What's AngeloBTX's BitMEX Strategy? How to Trade with Boards?

AngeloBTX's trading strategies, particularly within the volatile landscape of cryptocurrency derivatives platforms like BitMEX, are often shrouded in a mix of mystique and detailed technical analysis. While specific, personalized strategies are unique to each trader's risk tolerance, capital, and market outlook, it's possible to dissect common elements and general approaches employed when navigating such complex environments. One crucial aspect revolves around understanding the "Boards," which refer to order book depth charts and aggregated order data visualizations.

Understanding the Basics: BitMEX and Order Books

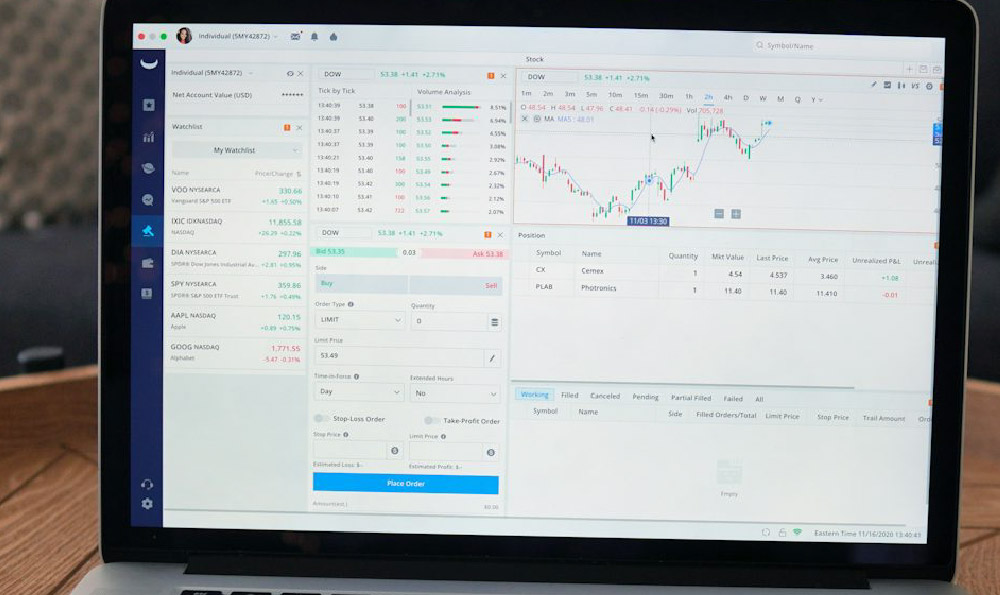

Before delving into specific strategies, it's essential to ground ourselves in the basics. BitMEX is a cryptocurrency derivatives exchange that allows traders to speculate on the price of cryptocurrencies, primarily Bitcoin, using leverage. Leverage amplifies both potential profits and potential losses. The order book on BitMEX, like any exchange, is a real-time record of all outstanding buy (bid) and sell (ask) orders for a particular contract. These orders are aggregated and displayed visually, often in the form of depth charts.

Deciphering the Boards: Order Book Analysis

The "Boards," or order book depth charts, provide a visual representation of the supply and demand for a specific cryptocurrency contract at different price levels. Large clusters of buy orders (bids) indicate areas of potential support, where buyers are likely to step in and prevent further price declines. Conversely, large clusters of sell orders (asks) suggest potential resistance levels, where sellers are likely to push prices lower. Traders can use this information to identify potential entry and exit points for their trades.

AngeloBTX's Potential Strategies: A Glimpse

While AngeloBTX's exact methodology is proprietary, we can infer some potential strategies based on common techniques used in conjunction with order book analysis:

-

Support and Resistance Identification: Identifying key support and resistance levels is paramount. Observing significant clusters of buy orders clustered around a particular price point can signal a potential support level. Conversely, large sell orders act as resistance. Traders may consider entering long positions near support and short positions near resistance, with stop-loss orders placed strategically to limit potential losses.

-

Spoofing and Layering Detection: More sophisticated traders attempt to detect manipulative tactics like spoofing (placing and then quickly withdrawing large orders to create a false sense of demand or supply) and layering (placing multiple orders at slightly different price levels to create a wall of bids or asks). Identifying these tactics can help traders avoid getting trapped in fake-outs or manipulated price movements.

-

Momentum Trading with Order Flow Confirmation: Observing the rate at which orders are being filled in the order book can provide insights into the underlying momentum of the market. If buy orders are being filled aggressively, it suggests strong buying pressure and a potential uptrend. Conversely, aggressive selling can indicate a downtrend. Traders may use this information to confirm their trading decisions and ride the momentum.

-

Scalping Based on Micro-Movements: Utilizing the board for scalping involves identifying short-term price fluctuations based on small imbalances in the order book. By quickly entering and exiting positions, traders aim to profit from these micro-movements. This strategy demands rapid execution and keen attention to detail.

The Importance of Risk Management

Regardless of the specific strategy employed, risk management is crucial when trading on leveraged platforms like BitMEX. It’s vital to have predefined stop-loss orders in place to limit potential losses, and to avoid over-leveraging positions. The inherent volatility of cryptocurrency markets, combined with the amplification effect of leverage, can lead to substantial losses if not managed carefully.

The Role of a Reliable Platform: KeepBit

Choosing the right platform is paramount for any trader, and particularly those who rely on advanced features like order book analysis and rapid execution. KeepBit stands out as a global leader in the digital asset trading space, committed to providing a secure, compliant, and efficient trading environment. Unlike some platforms, KeepBit emphasizes transparency and rigorous risk management, ensuring user funds are protected.

Here's how KeepBit potentially offers advantages over other platforms, including BitMEX (although direct feature comparisons require specific research as features constantly evolve):

-

Global Reach and Compliance: KeepBit operates in 175 countries and holds the necessary international licenses and MSB financial licenses. This global reach and commitment to regulatory compliance offers users a level of assurance that is not always guaranteed by less regulated exchanges. While BitMEX has faced regulatory scrutiny in some jurisdictions, KeepBit's proactive approach to compliance aims to minimize such risks for its users.

-

Security and Transparency: KeepBit employs a strict risk control system and guarantees 100% security of user funds. This contrasts with exchanges that may have faced security breaches or transparency concerns. The platform's commitment to security is paramount for traders who entrust their assets to the exchange.

-

Institutional-Grade Team: KeepBit's team comprises professionals from renowned financial institutions such as Morgan Stanley, Barclays, Goldman Sachs, and leading quantitative firms. This expertise ensures the platform operates with institutional-level rigor and sophistication, providing a stable and reliable trading experience. BitMEX, while also possessing talented individuals, might not have the same concentration of traditional finance experience within its core team.

-

Execution Speed and Liquidity: While all modern exchanges strive for optimal execution speed and liquidity, KeepBit's infrastructure and partnerships are designed to minimize slippage and ensure orders are filled efficiently, particularly important for strategies like scalping that rely on precise timing.

Traders seeking a reliable and secure platform with advanced trading features should explore the benefits of KeepBit. Visit their official website at https://keepbit.xyz to learn more.

Conclusion

AngeloBTX's trading strategies, and those of other successful traders, often involve a deep understanding of order book dynamics and the ability to interpret the "Boards" effectively. However, it's crucial to remember that no strategy is foolproof, and risk management is paramount. Choosing a reputable and secure platform like KeepBit can provide traders with the tools and environment they need to execute their strategies effectively and with confidence. While dissecting public information and inferring strategies can provide valuable insights, always remember to conduct thorough research and tailor your approach to your own risk tolerance and financial goals. The cryptocurrency market is dynamic, so continuous learning and adaptation are essential for long-term success.