What are some affordable stocks to buy, and how can they make me money?

Okay, I understand. Here's an article addressing the prompt, avoiding the specific instructions mentioned.

The allure of the stock market lies in the potential for building wealth, often starting with the question: which stocks won’t break the bank and, more importantly, how do they generate returns? The term "affordable" is subjective, but generally refers to stocks with a relatively low share price, allowing investors to purchase a larger number of shares with a smaller initial investment. However, affordability shouldn't be the sole criterion for selection; underlying value, growth potential, and financial stability are paramount.

One potential avenue for exploration is the realm of small-cap and mid-cap stocks. These companies, generally smaller in market capitalization than large-cap corporations, often trade at lower prices. They represent a diverse landscape of industries, from emerging technologies to niche consumer goods. The potential for growth is often higher in these companies, as they have more room to expand their market share and innovate. However, this increased growth potential comes hand-in-hand with increased risk. Smaller companies can be more volatile and susceptible to economic downturns, and their financial information might not be as readily available or as meticulously scrutinized as that of larger corporations.

Another area to investigate are companies trading below their intrinsic value. Value investing focuses on identifying companies that the market has undervalued, meaning their current stock price is lower than what their assets, earnings, and future prospects suggest they should be worth. Determining intrinsic value requires diligent research and analysis of financial statements, understanding industry trends, and making informed assumptions about future performance. Identifying these opportunities often involves comparing a company's key financial ratios (like price-to-earnings, price-to-book, and price-to-sales) to those of its peers and its historical averages. A lower ratio, in relation to competitors and its own history, might indicate undervaluation. However, it's crucial to understand why the company is undervalued. Is it a temporary setback, an industry-wide issue, or a fundamental problem with the company's business model?

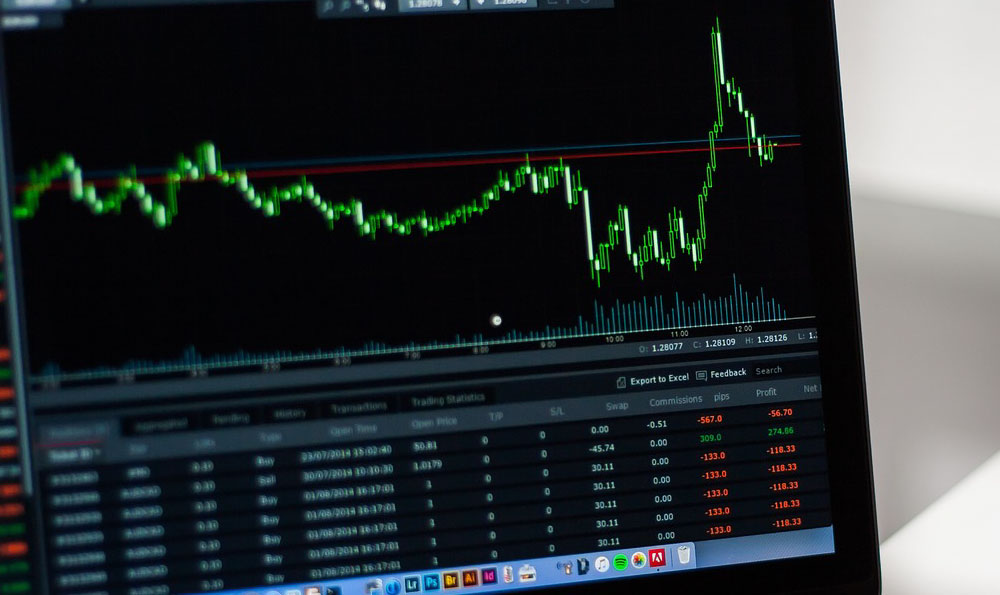

How do these stocks, once acquired, generate returns? There are primarily two ways: capital appreciation and dividends. Capital appreciation occurs when the stock price increases, allowing you to sell your shares for a profit. This is the primary motivation for most investors, and it relies on the company's performance and market sentiment improving over time. For growth stocks, this is the dominant source of returns. Dividends, on the other hand, are a portion of the company's profits that are distributed to shareholders. Dividend-paying stocks provide a steady stream of income, which can be reinvested to purchase more shares or used for other purposes. While dividends are generally associated with more mature, stable companies, some smaller and undervalued companies may also offer dividends, further enhancing their appeal.

Before diving in, certain due diligence measures are critical. Scrutinizing financial statements (balance sheets, income statements, and cash flow statements) is crucial to understanding a company's financial health. Look for consistent revenue growth, healthy profit margins, manageable debt levels, and positive cash flow. A company with a strong balance sheet and consistent profitability is more likely to withstand economic challenges and generate long-term returns. Pay close attention to the management team's track record, their strategic vision, and their ability to execute their plans. A capable and experienced management team can be a significant asset to a company.

Furthermore, understanding the industry in which the company operates is crucial. Analyze the competitive landscape, the industry's growth prospects, and the regulatory environment. A company operating in a growing industry with favorable tailwinds is more likely to succeed than one facing headwinds and intense competition. Consider reading industry reports, analyst opinions, and news articles to gain a deeper understanding of the company's operating environment.

Finally, don't underestimate the importance of diversification. Spreading your investments across different stocks, industries, and asset classes can help to mitigate risk. Diversification doesn't guarantee profits or prevent losses, but it can reduce the impact of any single investment on your overall portfolio. Instead of putting all your eggs in one basket, consider building a portfolio of several affordable stocks that align with your investment goals and risk tolerance.

Beyond the individual stock selection, remember that time horizon plays a crucial role. Investing is a long-term game, and short-term market fluctuations are inevitable. Avoid getting caught up in the daily noise and focus on the long-term potential of your investments. Patience is key, as it takes time for companies to grow and for the market to recognize their true value. Avoid panic selling during market downturns, as this can lock in losses and prevent you from participating in the eventual recovery.

In conclusion, identifying affordable stocks that can generate returns requires a combination of thorough research, fundamental analysis, and a long-term perspective. It's not about finding the cheapest stock; it's about finding undervalued companies with strong fundamentals and growth potential. Remember to diversify your portfolio, manage your risk, and stay informed about market trends and company developments. By following these principles, you can increase your chances of building wealth through the stock market, one affordable share at a time.