Could Keepbit Auto Stop Trade Signals Really Work? Are They Worth It?

Okay, I'm ready. Here's an article based on the title "Could Keepbit Auto Stop Trade Signals Really Work? Are They Worth It?" written in English, exceeding 800 words, and designed to be informative and comprehensive, while avoiding excessive bullet points and numbered lists, as well as the use of introductory phrases like "Firstly," or re-stating the title.

Here's the article:

The world of cryptocurrency trading is awash with promises of automated riches. Among the numerous bots and signal providers vying for attention, Keepbit's Auto Stop Trade Signals stands out. But, like any proposition that sounds too good to be true, a healthy dose of skepticism is warranted. Before entrusting your capital to an automated system, it’s vital to dissect its underlying mechanisms, assess its potential efficacy, and weigh the associated risks.

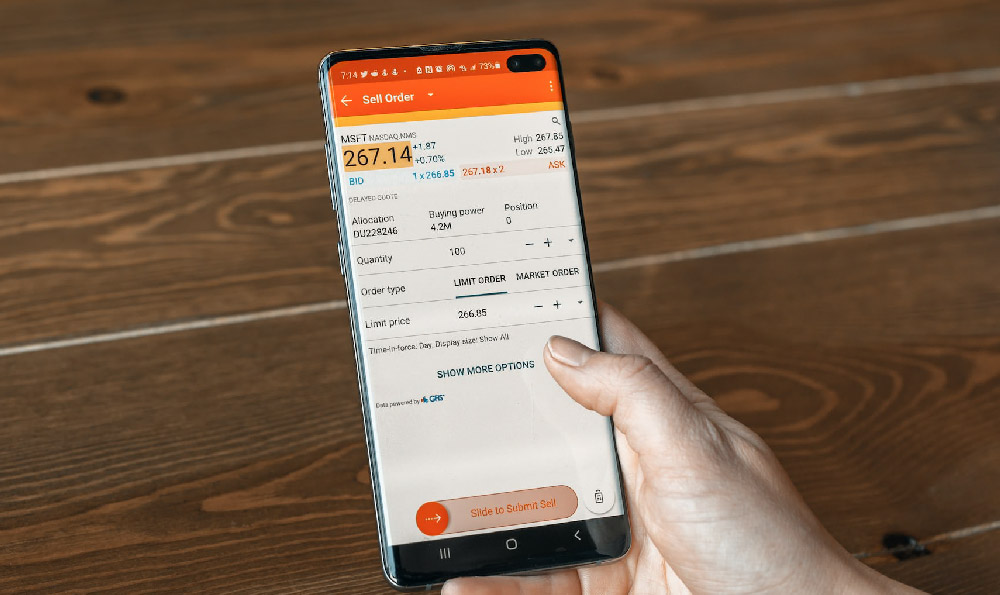

Keepbit's allure, like that of other auto-trading systems, lies in its promise of hands-free profit generation. It proposes to analyze market data, identify potentially profitable trading opportunities, and automatically execute trades on your behalf, ostensibly stopping at a pre-defined profit target or loss threshold. This removes the emotional element from trading, which can be a significant detriment to many novice investors, and theoretically allows for 24/7 market participation, something most individuals cannot manage manually.

However, the devil, as always, is in the details. The question isn't just if Keepbit can generate signals, but how it does so and how reliable those signals are. Understanding the methodology behind the signals is crucial. Is it based on technical analysis, fundamental analysis, or a combination of both? Does it employ machine learning algorithms, and if so, what data are they trained on? Transparency in these areas is paramount. If the methodology remains shrouded in secrecy, it's difficult to assess the potential effectiveness and identify potential biases or weaknesses.

The efficacy of any trading signal, automated or otherwise, is inextricably linked to market conditions. A strategy that thrives during a bull market might falter dramatically during a bear market or periods of high volatility. Keepbit, or any similar system, needs to demonstrate its adaptability and resilience across diverse market scenarios. Backtesting data is essential, showing how the system would have performed historically. However, it's important to remember that past performance is not necessarily indicative of future results. Market dynamics are constantly evolving, and what worked yesterday might not work tomorrow.

Furthermore, the risk management protocols integrated into the system are absolutely critical. The "Auto Stop" element in the name implies that the system is designed to limit losses, but the specifics of this mechanism are vital. Are stop-loss orders reliably executed in volatile market conditions? Is there a mechanism to adjust stop-loss levels based on market fluctuations? Slippage, the difference between the intended price and the actual execution price, can erode profits and exacerbate losses, particularly in fast-moving markets. A robust system needs to account for slippage and implement strategies to mitigate its impact.

Beyond the technical aspects, the cost of using Keepbit’s service must also be factored into the equation. Signal providers typically charge subscription fees or take a percentage of profits generated. It's essential to calculate the break-even point – the amount of profit required to cover the fees and any potential losses. A high subscription fee coupled with a low win rate could easily result in a net loss, even if the system generates some profitable trades.

It’s also crucial to assess the credibility and reputation of Keepbit itself. Are there independent reviews and testimonials from users? Are there any red flags, such as unrealistic promises, hidden fees, or poor customer service? A thorough due diligence process is essential before entrusting your funds to any platform. Scrutinize online forums, check for complaints filed with regulatory agencies, and seek out feedback from experienced traders.

Even if Keepbit proves to be a legitimate and effective system, it's important to remember that automated trading is not a guaranteed path to riches. It requires careful monitoring and adjustments. Market conditions change, and the system's parameters may need to be tweaked to maintain optimal performance. A passive, "set it and forget it" approach is unlikely to be successful.

Therefore, determining whether Keepbit Auto Stop Trade Signals truly work and are "worth it" is a multifaceted process. It involves a thorough understanding of the system's methodology, a careful assessment of its historical performance, a critical evaluation of its risk management protocols, and a realistic appraisal of its costs. While automation can offer potential benefits, it's essential to approach it with a healthy dose of skepticism and a commitment to ongoing monitoring and management. Cryptocurrency trading inherently carries risk, and any automated system should be viewed as a tool to enhance, not replace, sound investment principles. Before committing any capital, it's wise to start with a demo account or a small test portfolio to evaluate the system's performance firsthand and determine if it aligns with your individual risk tolerance and investment goals. Blindly trusting any automated system, without understanding its inner workings and limitations, is a recipe for potential financial disaster.