How to Earn Money with Coinbase: Profit Strategies 2024

(Staying Informed: Mastering Market Trends)

In the fast-paced world of cryptocurrency, staying ahead of market trends is crucial for maximizing returns. Coinbase provides a wealth of tools to track price movements, including real-time data, news updates, and customizable charts. To leverage these resources effectively, users should follow a strategic approach. Monitoring the performance of Bitcoin and Ethereum, the two most dominant cryptocurrencies, can reveal broader market sentiment. Additionally, exploring niche assets such as Solana or BNB allows for capitalizing on emerging trends. Combining Coinbase's internal analytics with external platforms like CoinDesk or CoinMarketCap enables a comprehensive view of market dynamics. It's essential to understand the factors driving price fluctuations, such as regulatory news, technological advancements, and macroeconomic indicators. By developing a habit of daily market analysis, investors can identify entry and exit points that align with their financial goals.

(Portfolio Diversification: Balancing Risk and Reward)

Diversification remains a cornerstone of successful investing, even in the volatile crypto market. Coinbase offers access to over 100 cryptocurrencies, providing an opportunity to spread investments across different asset classes. For instance, allocating funds to stablecoins like USDC can act as a safe haven during market downturns, while allocating to high-growth projects may yield significant returns in bull markets. It's important to consider the risk profile of each asset: blue-chip cryptocurrencies typically exhibit lower volatility, whereas altcoins may offer higher potential but come with greater risk. Seasoned investors can explore DeFi protocols through Coinbase's integrated tools to generate passive income via yield farming. Meanwhile, beginners might focus on long-term holding strategies, known as 'HODLing', to benefit from compounding growth. Regularly reviewing and rebalancing the portfolio helps maintain a healthy risk-reward ratio, especially in a market where prices can swing dramatically within hours.

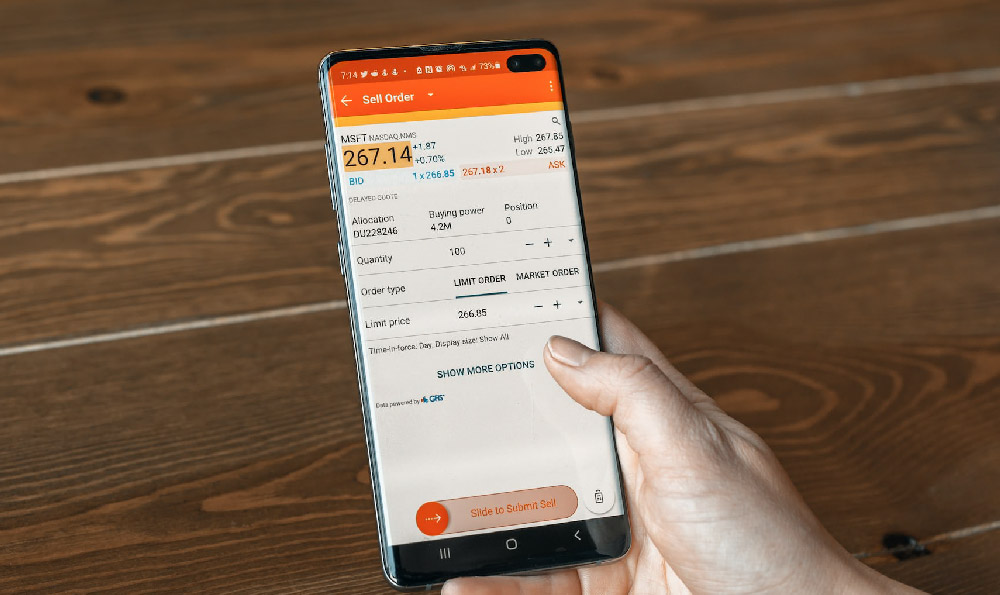

(Leveraging Tools for Maximum Profitability)

Coinbase's platform is equipped with advanced features that can be tailored for profit maximization. The platform's limit orders and stop-loss tools allow users to automate trades based on specific price targets, reducing the likelihood of emotional decision-making. For example, setting a limit order to buy Bitcoin at a 5% discount ensures entry at a favorable price while mitigating the risk of overpaying. Similarly, utilizing the stop-loss feature can protect capital by automatically selling assets when they reach a predetermined threshold. The platform also offers staking options for validators, enabling users to earn interest on their crypto holdings without needing to engage in active trading. Exploring Coinbase's educational resources can further empower users to refine their strategies, whether they're interested in day trading, swing trading, or long-term investment. Integrating these tools into a cohesive trading plan can significantly enhance profitability, especially for those with limited time to monitor the market continuously.

(Analyzing Market Cycles: Timing Your Moves)

Understanding the cyclical nature of cryptocurrency markets is essential for timing trades effectively. Historically, Bitcoin has shown predictable patterns of consolidation and breakout phases, each offering distinct opportunities. During consolidation, the price often fluctuates within a defined range, allowing for strategic buy-and-sell opportunities. In breakout phases, prices can surge rapidly, but timing the exact moment requires deeper analysis. Coinbase's market data can help identify these cycles through candlestick charts and volume analysis. For example, a decrease in trading volume during a price consolidation phase might signal an upcoming reversal. Additionally, studying historical data, such as Bitcoin's performance during the 2021 bull run, can provide insights into potential market behavior in 2024. Investors should also pay attention to macroeconomic trends, as interest rates, inflation, and geopolitical events can influence cryptocurrency prices. By combining technical analysis with fundamental insights, users can make more informed trading decisions.

(Active Participation in Emerging Ecosystems)

Beyond traditional trading, Coinbase empowers users to engage in emerging crypto ecosystems that offer unique profit opportunities. Staking and yield farming within DeFi platforms can generate passive income, leveraging the platform's integrated tools to simplify the process. For instance, staking Ethereum for a minimum of 32 ETH allows users to participate in the blockchain's consensus mechanism and earn staking rewards. Converting fiat currencies into smaller denominations, such as USDT or Tether, can also provide flexibility for arbitrage opportunities across different exchanges. Furthermore, exploring NFT marketplaces through Coinbase's integrated services allows users to invest in digital collectibles that may appreciate in value over time. These strategies require a deeper understanding of the underlying technology and market demand, but they can be explored through Coinbase's educational materials. By remaining active in these evolving sectors, investors can diversify their income streams and capitalize on niche opportunities.

(Building a Sustainable Earnings Framework)

Creating a sustainable earnings framework on Coinbase involves careful planning, discipline, and adaptability. Establishing clear financial goals, such as targeting a 10% monthly return or a long-term 50% growth, helps maintain focus and consistency. Risk management is integral to this process, as even the most promising assets can experience sharp declines. Limiting exposure to any single cryptocurrency through dollar-cost averaging or position sizing can reduce systemic risk. Continuous learning through Coinbase's educational resources, whether it's understanding smart contracts or blockchain security, ensures that users remain informed about potential risks and opportunities. Finally, maintaining a mindset of patience and adaptability is key, as the crypto market is constantly evolving. By implementing these principles, investors can build a resilient earnings strategy that adapts to market conditions while minimizing emotional bias.

(Exploring Cross-Platform Arbitrage Opportunities)

Coinbase's integration with multiple exchanges allows users to capitalize on cross-platform arbitrage opportunities, where the same asset trades at different prices across networks. For example, Bitcoin might trade at a higher rate on one exchange while being lower on another, prompting strategic buy-and-sell actions. Staying informed about price discrepancies through Coinbase's market data tools and external price-tracking services enables users to seize these opportunities efficiently. Arbitrage strategies are particularly effective during periods of high volatility, although they require quick execution and a deep understanding of market mechanics. Users can also explore yield farming across different DeFi platforms, leveraging Coinbase's integrated services to diversify their income sources. By developing a habit of monitoring multiple platforms, investors can identify profitable opportunities that might otherwise go unnoticed.

(Embracing Innovation: The Role of New Technologies)

The intersection of Coinbase and emerging technologies such as blockchain analytics, AI-driven forecasting, and smart contract automation presents new avenues for profit. Tools like on-chain analytics allow users to track transaction patterns, helping predict potential price movements based on market activity. AI-powered platforms integrate with Coinbase to provide predictive insights, analyzing historical data and current trends to recommend optimal trading strategies. Smart contract automation, through decentralized applications (DAPS), enables users to execute trades automatically based on predefined conditions, increasing efficiency and reducing manual oversight. For example, integrating AI tools with Coinbase's trading interface might suggest buying Bitcoin when its price dips below a moving average. Engaging with these cutting-edge technologies requires a willingness to adapt and experiment, but the potential rewards can be substantial. By embracing innovation, investors can stay at the forefront of the evolving crypto landscape.