How to Get Rich Quick: Is It Possible, and If So, How?

Okay, here's an article responding to the prompt "How to Get Rich Quick: Is It Possible, and If So, How?" written from the perspective of an investment expert, exploring the topic with depth, caution, and realism, and adhering to the requested formatting.

``` The siren song of rapid wealth accumulation has captivated humanity for centuries. From tales of striking gold in the Klondike to the allure of overnight fortunes in cryptocurrency, the dream of "getting rich quick" persists, whispering promises of financial freedom and a life of leisure. But is it truly possible? And if so, what paths might lead to such rapid prosperity? The answer, as with most things in finance, is complex and shrouded in caveats.

Let's be blunt: genuine, sustainable wealth creation rarely happens overnight. The vast majority of fortunes are built through diligent saving, strategic investing over the long term, and a significant amount of hard work, innovation, or both. Think of entrepreneurs who spend years building a successful business, or investors who patiently compound returns in the stock market. These are the more common, and certainly more reliable, routes to financial security. However, that doesn't mean the idea of accelerated wealth accumulation is entirely a myth. It's more accurate to say it's a high-risk, high-reward proposition, often requiring a confluence of skill, timing, and a healthy dose of luck.

One potential avenue lies in entrepreneurship. Launching a successful business, especially in a rapidly growing sector, can lead to exponential growth and significant financial returns. Consider the tech industry, where companies can scale rapidly and disrupt entire markets. However, the odds are stacked against aspiring entrepreneurs. The vast majority of startups fail, and even successful ventures require immense dedication, long hours, and the willingness to take significant financial risks. Funding is a constant challenge, and navigating the complexities of running a business requires a diverse skillset. Therefore, while entrepreneurship offers a legitimate, albeit difficult, path to potentially rapid wealth, it should not be entered into lightly. It demands thorough research, a solid business plan, and a realistic assessment of one's capabilities and risk tolerance.

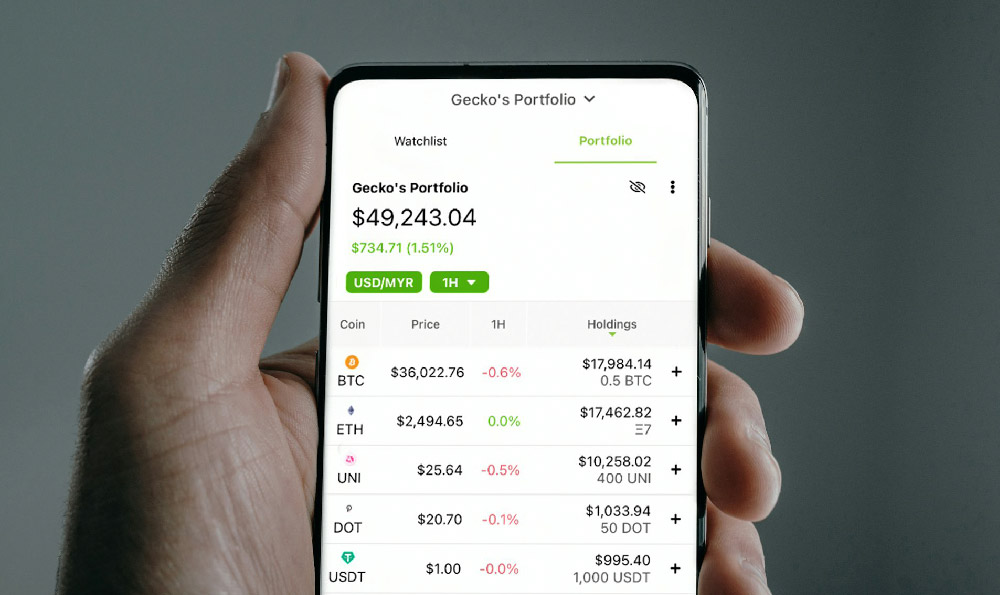

Another route, often romanticized, is through high-risk investments. This might include investing in penny stocks, speculative real estate ventures, or volatile cryptocurrencies. These assets have the potential for explosive growth, but they also carry a substantial risk of complete loss. The allure of multiplying your investment tenfold in a matter of months is undeniably strong, but the reality is that these opportunities are often plagued by scams, manipulation, and inherent instability. Only a small percentage of investors consistently profit from these types of investments, and those who do often possess a deep understanding of market dynamics, a strong stomach for volatility, and access to information that is not readily available to the average investor. For most individuals, chasing quick riches through speculative investments is akin to gambling; the odds are heavily stacked against them.

Beyond entrepreneurship and high-risk investments, there are other less common, but potentially lucrative, paths. Developing a highly sought-after skill, such as programming, data science, or digital marketing, can lead to high-paying job opportunities or the ability to command premium rates as a freelancer. This approach requires significant investment in education and training, but it can provide a more stable and predictable path to financial security than speculative ventures. Similarly, creating and monetizing intellectual property, such as writing a bestselling book, developing a popular mobile app, or inventing a groundbreaking technology, can generate substantial passive income. However, these endeavors require creativity, perseverance, and often a significant amount of upfront investment.

Furthermore, consider the role of sheer luck. Winning the lottery, inheriting a large sum of money, or being in the right place at the right time to capitalize on a fleeting market opportunity can all lead to sudden wealth. However, these events are largely beyond one's control and should not be relied upon as a financial strategy. It's important to remember that even sudden wealth can be mismanaged and quickly squandered if not handled responsibly.

Regardless of the path chosen, certain principles are crucial for anyone seeking to accelerate their wealth accumulation. First and foremost, financial literacy is essential. Understanding basic concepts such as budgeting, saving, investing, and debt management is critical for making informed financial decisions. Secondly, a strong work ethic and a willingness to take calculated risks are necessary for achieving ambitious financial goals. Thirdly, a long-term perspective is important, even when pursuing short-term gains. It's crucial to balance the desire for rapid wealth accumulation with the need for sustainable financial planning. Diversification can help mitigate risk, and seeking professional financial advice can provide valuable guidance and support.

Finally, it's important to define what "rich" truly means to you. Is it about accumulating a certain amount of money, achieving financial independence, or simply living a comfortable and fulfilling life? Once you have a clear understanding of your financial goals, you can develop a strategy that aligns with your values and risk tolerance. Remember, true wealth is not just about money; it's about having the freedom and flexibility to live life on your own terms. The pursuit of rapid wealth should not come at the expense of your health, relationships, or ethical principles. While the dream of getting rich quick may be tempting, a more realistic and sustainable approach is to focus on building a solid financial foundation, developing valuable skills, and making smart investment decisions over the long term. This may not lead to overnight riches, but it will provide a greater chance of achieving lasting financial security and a fulfilling life. ```