How Can a 13-Year-Old Make Money? What Are the Best Ways?

The allure of financial independence and early wealth creation is understandable, even at 13. While navigating the complexities of the world of finance at such a young age presents unique challenges and limitations, it's entirely possible to start building a financial foundation. However, it’s crucial to approach this journey with realism, patience, and, most importantly, parental guidance. Direct involvement in cryptocurrency trading or high-risk investments is absolutely not advisable for someone of that age due to legal restrictions and the inherent risks involved. Focus instead on learning the principles of value creation and responsible money management.

One of the most effective pathways to early earnings is through entrepreneurial ventures. Think about skills you possess or interests you have that can be translated into a service or product. Do you excel at art? Consider creating and selling custom digital artwork online or offering personalized drawings to friends and family. Are you adept at technology? Offering tech support to less tech-savvy neighbors or relatives could be a valuable service. The key here is identifying a need in your immediate community or online circle and providing a solution. Lemonade stands and car washes are classic examples for a reason – they capitalize on simple needs and require minimal start-up capital. The modern equivalent could be offering to manage social media accounts for local businesses that are struggling to keep up with the digital landscape.

Another avenue to explore is online content creation. Platforms like YouTube, TikTok, and Instagram offer opportunities to earn money through advertising revenue, sponsorships, and affiliate marketing. If you're passionate about a particular hobby, such as gaming, photography, or cooking, you can create engaging content around it. Building an audience takes time and effort, but the potential rewards can be significant. Remember to focus on creating high-quality content that provides value to viewers, rather than solely chasing views and likes. Also, be mindful of online safety and privacy, and always involve your parents in the process.

Freelancing is another option worth considering. Websites like Fiverr and Upwork offer opportunities to provide services such as writing, editing, graphic design, and social media management. While some of these services might require specific skills, there are also entry-level tasks that a 13-year-old can learn and offer. For example, you could offer proofreading services or data entry assistance. Learning to use design tools like Canva to create social media graphics for small businesses is also a valuable, and readily attainable, skill.

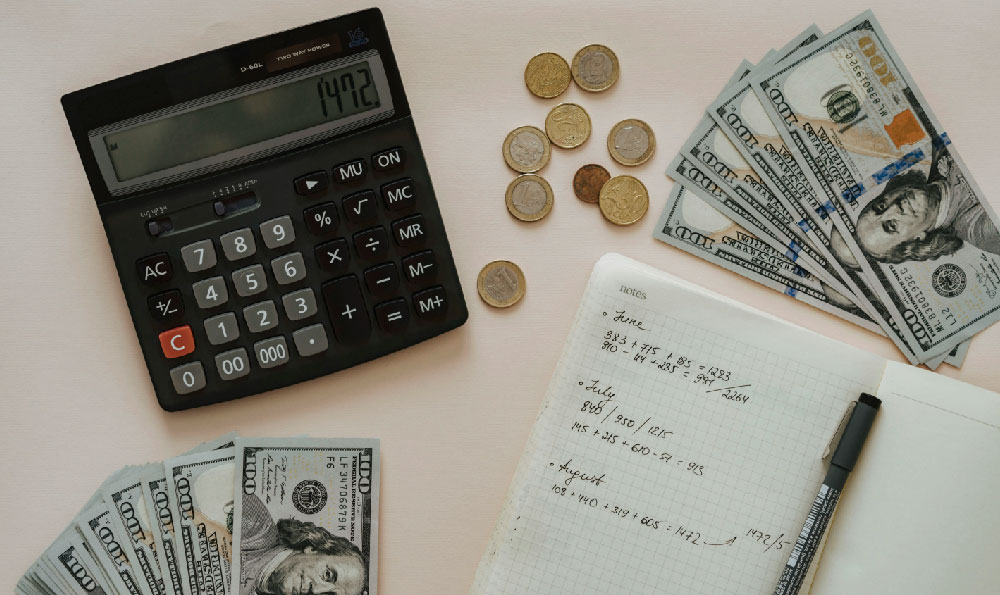

Earning money is only half the battle; managing it wisely is equally important. Open a savings account (with parental guidance and co-ownership) and start developing the habit of saving a portion of your earnings. Consider setting a savings goal, such as saving for a new video game, a future educational expense, or a charitable donation. Learning about budgeting and tracking your expenses is also crucial. There are numerous free budgeting apps and online resources that can help you track your income and spending habits. Understanding where your money goes is the first step towards making informed financial decisions.

While direct investment in complex financial instruments like cryptocurrency is not appropriate, there are age-appropriate ways to learn about investing. Encourage your parents to involve you in discussions about their finances and investment strategies. Read age-appropriate books and articles about personal finance. Participate in financial literacy programs offered by schools or community organizations. The goal is to build a foundational understanding of investing principles, such as diversification, risk management, and long-term investing.

Furthermore, it’s important to distinguish between earning money and building wealth. Wealth isn’t solely about accumulating cash; it’s about creating assets that generate passive income or appreciate in value over time. While you’re building your initial income streams, start thinking about how you can reinvest your earnings to create long-term wealth. This could involve investing in your education, acquiring new skills, or starting a business that has the potential for scalability.

Always remember that building wealth is a marathon, not a sprint. There will be setbacks and challenges along the way. The key is to stay persistent, learn from your mistakes, and never stop seeking knowledge. And most importantly, prioritize ethical behavior and integrity in all your financial endeavors. A good reputation is invaluable, and it will serve you well throughout your life.

Moreover, ensure all income earned is properly declared to the relevant tax authorities (through your parents or guardians). Familiarize yourself with basic tax concepts to understand your responsibilities and avoid potential legal issues later in life. Transparency and compliance are fundamental to responsible financial management.

Finally, and perhaps most importantly, prioritize your education and personal development. While earning money is valuable, it should not come at the expense of your studies or well-being. Focus on developing your skills, pursuing your passions, and building strong relationships. These are the building blocks for a successful and fulfilling life, both financially and personally. Early exposure to entrepreneurial principles and financial literacy can undoubtedly provide a significant advantage, but balance and responsibility are paramount.