

Beyond asset allocation, the overall performance of the market plays a crucial role in the growth of an IRA. Favorable economic conditions, strong corporate earnings, and positive investor sentiment can drive up stock prices and boost the value of investments. Conversely, economic recessions, geopolitical instability, and negative news can lead to market declines and reduce investment returns.

It's important to remember that past performance is not indicative of future results. While historical data can provide insights into potential returns, market conditions are constantly evolving, and investment outcomes can vary significantly. Therefore, it's essential to stay informed about market trends, economic developments, and the performance of your investments.

Is an IRA right for you? The answer depends on your individual circumstances. If you are employed and have access to a 401(k) plan through your employer, contributing to that plan, especially if there is an employer matching contribution, is generally the first step. The matching contribution is essentially free money, providing an immediate return on your investment.

However, if you are self-employed, do not have access to a 401(k), or have maxed out your 401(k) contributions, an IRA can be an excellent option. Traditional IRAs can be particularly beneficial for individuals who anticipate being in a lower tax bracket in retirement than they are currently. The tax deduction on contributions can provide immediate tax savings, while the taxes on withdrawals are deferred until retirement.

Roth IRAs may be more advantageous for individuals who expect to be in a higher tax bracket in retirement or who want the flexibility of tax-free withdrawals. Because contributions are made with after-tax dollars, the growth and withdrawals are entirely tax-free, which can be particularly appealing for younger individuals with a long time horizon.

Before opening an IRA, carefully consider your financial goals, risk tolerance, and tax situation. Consult with a financial advisor to determine the most appropriate type of IRA and investment strategy for your needs. They can provide personalized guidance based on your individual circumstances and help you create a comprehensive retirement plan.

Furthermore, understand the contribution limits for IRAs, which are subject to change annually. Contributing the maximum amount allowed each year can significantly accelerate your retirement savings. Also, be aware of the rules and regulations surrounding IRA withdrawals, including any penalties for early withdrawals.

In summary, an IRA grows through a combination of contributions, investment returns, and tax advantages. The type of IRA, the investments held within it, and the overall market environment all play a crucial role in determining the extent of that growth. By carefully considering your financial situation and investment goals, and by seeking professional guidance when needed, you can leverage the power of an IRA to build a secure and prosperous retirement. Remember to remain disciplined in your savings habits, diversify your investments, and stay informed about market trends to maximize the potential of your IRA.