How to Generate More Income Using Your Money

Generating more income through strategic financial management can be a transformative approach to building lasting wealth. While the concept of maximizing returns might seem complex, it fundamentally relies on understanding how to allocate resources effectively and identify opportunities that align with long-term goals. One of the most reliable ways to achieve this is by investing in assets that generate passive income, a method that allows individuals to earn money without constant active involvement. This strategy can be particularly advantageous for those seeking financial freedom or additional revenue streams beyond their primary income.

Passive income opportunities often require initial capital but offer the potential for steady returns over time. Real estate investments, for instance, can be a lucrative option. By purchasing properties and renting them out, investors can generate monthly cash flow while also benefiting from property value appreciation. However, it's important to consider factors such as location, market demand, and maintenance costs to ensure long-term viability. Another popular avenue is dividend-paying stocks, which provide regular income through shareholder distributions. Investors who prioritize income generation often favor companies with a strong track record of profitability and financial stability, as they are more likely to maintain dividend payouts even during market downturns.

Diversification plays a crucial role in maximizing income across various financial instruments. Instead of relying on a single investment, spreading capital across different asset classes can help mitigate risks and reduce the impact of market fluctuations. For example, a balanced portfolio might include stocks, bonds, exchange-traded funds (ETFs), and other alternative investments such as private equity or real estate investment trusts (REITs). This approach not only enhances the potential for higher returns but also provides a safeguard against potential losses. It's worth noting that diversification can be tailored to individual preferences, whether one prefers high-risk, high-reward options or more conservative investments with predictable income.

In addition to traditional investment methods, there are innovative ways to generate income by leveraging technology and digital platforms. Freelancing, online businesses, and cryptocurrency investing are all areas where individuals can create additional revenue streams. For those with specialized skills, freelancing platforms such as Upwork or Fiverr offer the opportunity to monetize expertise in fields like writing, graphic design, and programming. Similarly, online businesses can be established with relatively low startup costs, ranging from e-commerce ventures to digital content creation. While these methods require some level of effort or expertise, they can be managed part-time, allowing individuals to maintain their primary income while exploring new financial avenues.

Another effective way to increase income is by investing in assets that appreciate in value over time. This includes real estate, collectibles, and even certain stocks with strong growth potential. For instance, investing in rental properties not only provides rental income but also offers the benefit of equity growth as the property's value increases. Collectibles such as rare art, vintage cars, or antique jewelry can also be a source of income, though they typically require in-depth knowledge and patience to manage. Similarly, certain stocks with strong growth potential can generate both capital gains and dividend income, making them a dual-benefit investment option.

It's also possible to enhance income through lifestyle changes that reduce expenses and free up more capital for investment. Creating a budget, minimizing unnecessary spending, and increasing savings rates can all contribute to building a stronger financial foundation. For example, cutting costs in areas such as dining out, subscriptions, and transportation can free up significant funds that can be redirected towards income-generating opportunities. Additionally, increasing income through side hustles or additional jobs can provide more financial resources to invest, further compounding returns over time.

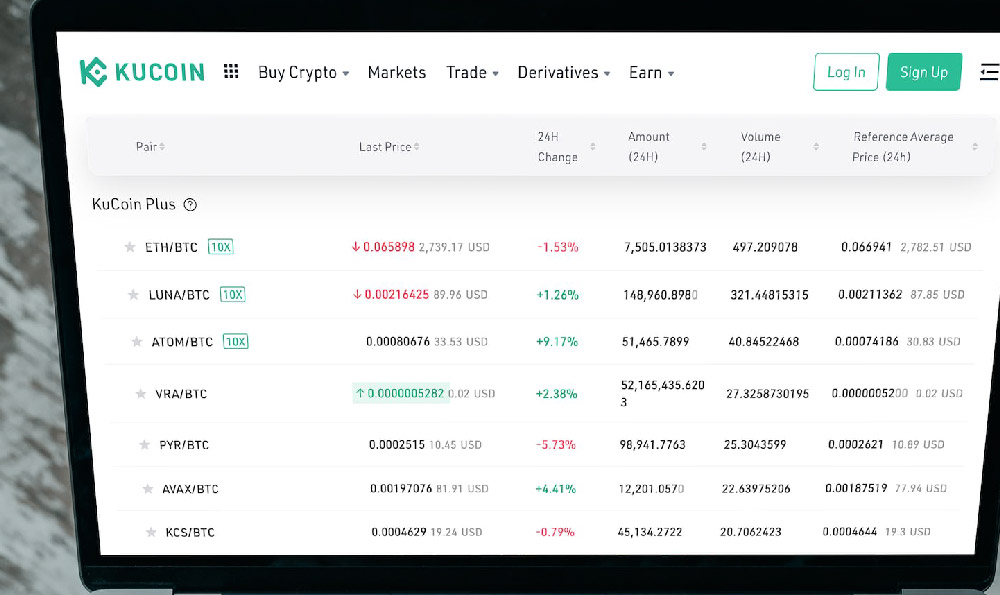

For those looking to accelerate income generation, leveraging financial products such as peer-to-peer lending or income-generating crypto can be an attractive option. Peer-to-peer lending platforms allow individuals to lend money directly to borrowers, earning interest payments in return. While this method can offer higher returns than traditional savings accounts, it also comes with greater risks, necessitating careful research and risk assessment. Similarly, investing in cryptocurrencies that generate staking rewards or token-based income can be a way to diversify portfolios and explore new opportunities in the digital economy.

Ultimately, the key to generating more income is to develop a comprehensive financial strategy that balances risk, reward, and personal circumstances. Whether one chooses to invest in real estate, stocks, or digital platforms, the core principle remains the same: capital is a resource that can be used to create additional income when managed wisely. As individuals explore different options, they should also consider factors such as time commitment, risk tolerance, and financial goals to ensure that their strategy aligns with their long-term vision.

By adopting these methods, individuals can take control of their financial future and create opportunities for income growth that extend beyond their current earnings. The process requires patience, research, and a willingness to learn, but the rewards can be substantial. As the financial landscape continues to evolve, staying informed and adaptable is essential for maximizing returns and achieving long-term financial success.