Bitcoin Longs or Shorts: Which BitMEX Position Prevails, Why?

Navigating the BitMEX Battlefield: Decoding Bitcoin Longs vs. Shorts

The cryptocurrency market, known for its volatility, offers various avenues for profit, with BitMEX, a prominent cryptocurrency derivatives exchange, being a key battleground. Here, traders engage in high-stakes contests, betting on the future price of Bitcoin through long and short positions. Understanding the dynamics between these positions, the factors influencing them, and the potential outcomes is crucial for anyone venturing into this arena.

Understanding Long and Short Positions

In essence, a long position is a bet that the price of Bitcoin will rise. Traders who "go long" buy Bitcoin contracts, hoping to sell them later at a higher price, profiting from the difference. Conversely, a short position is a bet that the price of Bitcoin will fall. Short sellers borrow Bitcoin (or Bitcoin contracts) and sell them, with the intention of buying them back later at a lower price, pocketing the difference.

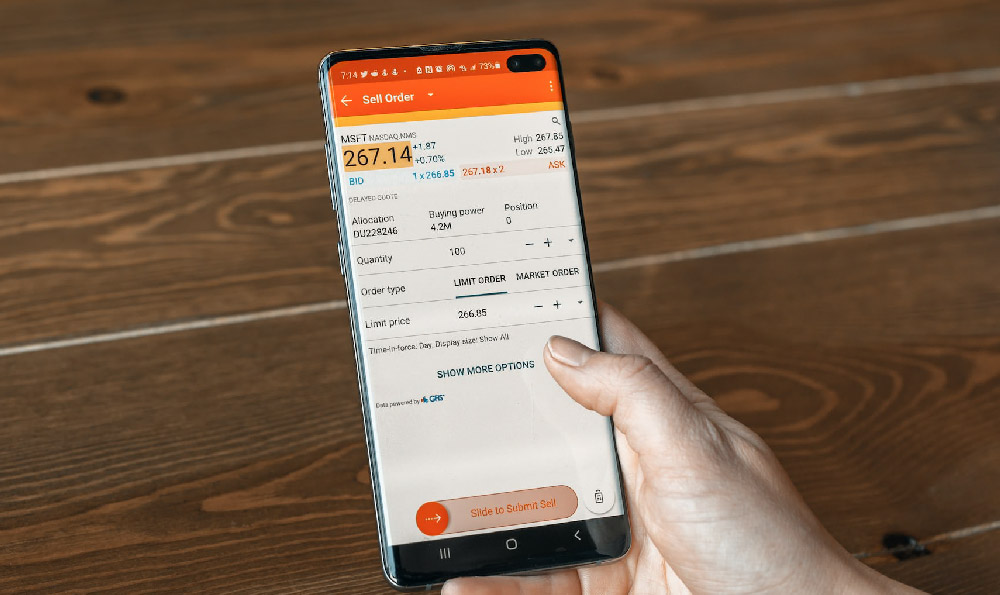

BitMEX facilitates these positions through leveraged contracts, meaning traders can control a larger amount of Bitcoin than they actually own. This magnifies both potential profits and potential losses, making it a high-risk, high-reward environment.

The Factors Driving Long and Short Positions

Several factors influence the prevalence of long and short positions on BitMEX:

Market Sentiment: Overall market sentiment plays a significant role. Bullish sentiment, fueled by positive news, adoption rates, or technological advancements, typically leads to an increase in long positions. Conversely, bearish sentiment, driven by regulatory concerns, security breaches, or negative price action, tends to favor short positions.

Technical Analysis: Traders often rely on technical analysis, studying price charts, patterns, and indicators to predict future price movements. Breakouts above resistance levels may encourage long positions, while breakdowns below support levels may trigger short positions.

Fundamental Analysis: Analyzing the underlying fundamentals of Bitcoin, such as its network activity, mining difficulty, and adoption rate, can also influence trading decisions. Positive fundamentals may attract long-term investors and increase long positions, while negative fundamentals may lead to increased short positions.

Leverage and Margin Requirements: BitMEX offers high leverage, allowing traders to control substantial positions with relatively little capital. However, this comes with a high risk of liquidation. Margin requirements, the amount of capital required to maintain a position, also influence trading decisions. Traders must carefully manage their leverage and margin to avoid being liquidated, which can exacerbate price swings.

Fear and Greed: Emotions play a significant role in trading. Fear of missing out (FOMO) can drive speculative buying and increase long positions, while fear of losses can trigger panic selling and increase short positions. The "fear and greed index" is often used as a sentiment indicator.

Who Typically Holds Long and Short Positions?

The motivations and characteristics of those holding long and short positions can vary:

Long Positions:

- Retail Investors: Often driven by the belief in the long-term potential of Bitcoin and the cryptocurrency market.

- HODLers: Individuals who hold Bitcoin for the long term and are less likely to sell during price dips.

- Institutional Investors: Increasingly entering the market, seeking exposure to Bitcoin's potential returns.

- Trend Followers: Traders who identify upward trends and seek to profit from rising prices.

Short Positions:

- Experienced Traders: Often employ sophisticated strategies to profit from price declines.

- Arbitrageurs: Exploit price differences between exchanges.

- Hedgers: Use short positions to protect their existing Bitcoin holdings from price volatility.

- Market Makers: Provide liquidity to the exchange and may take short positions to manage their inventory.

- Whales: Large Bitcoin holders who can influence the market with their trading activity.

Which Position Prevails, and Why?

Determining which position ultimately "prevails" is a complex and dynamic process. It is not always a clear-cut victory for either side. Several scenarios can play out:

- Bull Market: In a sustained bull market, long positions are more likely to prevail as the price of Bitcoin continues to rise. Short sellers are forced to cover their positions, driving the price even higher.

- Bear Market: In a bear market, short positions tend to be more profitable as the price of Bitcoin declines. Long holders may be forced to sell, further exacerbating the downward pressure.

- Sideways Market: In a sideways market, both long and short positions can be profitable depending on the specific price fluctuations. Traders often employ range-bound strategies, buying low and selling high within a defined price range.

- Volatility Spikes: Sudden and unexpected price movements can liquidate both long and short positions, leading to significant losses for those caught on the wrong side of the trade.

The "prevalence" isn't solely about pure profit/loss. It's also about market control and influence. Large entities with the ability to manipulate the market can strategically open large short or long positions to trigger liquidations and profit from the resulting price swings, regardless of the underlying market trend.

The Importance of Risk Management

Navigating the BitMEX battlefield requires a robust risk management strategy. Given the high leverage offered by BitMEX, traders must carefully manage their position sizes, use stop-loss orders to limit potential losses, and avoid over-leveraging. It's crucial to understand the potential for liquidation and to only risk capital that they can afford to lose. Thorough research and technical analysis are also essential for making informed trading decisions. Trading with leverage carries significant risks, and it's not suitable for everyone.

Conclusion

The contest between Bitcoin longs and shorts on BitMEX is a continuous tug-of-war, influenced by a multitude of factors. Understanding these dynamics, the motivations of different market participants, and the importance of risk management is crucial for navigating this high-stakes environment. While predicting which position will ultimately prevail is impossible, informed and disciplined traders can increase their chances of success. The key is to approach the market with caution, conduct thorough research, and always prioritize risk management. Remember, the cryptocurrency market is inherently volatile, and losses are always a possibility.