What Bank Does Fidelity Investments Use & Why Does It Matter?

Fidelity Investments, a titan in the financial services industry, doesn't use a single bank in the way an individual might. Instead, it operates with a complex network of custodian banks and banking relationships to manage its vast assets under management (AUM). Understanding these relationships, though often opaque to the average investor, reveals crucial insights into Fidelity's operational structure, risk management protocols, and its ability to safeguard client assets.

To understand this, it’s important to differentiate between a retail bank and a custodian bank. Retail banks provide services to individuals and businesses, like checking accounts, loans, and credit cards. Custodian banks, on the other hand, primarily serve institutional clients like mutual funds, pension funds, and, indeed, large investment firms like Fidelity. Their main role is to hold and safeguard financial assets, ensuring they are secure and accessible when needed. They also handle transaction processing, record keeping, and reporting.

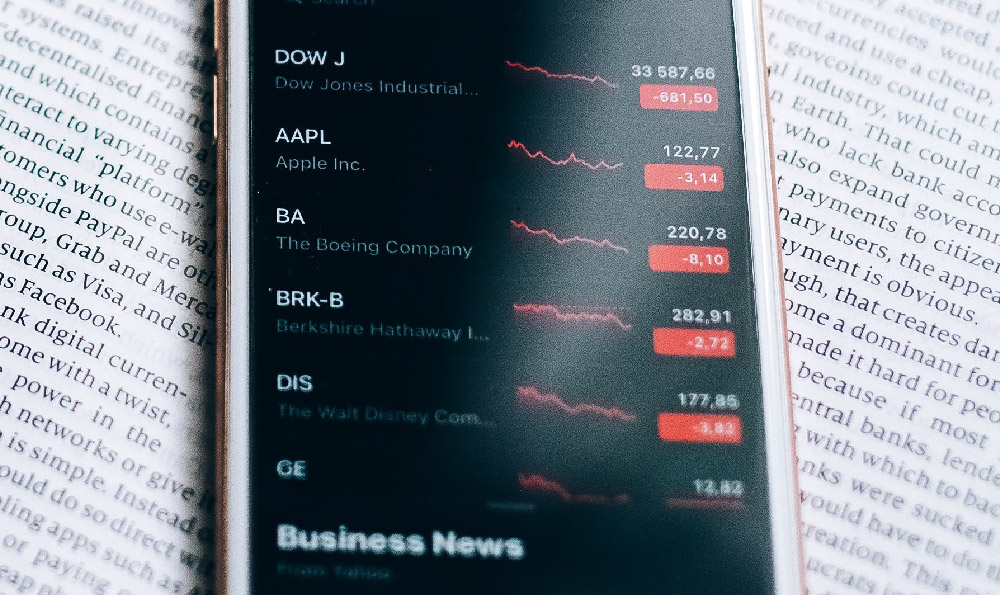

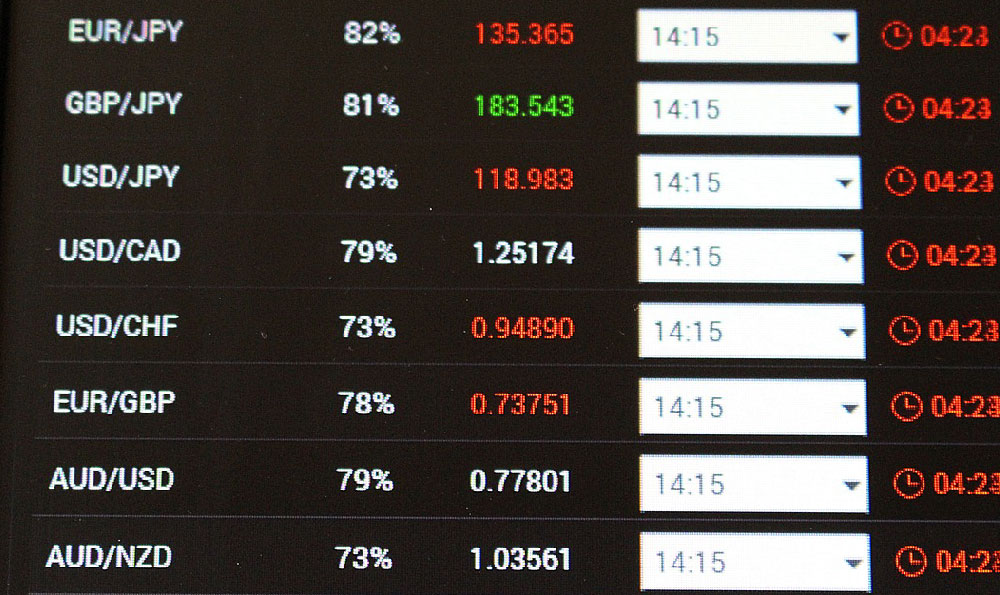

Fidelity, as a massive investment firm, requires the services of multiple custodian banks to manage its diverse holdings, which span stocks, bonds, commodities, and other asset classes, across various markets globally. The specific custodian banks used by Fidelity are generally not publicly disclosed for proprietary and competitive reasons. However, firms like State Street, BNY Mellon, and JPMorgan Chase are prominent players in the custodial banking industry and are likely partners for Fidelity. These institutions possess the scale, infrastructure, and regulatory expertise required to handle the complex needs of a firm like Fidelity.

Why does this matter to you, the investor? The choice of custodian bank has significant implications for the security and operational efficiency of your investments managed by Fidelity. A robust custodian bank provides several key benefits:

Enhanced Security: Custodian banks employ advanced security measures to protect assets from theft, fraud, and loss. They maintain detailed records of ownership and transactions, ensuring a clear audit trail. The fact that Fidelity disperses its custody needs across multiple strong institutions also acts as a risk mitigation strategy. Should one institution face unforeseen issues, the impact on Fidelity's overall operations and client assets is minimized.

Operational Efficiency: Custodian banks streamline transaction processing, settlement, and record keeping. This allows Fidelity to focus on investment management and client service, rather than being bogged down in administrative tasks. Efficient operations translate to faster trade execution, accurate account statements, and reduced errors, all of which contribute to a better investment experience for clients.

Regulatory Compliance: Custodian banks are subject to strict regulatory oversight and compliance requirements. This ensures they adhere to the highest standards of security and accountability, protecting client assets from mismanagement or abuse. These regulations, like those dictated by the SEC and other governing bodies, help to create a safe and secure environment for investors.

Transparency and Reporting: Custodian banks provide detailed reports on asset holdings and transactions, allowing Fidelity to monitor its performance and ensure compliance with regulatory requirements. This transparency is essential for maintaining investor trust and confidence. While the exact holdings within a specific custodian are not visible to the individual investor, the overall transparency that these arrangements create helps build confidence in the entire system.

Counterparty Risk Management: By using multiple custodian banks, Fidelity diversifies its counterparty risk. This means that if one custodian were to experience financial difficulties, it would not jeopardize the entire portfolio of assets managed by Fidelity. This diversification strategy is a critical component of risk management, safeguarding client assets from potential losses.

Beyond the choice of custodian banks, understanding Fidelity's internal banking operations is also crucial. Fidelity operates a brokerage service, which means it holds client funds in cash or money market funds within its own infrastructure. This “house banking” function allows Fidelity to efficiently manage cash flows, facilitate transactions, and earn interest income on client balances. However, it also introduces a certain level of risk.

Fidelity mitigates this risk through various measures, including:

- Capitalization: Fidelity maintains a strong capital base to absorb potential losses.

- Liquidity Management: Fidelity closely monitors its cash flows and maintains sufficient liquidity to meet its obligations.

- Risk Management Controls: Fidelity has implemented robust risk management controls to identify, assess, and mitigate potential risks.

- Insurance: Client accounts are typically covered by SIPC (Securities Investor Protection Corporation) insurance, which protects against the loss of cash and securities in the event of a brokerage firm failure.

In conclusion, while pinpointing the exact banks used by Fidelity Investments in a custodial capacity is not publicly available knowledge, understanding the general principles of custodial banking and Fidelity's risk management practices is essential for investors. The strength and security of the custodian banks and the internal banking operations are paramount to safeguarding client assets and ensuring the long-term success of their investments. The fact that Fidelity leverages a network of custodians, coupled with its own internal risk management processes, demonstrates a commitment to protecting investor interests. By choosing a reputable investment firm like Fidelity, you are indirectly benefiting from these sophisticated and robust security measures that underpin the entire financial system. It's not about knowing the specific names of the banks, but understanding the intricate web of security and oversight that protects your investments.