How did Brandon Fugal get rich? What are his income sources?

Brandon Fugal's wealth isn't solely tied to cryptocurrency, though strategic investments likely play a part. His fortune is primarily built upon a foundation of real estate and commercial enterprise, particularly in the competitive Utah market. To understand how he accumulated his wealth, it's crucial to dissect his diverse income streams and business acumen.

The Real Estate Empire: A Foundation of Wealth

Fugal is best known as the Chairman and owner of Colliers International in Utah. Colliers is a global real estate services company, and Fugal's leadership has solidified its dominance in the Utah commercial real estate sector. This position provides significant income through several avenues:

- Commissions on Transactions: A substantial portion of Colliers' revenue comes from commissions earned on buying, selling, and leasing commercial properties. As Chairman, Fugal likely receives a percentage of the overall company profit, reflecting the scale of these transactions. Utah's booming economy in recent years has undoubtedly fueled this growth.

- Property Management Fees: Colliers also manages numerous commercial properties. Property management generates recurring revenue streams through fees charged for overseeing building maintenance, tenant relations, and other operational aspects.

- Development and Investment: While not directly involved in every project, Colliers often facilitates and invests in real estate development projects. This participation can yield significant returns through property appreciation and rental income.

- Strategic Acquisitions: Fugal's leadership likely involves identifying and acquiring undervalued or strategically important properties. These acquisitions can later be sold for a profit or held as long-term income-generating assets.

- Consulting Services: Colliers provides consulting services to businesses looking to expand or relocate, advising on optimal locations, market trends, and investment strategies. Fugal's expertise likely contributes to this revenue stream.

Beyond Real Estate: Diversification and Investment

While real estate is his core business, Fugal has also diversified his portfolio through various investment avenues, including:

- Private Equity: Fugal is known to invest in private companies and startups. This allows him to participate in the potential growth of innovative businesses and generate higher returns than traditional investments.

- Venture Capital: Similar to private equity, venture capital involves investing in early-stage companies with high growth potential. These investments are inherently riskier but can offer substantial rewards.

- Technology Investments: Given his interest in cutting-edge topics, it's plausible that Fugal has invested in technology companies, particularly those focused on data analytics, artificial intelligence, or cybersecurity. These sectors align with his entrepreneurial interests and offer significant growth prospects.

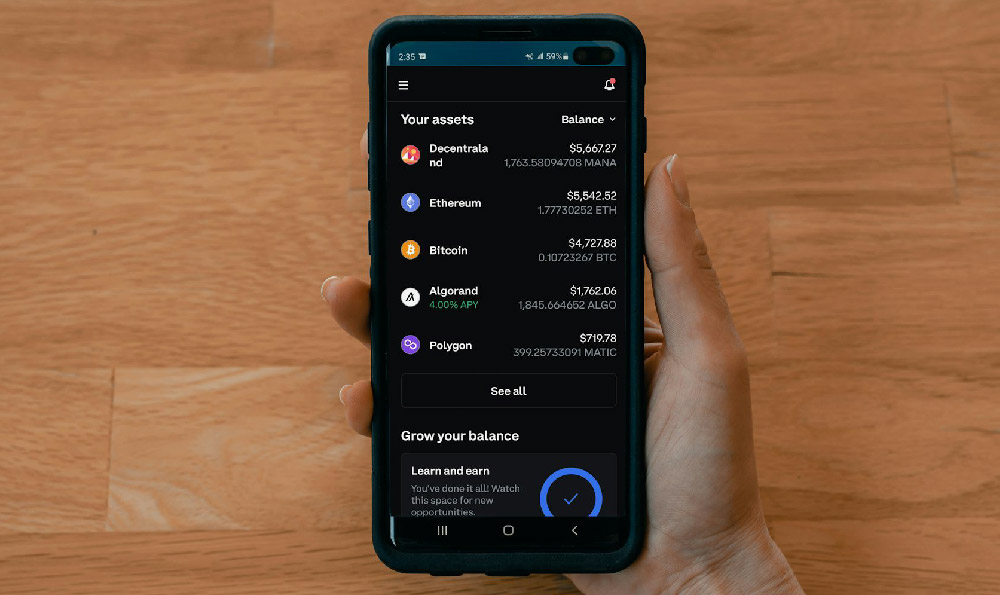

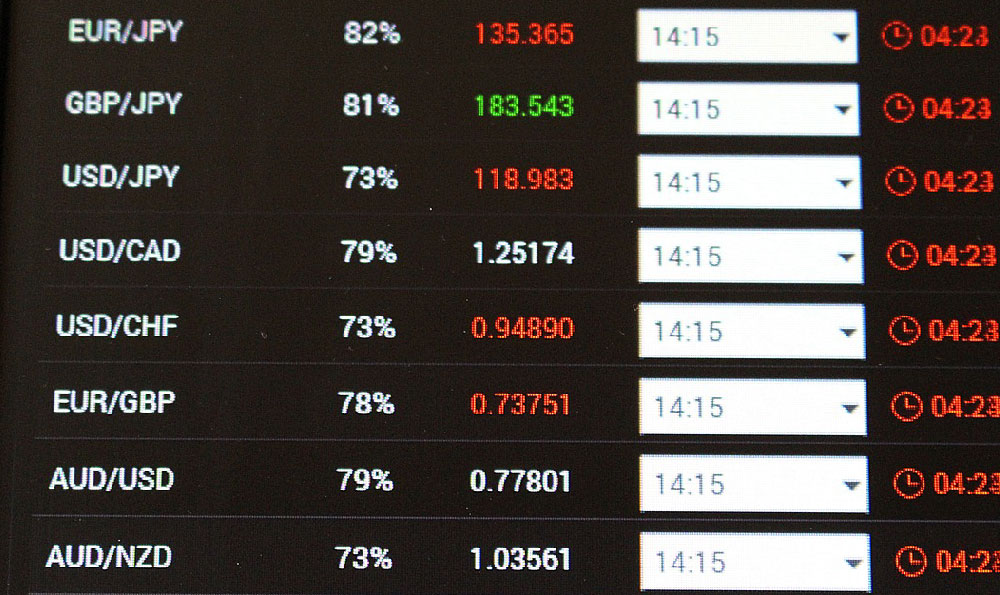

- Cryptocurrency and Digital Assets (Speculation): While not publicly emphasized as a primary driver of his wealth, it is reasonable to assume Fugal has allocated a portion of his portfolio to cryptocurrency. Given his technologically minded approach to business and openness to unconventional ideas, investment in cryptocurrencies is logical. This could involve both long-term holdings of established cryptocurrencies and strategic investments in promising blockchain projects. He likely takes a calculated and informed approach to these investments, mitigating risk through diversification and thorough research.

The UFO Connection: Unveiling the Financial Implications of a Unique Passion

Fugal's acquisition and ownership of Skinwalker Ranch, a site famous for alleged paranormal phenomena, is another facet to consider. While the ranch may not be a direct source of profit, it could indirectly contribute to his wealth through:

- Media Rights and Production Agreements: The popularity of Skinwalker Ranch has spawned documentaries, television shows (like The Secret of Skinwalker Ranch), and books. Fugal likely benefits financially from the licensing of media rights and production agreements.

- Increased Brand Recognition: Owning Skinwalker Ranch has significantly raised Fugal's profile, making him a more recognizable figure in business and investment circles. This increased visibility can lead to new opportunities and partnerships.

- Scientific Research and Development: While the primary focus is on investigating paranormal phenomena, the research conducted at Skinwalker Ranch could lead to technological breakthroughs or scientific discoveries with commercial applications. Any intellectual property developed at the ranch could be a valuable asset.

A Strategy of Calculated Risk and Long-Term Vision

Brandon Fugal's wealth is not a result of a single lucky break but rather a consequence of strategic business decisions, calculated risk-taking, and a long-term vision. His success can be attributed to the following key principles:

- Diversification: Spreading investments across various sectors reduces overall risk and increases the likelihood of generating consistent returns.

- Strategic Acquisitions: Identifying and acquiring undervalued assets with growth potential is a key driver of wealth creation.

- Long-Term Perspective: Focusing on long-term investments rather than short-term gains allows for compounding returns and weathering market fluctuations.

- Network and Relationships: Building strong relationships with industry leaders, investors, and entrepreneurs provides access to valuable opportunities and insights.

- Continuous Learning: Staying informed about market trends, technological advancements, and emerging opportunities is crucial for making informed investment decisions.

While the exact breakdown of Fugal's income sources remains confidential, his real estate empire, coupled with diversified investments and strategic ventures, paints a clear picture of how he accumulated his wealth. It is important to note that successful investing, including investments in digital currencies, requires careful consideration, thorough research, and an understanding of associated risks.